With Thanksgiving and Christmas right around the corner, traders gear up for another crazy winter of activity, volatility, and opportunity. During the holiday season, the action in the markets tends to aggressively spike, especially in the small cap world.

With small caps, there is so much opportunity for profit in a short period of time, yet a lot of danger as well if you don’t know precisely what you are doing.

Today, we wanted to focus on small cap activity in the winter, and how to stay safe trading these types of stocks.

What Are Small Caps & Why Do They Have Such Big Moves In The Winter?

Small caps are companies that are usually in the development phase and are less reputable than bigger companies you see publicly listed. They approximately have a market cap between 300 million and 2 billion. The ones with even less are called micro-caps. These stocks tend to have a low float (the number of shares publicly available at any given time on the market… aka the supply of the stock) which means they can be extremely volatile.

With low supply or float, it doesn’t take much demand to ignite major moves in these stocks. Small caps usually are good for quick day trades or short-term swings at the MAX. You have to beware of the volatility of the given stock, the float, and the volume coming in at any time. Knowing that these stocks can rip on you in either direction at any time means you have to be diligent and sharp while trading them

If you decide to trade small caps, you need to know to maintain a strong risk vs reward on your trades. You need to find low-risk, high-reward setups. See how much easier it is to be profitable if you can maintain a strong ratio:

Circuit Breaker Halts 101

Circuit breaker halts are something we should mention now as well. You will see some small-cap stocks intraday get ‘halted’ by the NASDAQ or NYSE exchange due to volatility. Circuit breakers are algorithms that have been implemented into the exchanges in the markets to attempt to curb panic-selling or manic-buying within individual stocks. If a stock is being sold extremely hard or bought extremely hard outside of certain limits, it will be halted for a period of time, usually, 5-10 minutes, as the exchange sorts out incoming orders. Circuit breakers stop trading immediately when triggered.

For stocks between $.75 and $3.00, a move of 20%+ within a 5 minute window during the first 15 minutes of the market open OR a move of 40%+ within a 5 minute window after 9:45am will trigger a halt. It is important to know what could trigger a halt so you can get out before you see one occur. Even if the direction of the halt is in your favor, you can see big gap ups or down after halts. Avoiding getting stuck in them entirely is the safest way to go.

Staying Safe Trading Small Caps

As we mentioned above, risk-reward is everything. You have to pay sharp and consistent attention to your risk-reward ratio when trading small caps. Always make sure you are risking 1x to make 3x on a given play, and ALWAYS respect your stops. A lot of moves to the upside and downside on small caps are aggressive, so having your stop in place and respecting it will keep you from becoming a bag holder or getting squeezed in an ugly parabolic move.

You have to pay attention as well to your size. Following the tips in this graphic to make sure you aren’t sizing up too much on any given setup will keep your risk-reward profile and consistency in check.

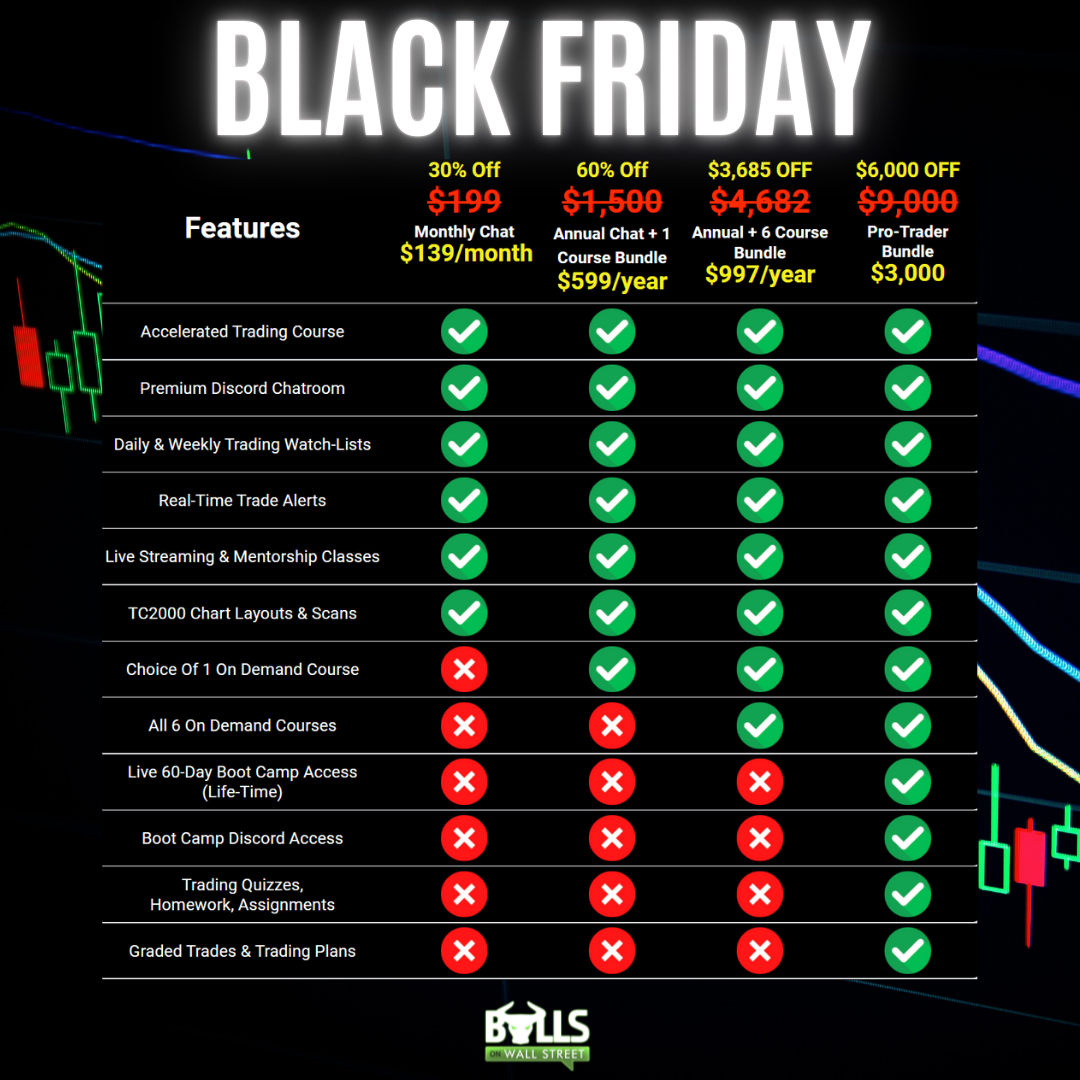

We hope you learned a lot about small cap trading and circuit breaker halts! If you have been on the fence about joining Bulls on Wall Street, there is no better time then this week to join.