If you have watched the news for even a second or scrolled through social media, the newest headline gripping the world is the collapse of Silicon Valley Bank, or SVB for short, causing fear, destruction, and shockwaves across the nation.

More bank-runs are occurring in other banks like First Republic bank on the west coast, for example, as many regular consumers and users of banks that had exposure to SVB are starting to become fearful that their deposits are not safe.

So, with all of this crazy SVB collapse drama going on, it is essential to step back and look at how this will affect the market, everyday people, and other banks. First, let’s dive into SVB and a little more about the collapse before we expand further into the realm of the implications the collapse has for traders and investors.

What is Silicon Valley Bank?

Silicon Valley Bank (SVB) was founded in 1983 and has operated for nearly 40 years. The bank was created to provide financial services to technology and life science companies, and it has since become one of the leading providers of financing, banking, and investment services to startups and venture capital firms.

What does the collapse of SVB mean for the stock market?

The collapse of SVB represents a significant setback for the technology startup ecosystem, which relies heavily on venture capital funding. As one of the most prominent venture capital firms, SVB’s failure has the potential cause a ripple effect throughout the industry, with other firms potentially being forced to tighten their purse strings and limit investments to mitigate risk, even with the fed bailout as people lose trust with their bank systems, causing bank runs.

While looking at individual companies in the tech space that are publicly listed or are private, it is important to look into their holdings and exposure to SVB as well as companies that heavily relied on loans and credit lines from SVB and its associated parties/venture capital firms, to see if there will be any drastic impact or not on the company.

What does the collapse of SVB mean for investors?

The collapse of SVB highlights the importance of due diligence when investing in any financial institution. For investors, the collapse of SVB is a rough reminder that there is always an element of risk involved in investing, and that the failure of one institution can have a ripple effect throughout the industry. It is essential for investors to diversify their portfolios and to carefully evaluate the financial strength and stability of any institution before investing.

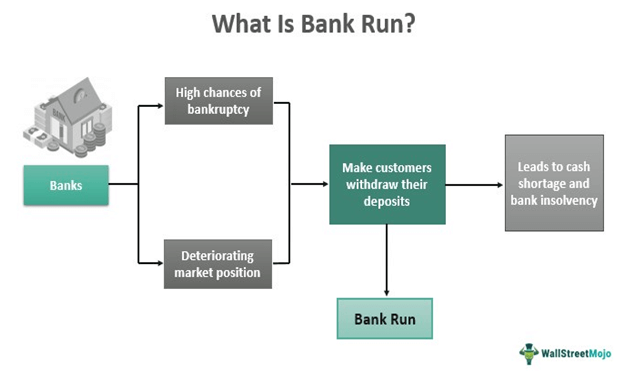

What caused their collapse? The age-old story of being overleveraged and using customer deposits to buy risky assets that went south on them. Once the signs of distress got out there, a bank run ensued resulting in the collapse. A bank run is explained in the graphic below:

What does the collapse of SVB mean for everyday people?

The collapse of SVB may not have an immediate impact on everyday people, but it could lead to a slowdown in the creation of new technology startups, which could have a long-term impact on the economy. Additionally, the collapse of SVB is a reminder of the importance of maintaining a stable financial system, as the failure of one institution can have a domino effect that impacts businesses and individuals throughout the economy.

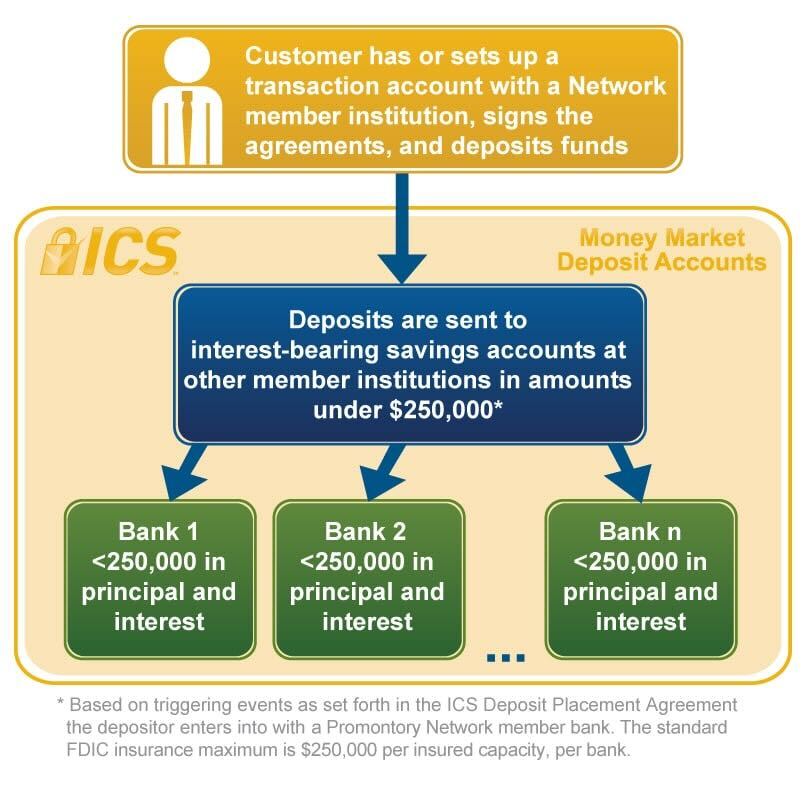

Well, the FDIC (or the federal government) will insure deposits up to 250,000 in the United States. HOWEVER, the fed decided to bailout SVB acc, regardless of their deposit size. The “old definition” of the FDIC is explained below:

Comparing the Lehman Brothers collapse to the SVB collapse

The collapse of SVB has drawn comparisons to the collapse of Lehman Brothers in 2008, which was a key factor in the global financial crisis. While there are similarities between the two collapses, there are also some key differences.

Always worth watching the iconic scene in the Big Short before we dive in, when Bear Sterns is tanking:

The Differences

One major difference is the size of the institutions involved. Lehman Brothers was a massive investment bank with assets of over $600 billion, while SVB was a much smaller venture capital firm. Additionally, the causes of the collapses were different, with Lehman Brothers being brought down by a combination of excessive risk-taking and the bursting of the housing bubble, while the collapse of SVB was more directly related to its exposure to high-risk startups..

The Similarities

One major and fascinating similarity is that both SVB and Lehman Brothers were financial institutions that faced significant financial instability PRIOR to their ultimate demise, which led to their collapse. In 2020, SVB had some very shaky lawsuits and questions about its solvency and ability to cover deposits. These same questions were raised 2 years before Lehman Brothers collapsed as well in 2006.

The collapse of SVB highlights the importance of due diligence and risk management in the financial industry and serves as a reminder that the failure of one institution can have a ripple effect throughout the economy. It’s important now that we keep a keen and watchful eye on the financial system. Always do your due diligence, and lean on the side of caution.

What does the collapse mean for traders?

What does the collapse mean for traders? Volatility and range. With the price action of the last several weeks, this kind of catalyst is a blessing. One of the best parts about being a trader is that you don’t need to PREDICT how this will play out. You only need to worry about reacting to the price action.

Some of our students have been having their best trading months ever!

These students have been trading and studying for years with us to make these kinds of days happen. If you want to learn the strategies that allow you to capitalize in these market conditions, apply for our LIVE Trading Boot Camp below!

Early-Bird Pricing Ends SOON For Our Next Live Trading Boot Camp