Today we are going to talk about what we learned trading the “great pandemic bear and bull market” of 2020.

Yes, that’s what I’m calling it.

It might not be catchy, but it’s exactly how I see it.

The focus: Trading lessons gleaned from a historically wild year that will make us better traders.

I love learning from the markets. I keep a journal of trading lessons that’s constantly evolving. I believe success is directly linked to learning and implementing the lessons learned from the markets each year.

As Peter Drucker said “Learning is a lifelong process of keeping abreast of change.”

The man was on to something when he said this.

Unlike many other disciplines, markets constantly change. You can’t blindly do what you did yesterday and think it will work tomorrow.

So we accumulate data, analyze and adapt. Constantly.

In 2020 many traders learned this the hard way. Things that were bread-and-butter moves in prior years did not work. Many were perplexed by the markets because what seemed logical failed. Those who did the best identified this concept quickly, made changes and adapted to the new tide.

Today, I am sharing with you my 7 most important lessons from 2020. These are the lessons that are going in my own journal.

Lesson #1: Ignore the news

Throughout the year I’ve had friends who don’t trade tell me I needed to sell everything. With every Trump tweet or Covid spike the world was going to end. Economists correctly predicted the economy would tank.

So the market tanked, right?

We all know it did not. In fact, after the March pandemic meltdown, the market went on a historic bull run.

This all happened in the midst of horrible news. It didn’t make any sense. How could the market continue to go up while a scary virus was killing us and people were losing jobs at levels not seen since the Great Depression? We’ll talk about that in lesson two, but the point here is that we must ignore the news and follow the price action.

Let me repeat: Follow price action and ignore the news!

Lesson #2: The market tries to predict the future

There are two types of people: those who live in the past and those who look to the future. If the market was a person it would be the latter. Mr. Market doesn’t care about what has already happened. It has already priced that into the equation.

For the market, the present is dictated by the future.

This concept is illustrated by the entire market move of 2020. If the market was looking at present data, it would be at levels below the March pandemic lows.

Instead, the market is at all-time highs.

That’s because the market is looking out at the future. It knows things are bad, but does not believe they will stay bad.

And that’s why I’m not afraid to go long when things are at their worst. If price action tells us the market thinks things will get better, we look to the future.

Lesson #3: Markets move on hope, not reality (sell the news)

If you want big results, study the best.

The biggest movers of 2020 had one thing in common. They made their big moves on hope, not reality.

This might be the biggest lesson of 2020.

Some of the biggest movers in 2020 were biotech stocks working on vaccines, electric cars, solars and IPOs.

A common thread between these big movers was hope. The hope of big results. However, once the results were in, they often slowed down or sold off.

The vaccine plays are a great example of this.

Moderna made a historic run in 2020 as it worked on the Covid-19 vaccine. The day it was announced that the vaccine was ready was an epic moment for the stock (and the world). It was clear at this point the company was one of the winners in this space and would make billions.

However, the stock tanked after the announcement and is currently 75 points below it’s peak sitting at $103 after making a pre-announcement high of $178.

This is why I look to trade hope and sell results.

Lesson #4: Speculation rules in pumped up markets

Any time you are trading an overheated market, follow the junk.

That’s because when euphoria hits, the junk rises to the top. The stock that will fizzle quickly and in a year’s time will be back to being ignored are now the darlings of the market.

Look to ride the wave of recent IPOs, stocks with no profits and fad stocks in speculative areas. They are the stocks that make insane runs.

But be careful. These are also the stocks that will have epic falls.

Lesson #5: Strength begets more strength (RS)

I remember when I first started trading I was constantly on the lookout for value. I would buy “cheap” stocks and wonder why they continued to underperform while stocks that were expensive made the big money.

It’s because strength begets more strength. Bullish runs are led by relative strength leaders.

Stocks in action tend to stay in action.

This year the market was led by a plethora of stocks like Zoom, Tesla and Coupa. These stocks were relative strength leaders throughout the year.

In hot markets, make a list of leaders. Most of your trades should come from these stocks.

Lesson #6: Extended markets get more extended

I love extended markets. That’s because when I see a market that’s extended I see opportunity. That’s the opposite of how many traders see overbought markets.

They become fearful.

Here’s why you should throw that fear to the side and get ready to trade. In hot markets, markets move irrationally. In the midst of fear, they climb the “wall of worry”.

This is often the best time to get long.

I know it might not make common sense, but take a look at the 2020 chart. What you will find is most of the time when the market got extended, it was a good buying opportunity.

Lesson #7: Don’t over-react to short term news

Do you remember all of the times this year the market dipped in the morning because of a Trump tweet? How about all the times it was red after hours because of scary Covid news, job loss number or lockdowns. What about all the strong stocks that took momentary dumps because of earnings or a news event?

