Your decision-making abilities are tested in trading more than in any other profession.

Every decision you make will either move closer or further to making or losing money.

Many of you reading this have moments where you get struck with indecision:

Should I be trading this stock? Should I enter now? Should I take some profits here? Should I stop out here?

Indecision is costly. Why I'm writing this blog. Read this carefully. These 5 habits will significantly improve your decision making in your trading:

Tracking Trading Performance Metrics

You cannot be decisive unless you know where your edge is in the markets, and stick to it. Why would a professional poker player play slots at a casino?

Know your A+ setups. You only need to master one strategy to be profitable. But in order to find out what your A+ setup is, you need to be journaling and tracking your trades. This is what allows you to assign probabilities in any given market scenario. This is how you create your edge.

What you should be tracking in your trade journal (the bare minimum):

- Trade outcome

- Entry price

- Exit price

- Trade setup/strategy used

- Trade thesis

- Reward to risk ratio

We recommend using software like TraderSync to journal your trades. Knowing your trading metrics is what gives you conviction in your trading. When you know the probabilities, the correct decision becomes much more obvious at any given moment.

Pre-Planning Trades

Every trade you take needs to be calculated. No “let me buy some here and see what happens.”

Don’t let FOMO cause you to jump in a trade without carefully planning it. That is the most common reason why traders get stuck in trades where they have no idea what to do.

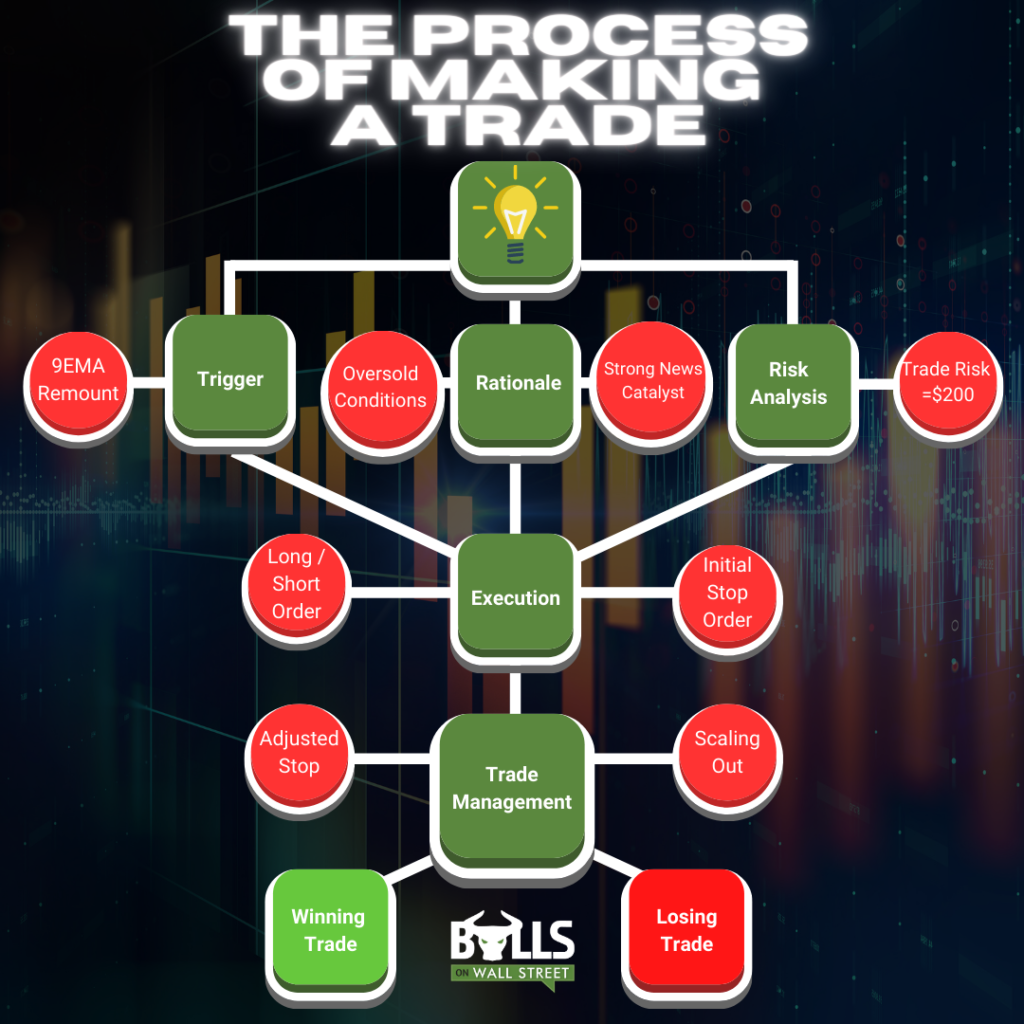

This is what your trading process should look like:

No plan, no trade. Define everything above for putting on a position.

Repetition of Charts

Lebron takes hundreds, sometimes thousands of shots every day. In trading, looking at charts is your practice. The more familiar you are with reading charts, the quicker you can filter bad setups, good setups, and A+ setups. You need to get repetitions in to achieve mastery.

Dedicate 30-minutes to an hour every day to looking at stock charts.

When you run through charts, look for the following:

- Trend (Bullish, Bearish, Sideways)

- Key resistance and support areas

- Volume pattern

- Sector

- Catalyst

- Weekly/Daily & intraday time frames. Big and small picture

The more charts you study, the more adept you will become at trading them. Correct decision-making will become habitual.

Automate Decision Making

Hard stops. Limit orders for entries. Limit orders at targets. All of these can take a lot of your trigger shyness away in your trading. When these key price levels are determined in a trade, everything becomes so much simpler. Your trade either works, or it doesn’t.

Create scans for the type of stocks you trade. This will allow you to know what stocks you should, and should not be trading.

Prioritize Your Watch List

Don’t just make a watch list of 20 tickers. Rank them. Setups are not created equal.

Within 30 minutes of the market open, you should have a list of your top 5 stocks you will be watching. Make sure to follow the flow chart above to make sure you have a thorough trading plan for all the stocks on your watch list.

Summary

5 Ways to Improve Your Decision-Making in Your Trading:

- Track Performance Metrics

- Pre-Plan Trades

- Study Charts Religiously

- Automate Decision Making

- Prioritize Your Watch List

Get Early-Bird Pricing For Our Next Live Trading Boot Camp

Learn all the day trading strategies we’ve been using for 2 decades in our Live Stock Trading Bootcamp. Early-bird pricing ends on 2/1!