How can you maintain confidence when you know there is always a chance you could be wrong on a trade?

Many traders struggle to maintain confidence with their methods, even when trading a proven strategy. This results in self-destructive tendencies that cause huge losing streaks, which often ends in a blow-up.

Hesitating on pulling the trigger and missing a big move. Stopping out before there is a sell signal and then missing the move you were waiting for. Getting in and getting out constantly cause you’re scared. Sound familiar?

All of these behaviors are the result of low confidence. Confidence is one of the most important traits of successful traders. In order to build confidence, you first have to accept these two core beliefs about the nature of trading:

Losses Are Not Personal

One of the biggest causes of a loss of confidence is traders taking losses personally. In the real world, losing money is considered a negative event. The stock market is one of the few environments where losing money should not be considered a negative occurrence by itself. Why?

In order to make money trading, you have to risk money. You cannot be in winning trades without embracing the risk of potentially losing money.

Even when you trade setup with a 70% win rate, 3 out of 10 times you take that setup will be a loser. Whenever you take a loss to remind yourself that this is just the price to you pay to see if the trade will be a winner. You cannot be in winning trades without risking the possibility of it being a loser. Therefore, there is no logical reason to feel bad after a losing trade.

Each Trade Is Independent

Whatever happened on your last trade has no impact on what will happen in your next trade. Inexperienced traders think that because their last trade was a winner their next trade will be one as well. They also have the tendency to think because the last trade was a loser the next trade will be as well.

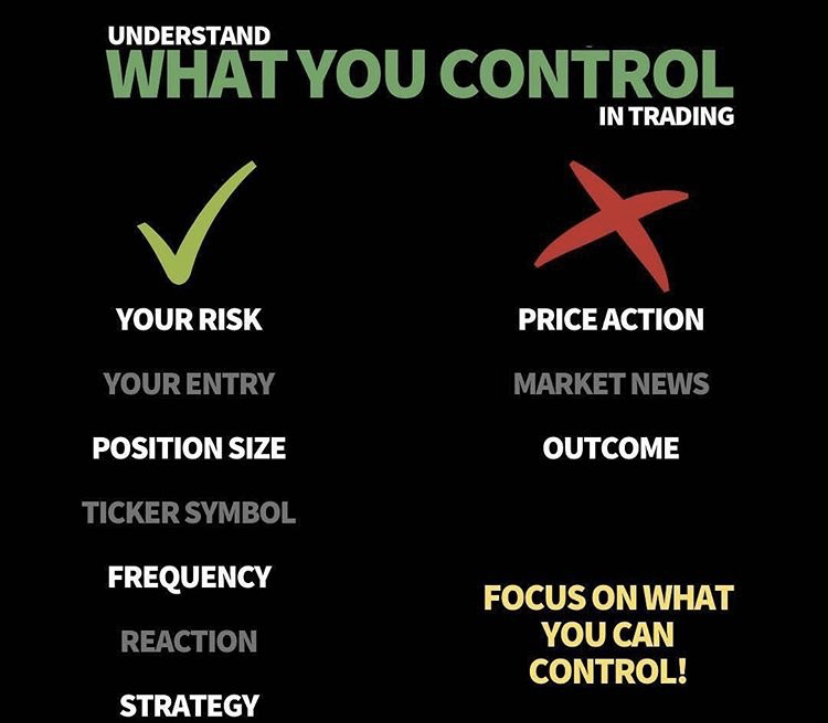

Focus on what you can control in your trading:

When you don’t understand that each trade outcome is independent, you create a self-fulfilling prophecy in the markets. When you have a bias to believe that your next trade will be a loser because the last one will be, you will subconsciously look for price action to confirm this belief.

As a result, you stop looking at the market objectively. Losing streaks happen when you focus too much on what you cannot control. Then you go on huge losing streaks, and your confidence gets crushed.

When you embrace this belief, you stop caring about what happened in the last trade. Eventually, you will start to feel more pain from missing your go-to setup than from losing money. When you make this shift, you are well on your way to become a winning trader.

How to Build Confidence

Once you have accepted these important beliefs, you can start taking steps to rebuild your confidence in your trading:

– Trade small: Build proficiency without losing much money

– Focus on only on your best setups

– Study and journal your trades religiously

– Focus on what you can control

– Stick to your process

Remember: Confidence comes from competence. Put in the hours when the market is closed. Trade with small size into you start seeing consistent green days and green weeks again. There is no reason to risk a lot of your hard-earned money until you have proven you can trade with confidence and edge.

Be patient. This is not an overnight process. The payoff is well worth the time you put into it.

Join Our Next Live Trading Boot Camp!

2 seats left in our next class starting soon!