Flat day in the market with many chops in between intraday. Technology stocks remain weak and relative strength in metal, energy and financials names.

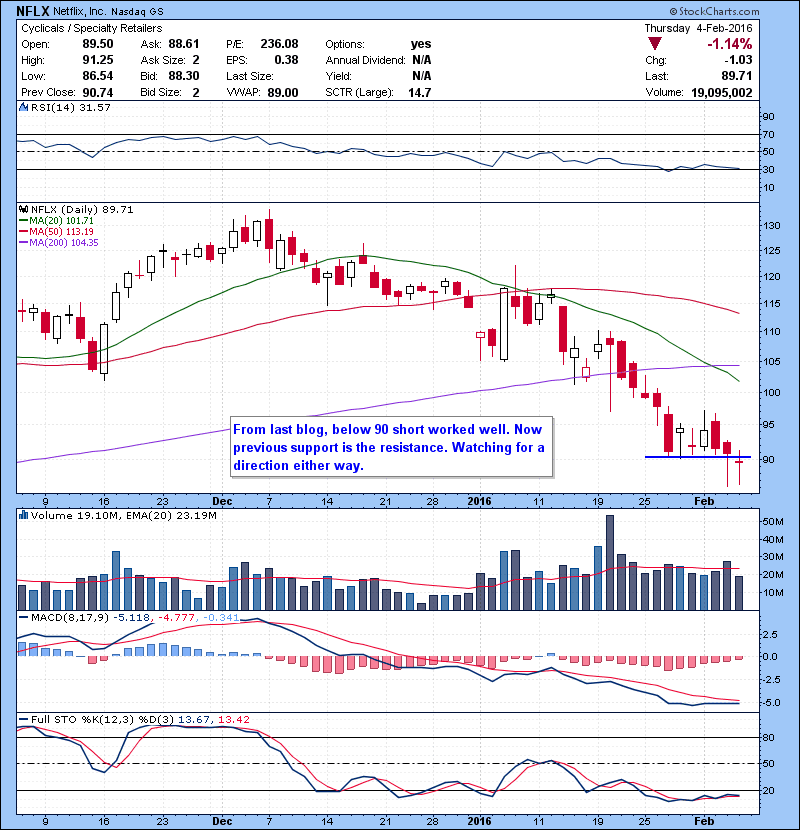

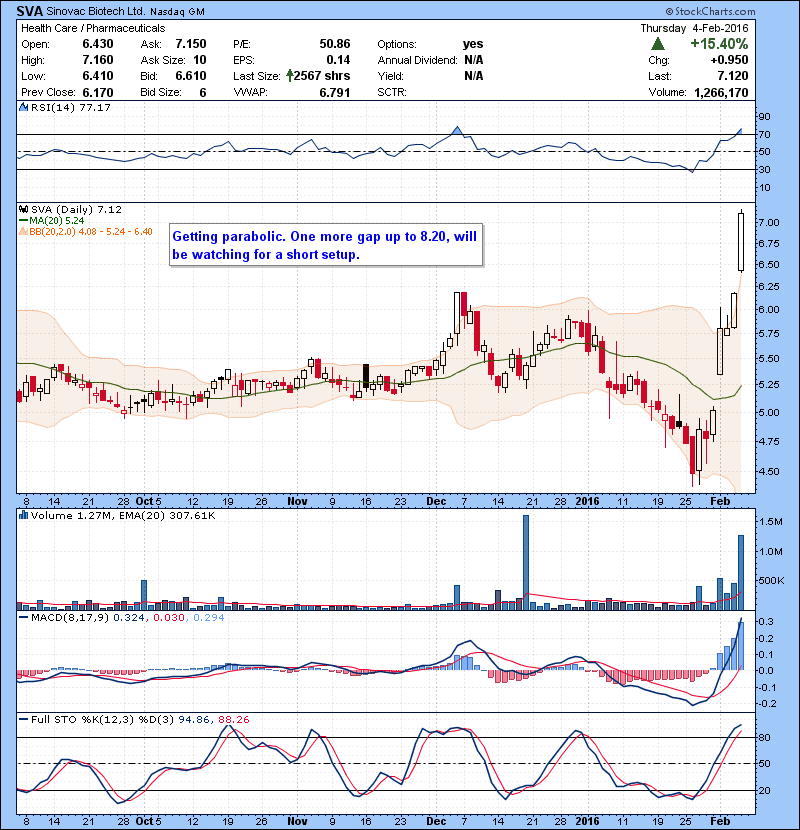

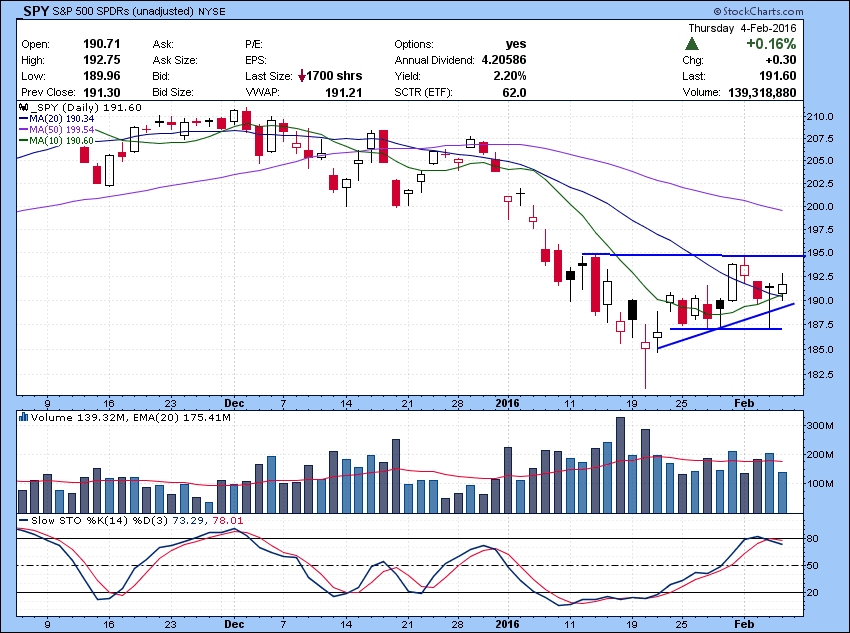

Seems like sector rotation in play, tech/bio money going into sectors like metal, energy and financials names. Some nice plays from last blog. Oil support bounce worked well and NFLX , BIDU short idea also worked. SPY now in the middle of a bear flag range with some clear support and resistance. 187 still a big support, however a low below Thursday’s low , 190 area will break the short term momentum, 20 MA. Bears might make come back again if that happens. Hit and run market our there, so be quick and take gains fast. Action hasn’t been linear so there are opportunity for round trips trades. (long/short/long).If you are struggling with your trading or learn how to trade you need to join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room , take a free trial! Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.