Despite what you see on social media, trading is a game where over 90% of people fail.

So why do most traders fail to become consistently profitable?

A primary reason is their belief systems. Most of these traders lose in the long run because they do not have the winning belief systems needed to optimize trading performance.

This is not entirely their fault. Most never had the education or mentorship to give them a shot at success and set realistic expectations. Trading does not come naturally most and requires a complete reprogramming of their mind to create success.

After working with 1000’s of students over the past 13 years, this is one of the biggest reoccurring issues we’ve seen with struggling traders.

Learn these 7 core beliefs needed for profitable trading:

Consistency Doesn’t Happen Overnight

When you come into trading, Nothing worthwhile in life happens fast. Trading is no different.

Your account growth and trading progress will not be linear:

Come in with realistic expectations. If it was easy, why would anyone work a regular job? But it’s more than worth taking a few years to master something that has the potential to generate ou wealth for the rest of your life.

Anything Can Happen On Any Trade

Nobody knows what will happen next in the markets. You can know what is likely to happen, but even on the best setups, there is still always a small chance you will be wrong. You HAVE to prepare for every scenario in a trade, especially the losing ones. All you need to know is 3 price areas: Where you will enter, where you will stop out and take a loss, and where you will take profits. Embrace the uncertainty in the markets, and you give yourself much improved chances of success.

