The 2022 bear market has humbled many traders, even experienced ones. Traders who have been crushing the rabid bull market of the past 2 years are being brought back to reality.

Markets change, and if you don’t change with them, you WILL lose all your money.

This year we are seeing lower highs, failed breakouts, and many breakdowns in major indices. To help prepare you for the worst of this bear market, which has yet to come, we want to talk about 3 simple approaches you can take to capitalize during this market.

Here are 3 strategies you need to be using in a bear market to survive and profit as a trader:

Short Sell

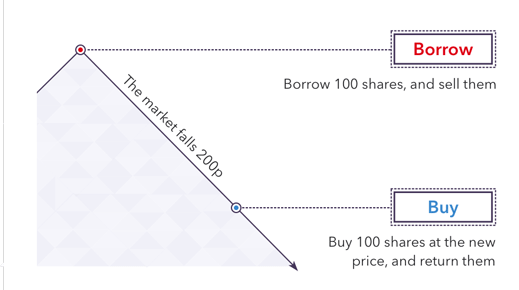

Not many new traders know that you can make money when stocks go down. This is called short selling (also referred to as shorting) , when you borrow shares of a stock from your broker and then buy them back later, ideally at a lower price. Short selling can be very profitable in market environments like the ones we are currently in.

Here is a simple graphic explaining how it works:

However, you have to manage your risk even more aggressively when short selling. A long position you can only lose what is in your account balance. But with short selling you can lose more than what’s in your account because stocks can go up more than 100%, meaning you would go in debt to your broker. You HAVE to understand timing an risk management to short-sell profitably.

This video will show you more about short-selling, and you can manage risk so you can execute these trades correctly:

Long Oversold Bounces

Most traders don’t know that the biggest rallies to the upside happen in bear markets, not bull markets.

Bear markets bring a lot of volatility into the markets. This means that stocks will be trading well outside of their normal ranges, which is great for day traders. If you are not familiar with or confident short selling stocks, there is still plenty of money to be made to the long side in a bear market. Stocks that have big pullbacks will always bounce at some point.

Stocks don’t just go straight down forever in a bear market. Just like stocks pull back when they are in an uptrend, stocks will spike when they are in a downtrend. When stocks get overextended to the downside, they will often have nice bounces. This strategy works especially well when a stock has had several consecutive down days. Keep in mind that this type of trading setup is not something to marry. You are just going for the quick counter-trend move, and then quickly taking your profits. Once the stock bounces, it could start to fade off again and you may end up breakeven or with a losing trade.

Here is a video explaining how to improve the timing on your trades so you can time these trades correctly:

Stay In Cash

Knowing when not to trade is essential for achieving success as a trader in the long run. In bear markets, stocks will not just go straight down every month. They will sometimes consolidate sideways, and not have an obvious trend. They will start to trade in a tight range, and there will not be much money to be made because there is no volatility or range to profit off of. During these times it is crucial that you stay on the sidelines until one of your go-to setups presents itself. Patience is crucial during these periods.

When you look back at your trades at the end of every week and add up your PNL for the week, you will see how much overtrading can hurt you. Even if they are small losses, boredom trades are a complete waste of your physical and mental capital. In order to be a successful trader, you need to have the discipline to only trade when your edge is there. In a bear market, you cannot be expecting the market to dump huge every day. You need to wait for an obvious trend and volatility to come back into the market before making trades.

Our Live Trading Boot Camp focuses specifically on teaching traders how to dominate bear markets. The best traders make the biggest fortunes during a bear market. The goal of this course is to show you how to grow your account in ALL market conditions, bull and bear:

Get Early-Bird Pricing For Our Next Live Trading Boot Camp

Click here to apply for our next trading boot camp!