As a record number of retail traders enter the stock market in the past 12-13 months, many are learning a hard lesson:

Timing is everything. A trade thesis is meaningless unless you can buy and sell the stock at the correct time.

FOMO is at all-time highs as people buy into the hype of meme stocks & cryptos, and get stuck holding the bag down 50% from when they bought.

If this sounds like you, this article is for you. First, understand what causes you to make these reckless decisions in the first place, and then figure out how to break the pattern:

Why Do We Chase Stocks?

We know we shouldn’t do it. But emotions get the best of us. We cannot afford to miss out on the trip to the moon.

FOMO is the primary reason why traders are chasing stocks everywhere this year. We want to be in the move so badly, that we throw reason out the window and jump in.

There are so many opportunities in the markets every day, you will always be missing an opportunity to make money. You have to learn to deal with the pain of missing out on moves ALL the time as a trader or investor. You cannot let the event bring emotions into your trading.

Not Understanding Technical Analysis

Chasing is often the result of not understanding how markets trend. Most inexperienced traders want to buy something just because it is up on the day or sell something because it is down on the day.

These incorrect assumptions stem from a lack of understanding of technical analysis and understanding how to make a system with defined and accurate buy and sell signals.

It’s easy to get FOMO when you don’t understand how stocks move. You won’t know when a stock is too overbought to buy, or too oversold to sell. You don’t know where support and resistance areas are that have a high probability of halting a stock’s advance.

You need to understand technical analysis (learn more about this here) in order to have a sense of market timing. You need to have a trading system that has statistical evidence of being profitable.

Otherwise, you won’t be able to identify when you are chasing, and when you are taking an entry you should be taking.

Managing Risk

It’s one thing to be wrong and buy at the wrong time. It’s another to stay wrong. There is no reason to lose more than 2-3% of your portfolio on any given trade.

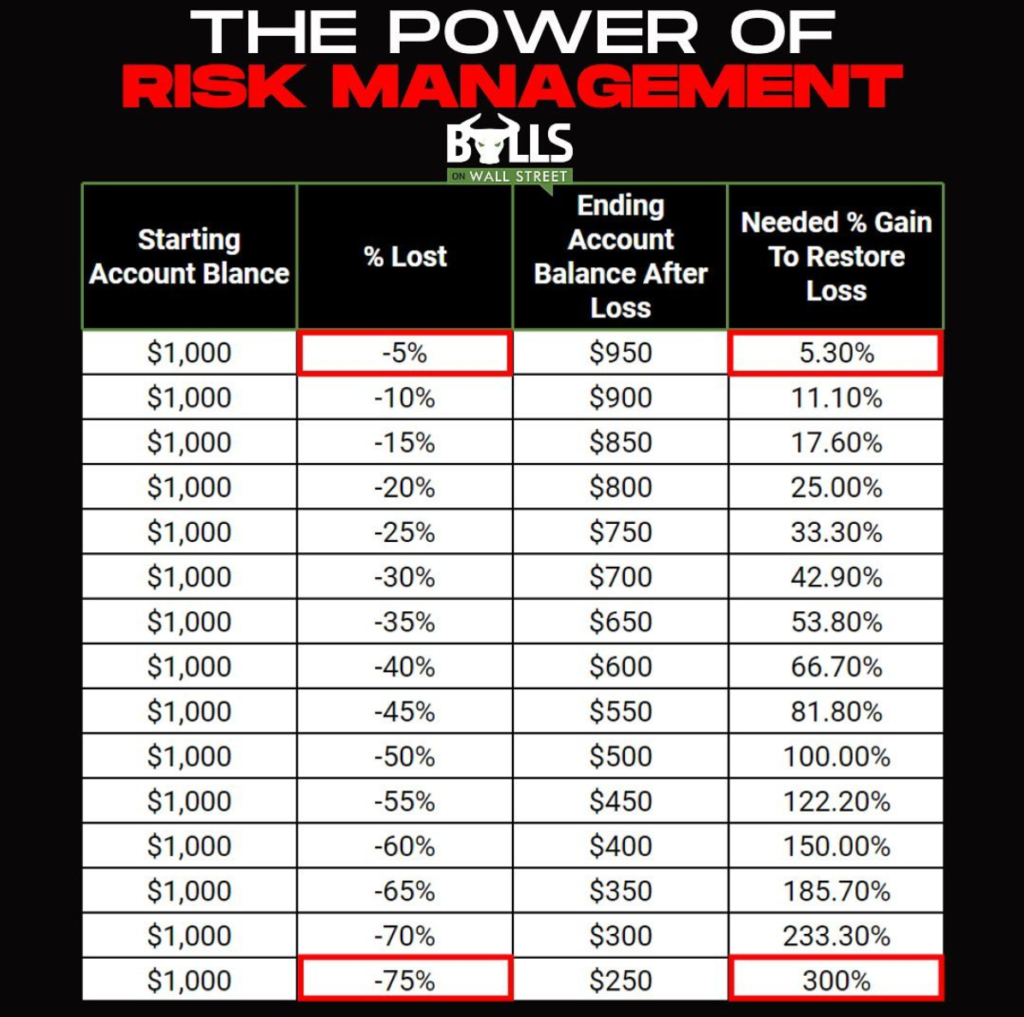

Understand the consequences of not keeping losses small:

The bigger the loss, the bigger the hole you put yourself in.

How to Combat FOMO

A great way to combat FOMO is to study how many opportunities in the markets present themselves each month. When you realize that there are usually 1-3 high-quality opportunities every day, you don’t have to have a mindset of scarcity.

You get FOMO because you have a belief of perceived scarcity in market opportunities. There is no reason to feel fear of missing out on a move if there will be another big mover tomorrow.

When you keep a trading journal, you can easily go back and remind yourself that there are high-quality opportunities every week. The scarcity of high-quality opportunities in the market is a myth. And you only need to capitalize on a few good opportunities a month to make a great living from trading.

Stop Betting on Black Swans

Trading is a game of probabilities. When you get into a trade anything can happen. Yes, you could buy a stock and it could go up 1000% in a few days or weeks.

But how often does this happen? Maybe once or twice a year.

New traders: Stop chasing meme stocks up 200% thinking that they have more upside.Yes, it could go higher in the near term.

But what is LIKELY to happen? You will get stuck holding the bag. Learn how to trade properly. Stop gambling.

Only 4 Seats Left in Our Next Live Trading Boot Camp!

Learn how to day trade and swing trade in live classes from veteran traders with over 20 years of trading experience. Only 4 seats left in our next class!