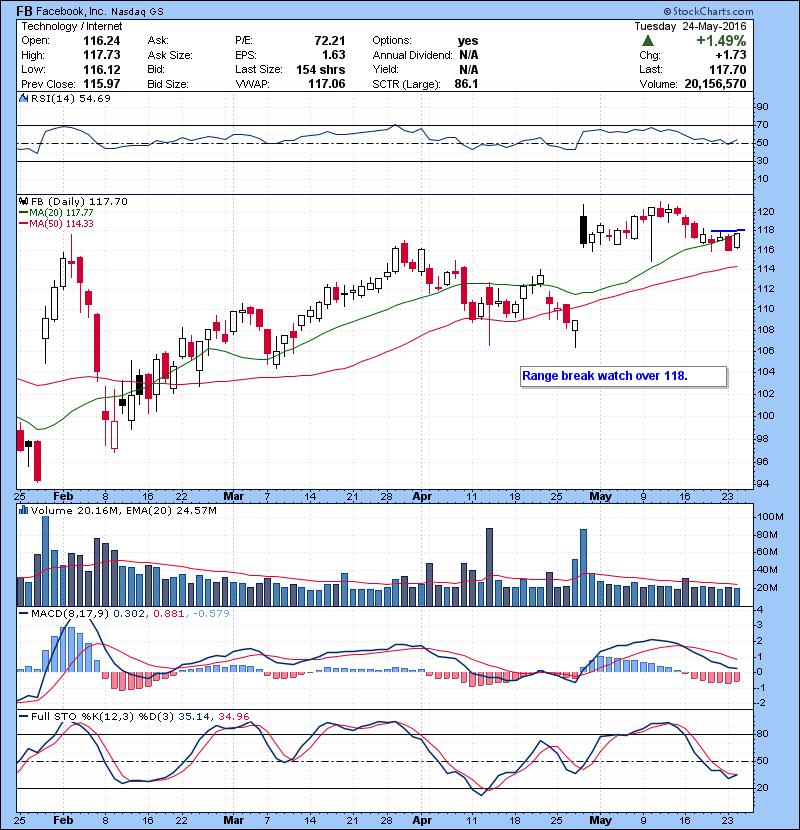

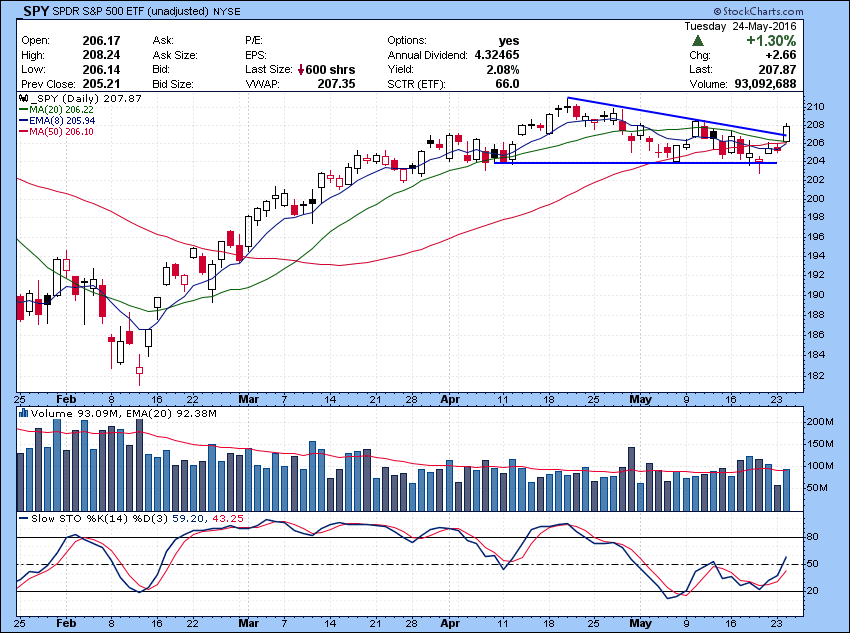

Gap and go day in the market , led by technology and financials stocks.

