We are all in a reflective state of mind as we approach the end of the decade. Looking at trading quotes from the greats is one of the best ways to reflect on market patterns, and see how they played out over the past 10 years.

Patterns in the markets repeat themselves over and over again. Today we will look at 20 of the best trading quotes of all time. We will categorize them into different topics, and see which ones resonate with you the best:

Risk Management Quotes

“Markets can stay irrational longer than you can stay solvent”

John Manayard Keys

There are old traders and there are bold traders, but there are very few old, bold traders.

-Ed Seykota

The whole secret to winning big in the stock market is not to be right all the time, but to lose the least amount possible when you’re wrong.

-William J. O’Neil

Trading is a waiting game. You sit, you wait, and you make a lot of money all at once. Profits come in bunches. The trick when going sideways between home runs is not to lose too much in between.

-Michael Covel

“Throughout my financial career, I have continually witnessed examples of other people that I have known being ruined by a failure to respect risk. If you don’t take a hard look at risk, it will take you.”

– Larry Hite

“The four most dangerous words in investing are: This time it’s different.”

Sir John Templteton

Trade Management Quotes

People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.

-Peter Lynch

The goal of a successful trader is to make the best trades. Money is secondary.

-Alexander Elder

It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.

-Charlie Munger

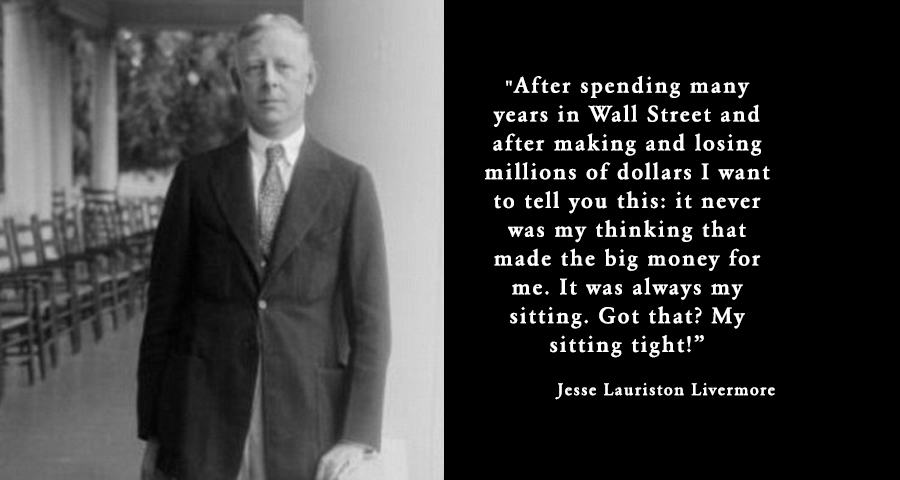

“It was never my thinking that made the big money for me, it always was sitting.”

-Jesse Livermore

If it’s obvious, it’s obviously wrong.

-Joe Granville

Are you willing to lose money on a trade? If not, then don’t take it. You can only win if you’re not afraid to lose. And you can only do that if you truly accept the risks in front of you.

–Sami Abusaad

In trading, you have to be defensive and aggressive at the same time. If you are not aggressive, you are not going to make money, and if you are not defensive, you are not going to keep money.

-Ray Dalio

Trading Psychology

The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.

-Warren Buffett

There is no single market secret to discover, no single correct way to trade the markets. Those seeking the one true answer to the markets haven’t even gotten as far as asking the right question, let alone getting the right answer.

-Jack Schwager

Trading is a psychological game. Most people think they are playing against the market, but the market doesn´t care. You’re really playing against yourself.

-Martin Schwarz

The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading.

-Victor Sperandeo

“What seems too high and risky to the majority generally goes higher and what seems low and cheap generally goes lower.”

-William O’Neil

“You don’t need to be a rocket scientist. Investing is not a game where the guy with the 160 IQ beats the guy with 130 IQ.”

-Warren Buffet

Don’t Miss our Live Webinar on Monday 1/27

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.”

In our live webinar, we will show you how to find and master a ONE trading niche, and avoid the noise.

Click here to sign up for the webinar