Money is the most emotional subject in the world.

Unlike other professions, your emotions and perceptions about money in stock trading determine your odds of success. You need to have the correct belief systems about money and emotions, otherwise, you have no hope of success.

Trading brings out the best and worst emotions within us, even if we aren’t fully aware of it! The best traders and those who find the most success and longevity in this industry are experts at keeping emotions out of their decision-making process..

Today, we wanted to cover one of the most important topics you can possibly dive into, and that is the psychological side of trading.

We are going to go over exactly how you can remove all of the emotional attachments that come with trading so you can be cool, calm, and collected when you place your trades:

Remove Any Attachment To PNL

If you chase PNL, it runs. When you sit there watching your PnL go up and downtick by tick, your emotional battery life is being drained.

You may become anxious, impatient, and ancy as you go through the spin cycle of emotions from euphoria to doubt, over and over.

These cause you to make bad trading decisions like closing a position too late or too early.

Stop staring at your PnL every single trade, and start focusing on the chart/price action in front of you. Treat the chart and the decisions you make about what you are seeing on it completely independent of the money you’re making or losing as a result. Trading too much size is a common result of trading with too much attachment to your PNL. These traders want to make as much money as possible in the time they spend trading, so they go in BIG.

But what happens is that you end up LOSING money more often because emotions are affecting your decision-making more.

If any of these are happening to you, it’s a sign you are trading too much size and you are too attached to your PNL:

Remove Attachment To Bad Stocks/Setups

The definition of insanity is doing the same thing over and over again hoping for a different result. You have probably heard that one before. In the context of trading, this has disastrous consequences.

A lot of traders think that a certain stock or pattern will give them profits over and over again. On the flip-side, they want to battle the stock get revenge on a stock they lost on, or just a company they don’t like!

A lot of people on Twitter for example when $TSLA first made its historic run to $1000 per share were blindly short-biased, had lost money on $TSLA before to the short side, and wanted revenge. As a result, they all ignored bullish technical factors and got flattened.

You see, this group of biased traders had an emotional attachment/drive already hurting them before they even opened their platform to place a trade. They were attached to the idea of getting revenge or finally winning on a pattern/setup they THINK is full proof.

Just like we talked about in the last section, trade the chart. Ignore what the ticker is, ignore the back story behind it, ignore your prior history or run-ins with the stock, and just focus on the chart. Price action is ALWAYS king. Don’t get caught up in the company’s story. These 6 questions will help you stay away from attachment to stocks and bad set ups:

Remove Attachment to The Trade Outcome

Losing traders tend to dwell on bad trades for extended periods of time and let them emotionally drain them. You have to develop the ability to MOVE ON from any trade, win or loss. Take the lessons you learned from it and hit the next chart. As traders we are dating stocks, not marrying them.

If you are severely emotionally impacted by a loss, that simply means you went way too big on it. Losses are a normal part of the game and should feel as such. Size down if you are getting emotionally crushed by a loss.

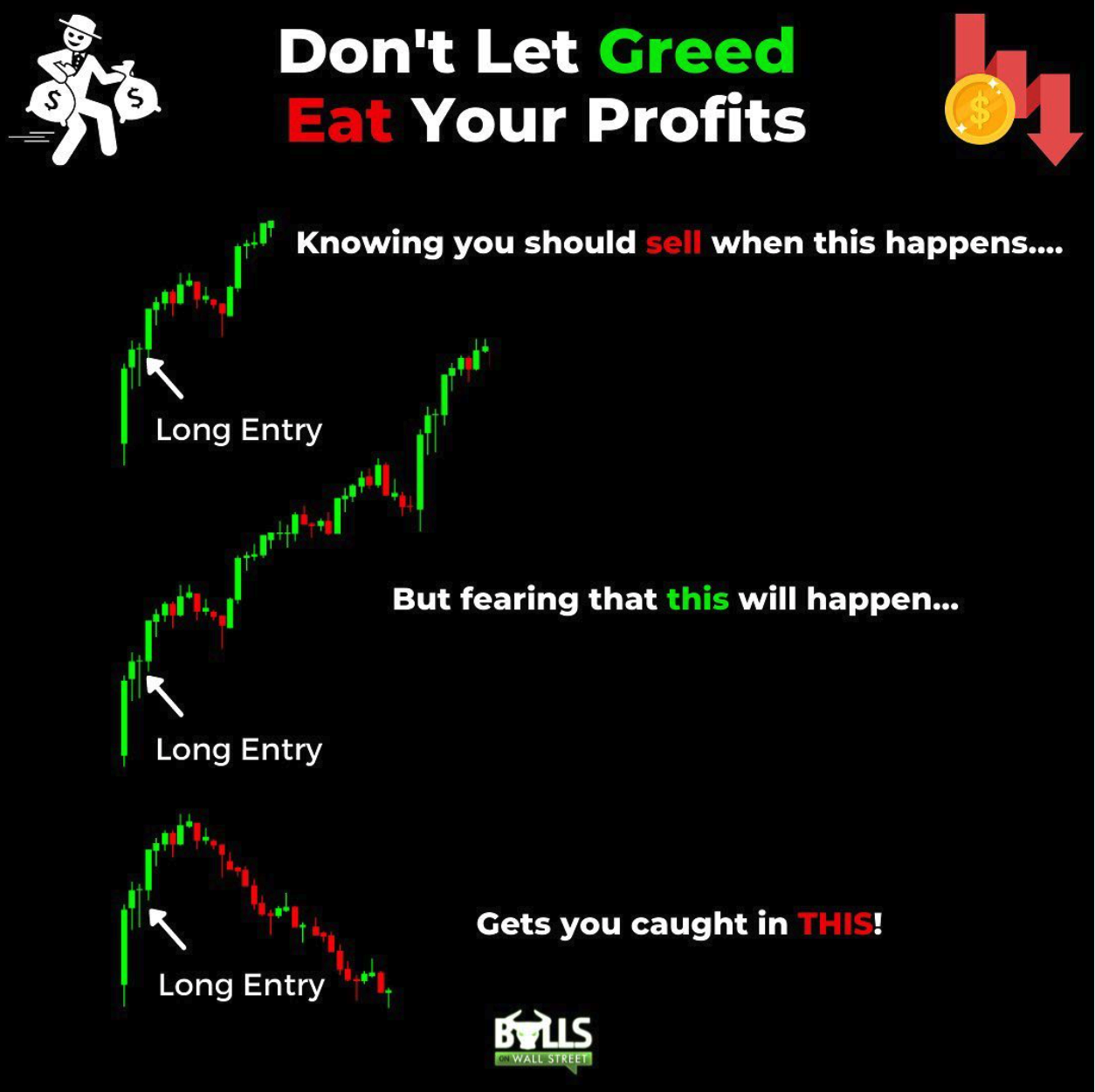

On the flip side of the equation, if you got attached to the idea that this trade will be your million-dollar retirement trade, you will fail to take profits at the right time, and this will happen:

Don’t let emotions run your trading. Follow your trading process, don’t be outcome orientated.

This is the main focus of our 60-Day Live Trading Boot Camp. Learn to conquer your emotions, master a strategy, then achieve consistency through refinement and practice!

Save Your Seat for Our Next 60-Day Live Trading Bootcamp (Get Early-Bird Pricing)

We don’t sugarcoat it. Becoming a consistently profitable stock trader isn’t easy, or an overnight process. That’s why our 60-day Live Trading Boot Camp is designed specifically to help struggling traders overcome their weaknesses, and expedite their path towards profitability.

Contact us ASAP to save your seat in our next trading boot camp!