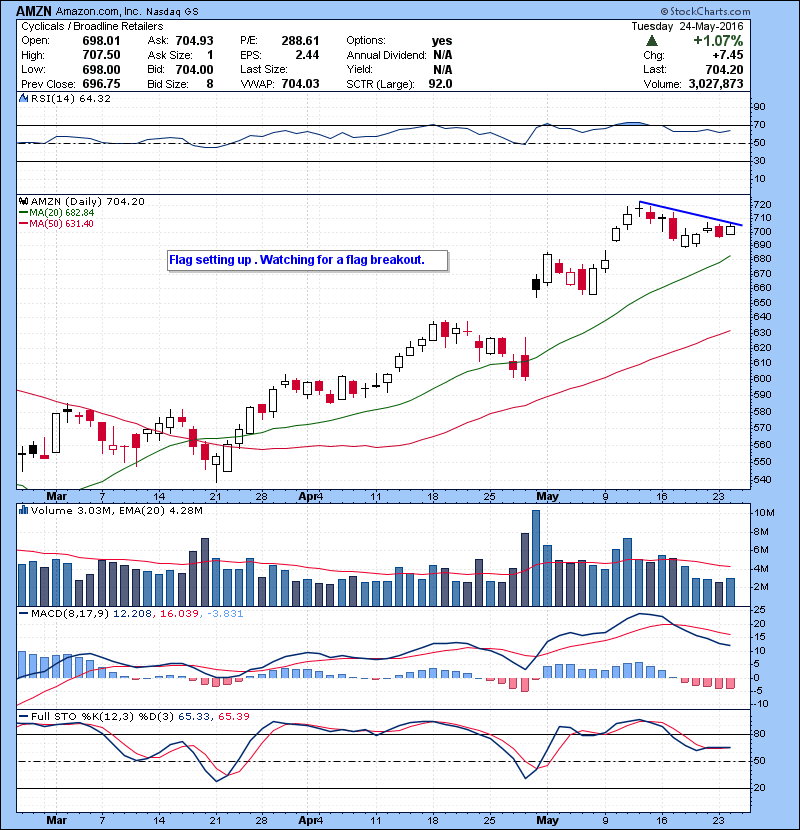

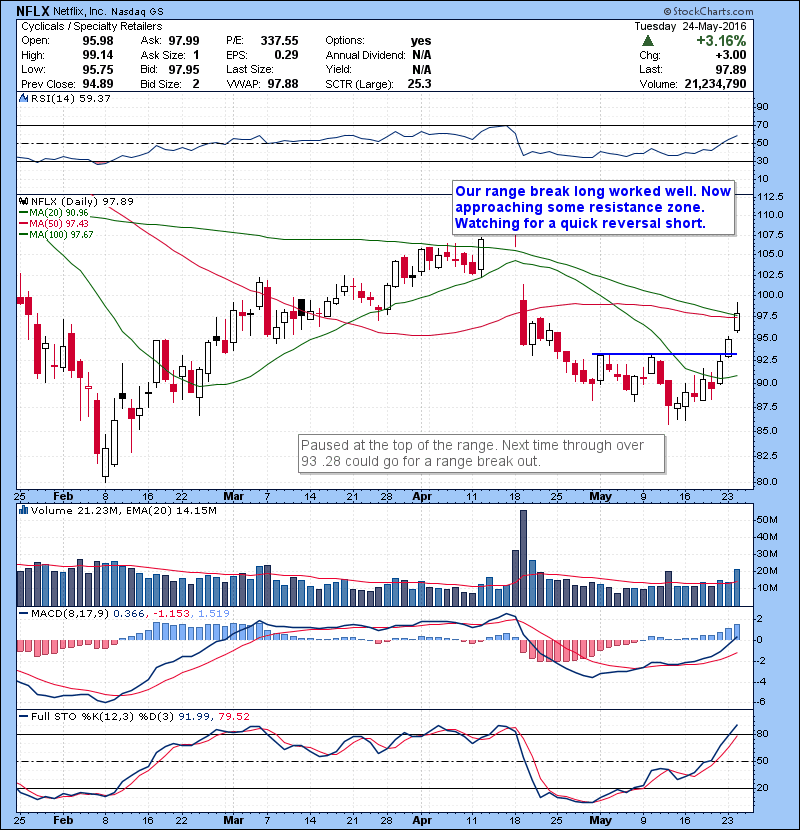

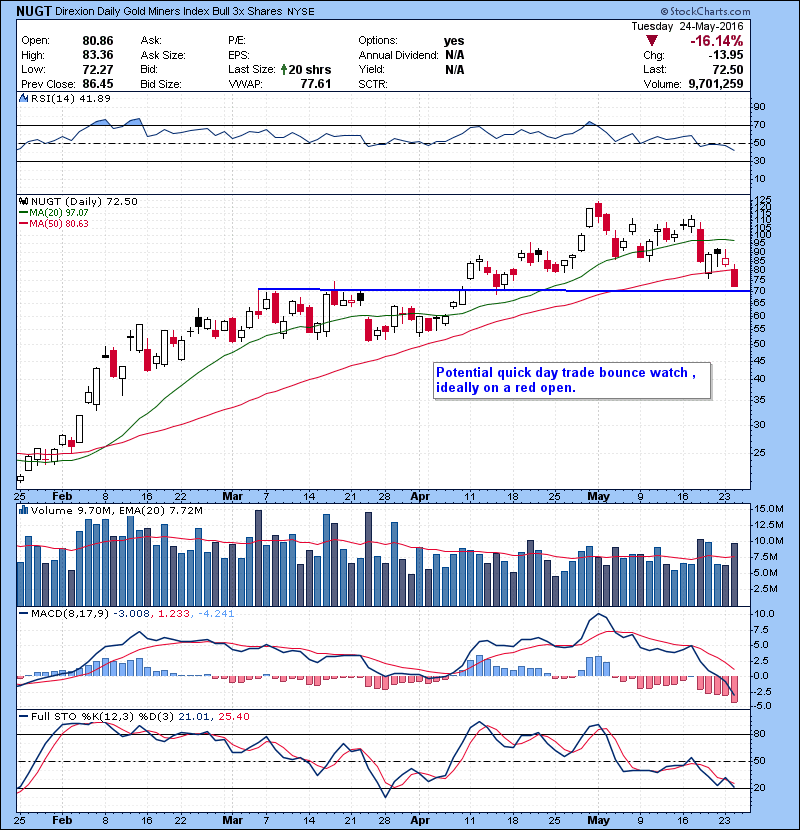

SPY broke out of short term range and flag pattern. Usually this type viscous move, gap and close all over major moving averages (8,20,50) sees follow through move but given the market action lately, upside momentum tends to fade in few days. So I’ll be keeping an open mind and trade what i see. Market has been in a range for a long time, if market finally starts moving, we might see some chasing and short squeeze which in turn should propel the market higher. Only issues is, not seeing any positive catalyst for that to happen .But we just trade the price action and price action certainly was impressive Tuesday. SPY resistance at 208.54 followed by big one 210.92. Short term support now blow 20/50 MA, 206 area. Some nice movers from last blog post, LABD, NFLX, BEAT all gave some decent trading action.If you are struggling with your trading or learn how to trade you need to check out our trading courses. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.