Unless you have photographic memory, you probably don't remember many of these moments. The market ended up fine. Most of the relative strength stocks overcame the momentary dumps and the Covid news was ultimately ignored.

The momentary dips were over-reactions.

This is one of the weird conundrums of the market.

While we have already established it is forward looking, in the very short term it gets scared out of its mind by current news events that don’t mean much in the future.

I learned this concept very early on in my trading career. Don’t get faked out by over-reactions to short term events. In fact, often they provide amazing opportunities.

So these are the big lessons of 2020. Now it’s time to put them into practice in the new year!

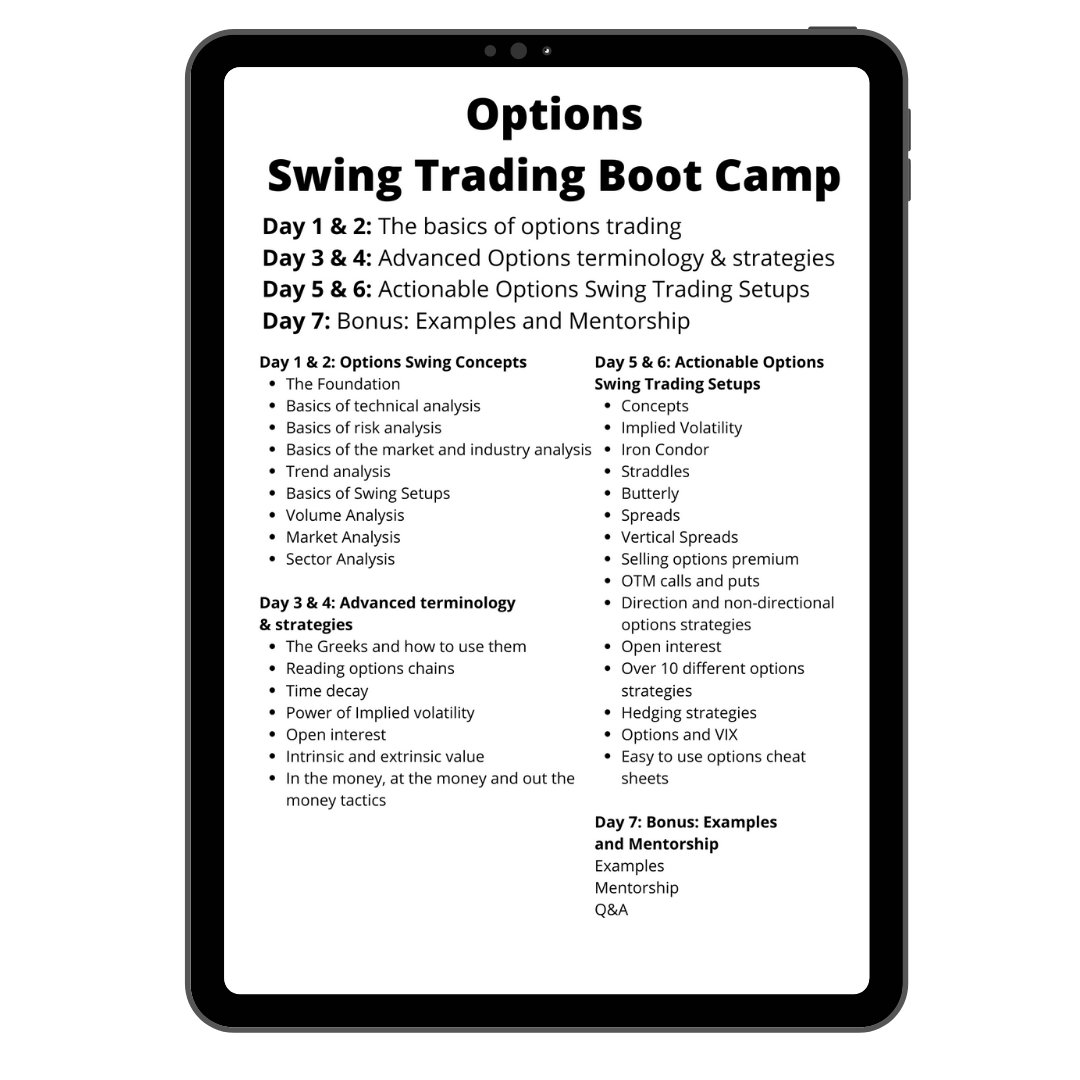

Join Our New Live Options Swing Trading Boot Camp - January 12th

If you want to learn how you can transition from swing trading stocks to options trading, or if you are a new trader looking at learning options swing trading strategies, then you should checkout my new and upcoming live Swing Trading Boot Camp here.