BLOX was on our watch list for a bounce play. On the daily chart stock had a big volume earning gap on 2/22. As you can also see back in 11/29 the stock also gapped up on earning then pulled back to 20 EMA before starting next run. So given prior price history and the fact that stock has pulled back for four days after earning gap , I was eying it for bounce play. Usually after fast and rapid pullback stock tends to bounce/overshoot and then bounce at some inflection point whether it is moving averages or trend line or previous support.

I was looking for a bounce, however i do not want to catch any falling knife either just because it has been down for 4 days now. Before i can buy it i want to see whether buyers stepping up , that way i have a clean stop or reference point as where buyer came and when i need to get out with minimal loss.

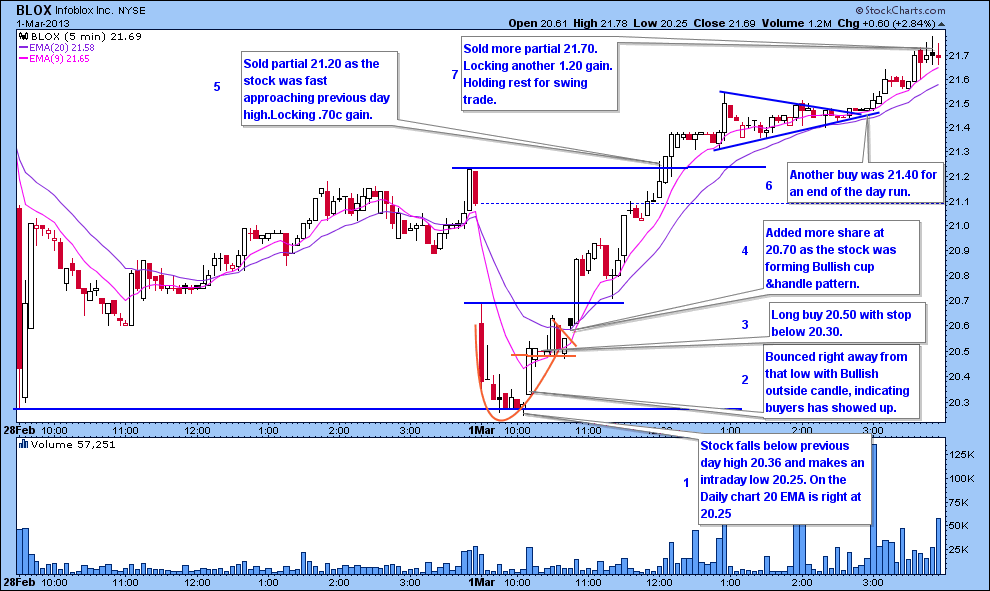

Let’s see intrday chart to see how the trade setup.

Stock gaps down along with broader Market index.

1.It falls below previous day high 20.36 and makes an intraday low 20.25 . On the Daily chart 20 EMA is right at 20.25. So that is now one reference point.

2.Stock bounced right away from that low with Bullish outside candle, indicating buyers has showed up. So now if our reference point 20.25 fails. Setup is invalid.

3.Long buy 20.50 with stop below 20.30 or below 20.25.

4.Added more share at 20.60 as the stock was forming Bullish cup &handle pattern.

5.Sold partial 21.20 as the stock was fast approaching previous day high. Locking .70c gain.

6.Another buy was 21.40 for an end of the day run.

7.Sold more partial 21.70. Locking another 1.20 gain. Holding rest for swing trade.

If you are interested learning this type of strategy and more for quick and explosive gains, check out Bulls Trading Bootcamp #6 starting in March. bit.ly/WJG5QW.New feature, I will share my explosive money making day trading strategies.

Email for info. thenyctrader@gmail.com

Follow me on Twitter and StockTwits @szaman