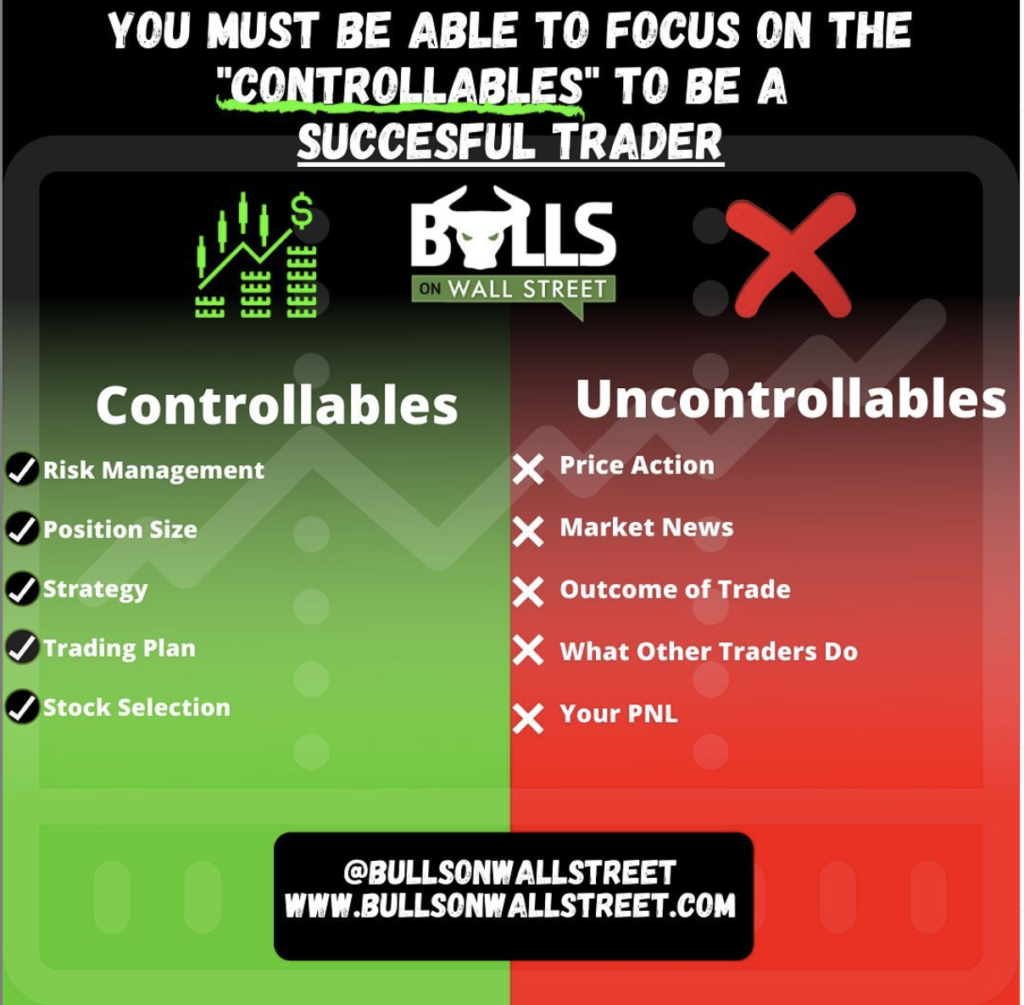

I Control My Own Trading Results

Stop blaming the market makers, hedge funds, and institutions for bad trading results. Everything important in trading is in your control. All of the controllables will lead to the best results for the uncontrollables:

Profits come from following a process.

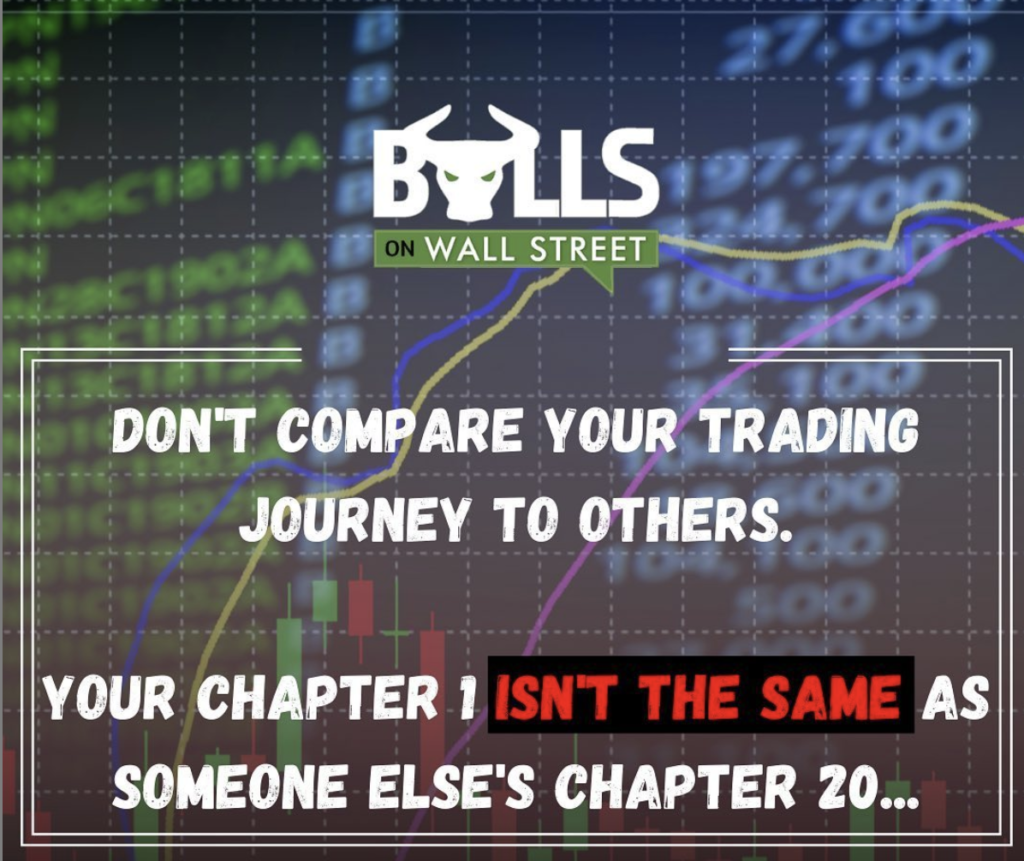

Others’ Trading Results is Not My Business

One of the worst things you can do early on in your trading career is to compare your progress to others.

Everyone starts somewhere. Don’t waste time on social media getting PNL envy. It provides ZERO benefit for your trading career, besides potential inspiration of what is possible.

