We are all raised to think that ‘cheap’ is better than ‘expensive.’ This is reinforced daily, to a degree that you probably don’t even realize. Look through your mail, your email, the ads in your browser, the commercials on your television – how many of those involve some sort of sale, discount or price comparison? Most do. And there’s nothing wrong with that in most of your life; being a discerning consumer is a good thing! Saving money is a good thing.

But, as a trader, cheaper isn’t better. This problem is ubiquitous among new traders. I constantly get emails and chats that go something like this:

XYZ stock is really cheap now! Should I buy it before it goes up again?

No, you should not. Here are a few reasons why.

- You might have to wait a very long time for your stock to go up again. A business can only afford to sell its products at a discount for so long. A stock, however, can stay down a long, long time.

- While you are waiting for your discount stock to bounce, you are missing a world of opportunities. There are thousands of stocks traded in the US stock market, and every single day there are at least a few that could be home run trades for you, plus a bunch more that could provide solid gains. Why do you want to sit on a ‘cheap’ stock when you could be trading these?

- Momentum plays a factor in stocks that are on the decline, as well as those that are running. As the saying goes, “cheap gets cheaper.” Usually, it takes a significant catalyst, like an earnings surprise, to change the direction of a trending stock, and those don’t happen often.

- Your cheap stock may never recover. When I tell traders this, the response is usually something about what a great product the company makes, so surely it must recover. Maybe they do make a great product, or have a good management team, or whatever. But there are many, many pieces to that puzzle, and as retail traders we are low on the information grapevine. We are competing with large market institutions that spend vast amounts of money for access to all the fundamental data about a company – do you want to bet against them?

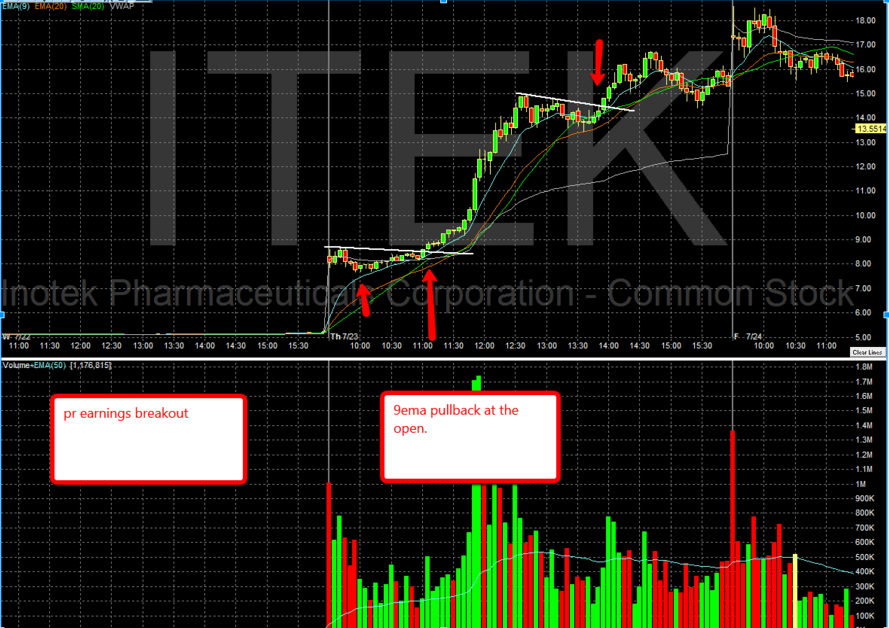

So hopefully I’ve convinced you that buying a stock simply because it’s cheap is a bad idea. But, that doesn’t mean cheap is bad IF you have other criteria and reasons for making your trade! One of the setups I teach in my Trading Bootcamp is the pullback setup. There are several variations of this setup, but essentially, you are looking for a stock that has pulled back (gone lower) down to some sort of support level. The expectation is that you can buy at this support level, for little risk, and then ride the bounce. If it doesn’t bounce, you cut your losses.

Again, while we are often buying ‘cheap’ stocks for pullbacks, we have multiple reasons for doing so, and a clearly defined time frame. Send me an email if you have questions!