No Plan, No Trade

If you fail to prepare, you prepare to fail. Trading is one of the highest stakes games in the world. You are competing against some of the biggest and smartest people in the world. Every trade you take needs to be carefully planned out. This planning is what separates a trade from a gamble. Impulsive trades do NOT work when you’re new or inexperienced.

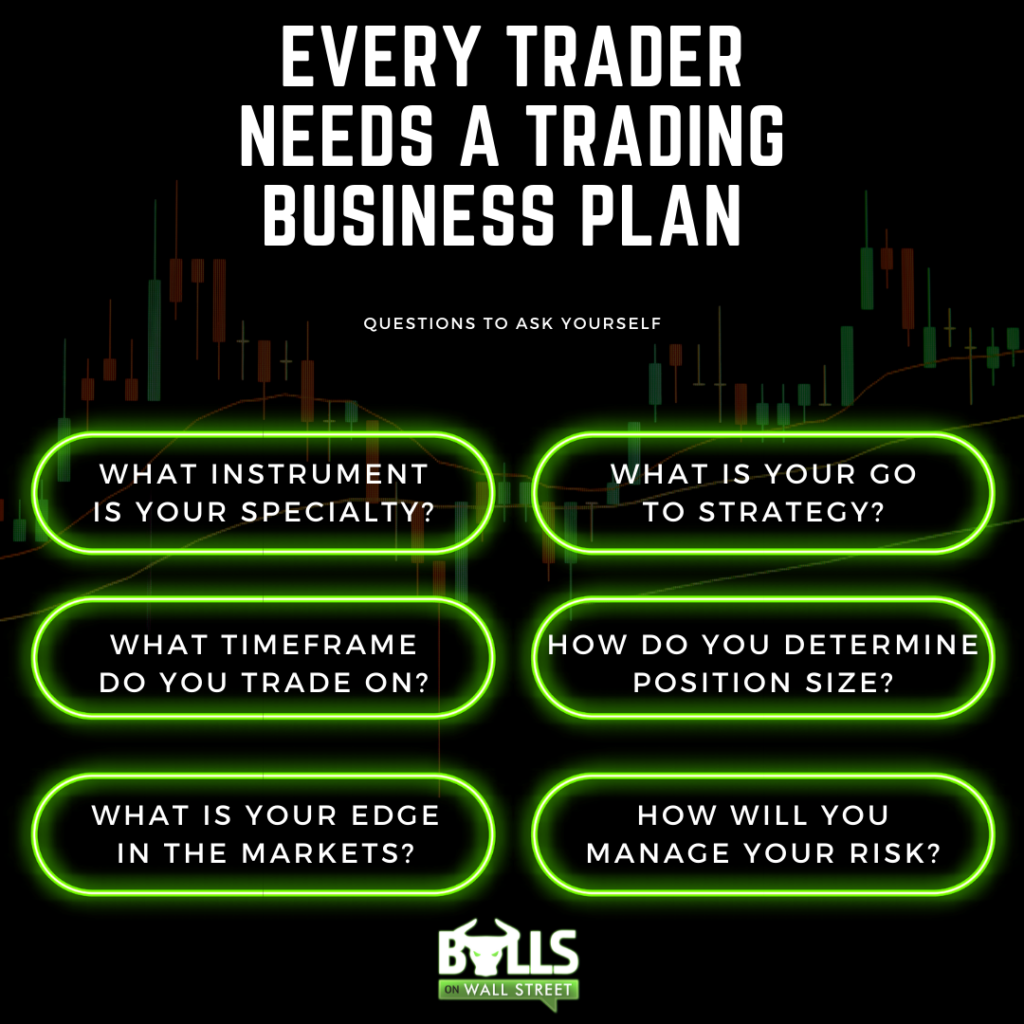

Trading is a Business

You cannot treat trading like a hobby or an experiment if you truly want to be profitable. You need answers to all of these questions before jumping into trading.

Need help building your trading business plan? Don’t hesitate to reach out to us for guidance!

Live Trading Classes From Experienced Traders: Join Our Live Trading Boot Camp

Space fills up fast in our boot camps. Apply for your seat to see if you qualify!