Trend Pullback Setup and Relative Strength

There are only 24 people trading the trend pullback correctly. After you read this post and watch the video there will be 25.

The hidden mistake swing traders make when trading pullbacks is they do not take relative strength into account. This is a fatal flaw because as swing traders, we want to be in the strongest, most volatile stocks. Relative strength is what lead me to a $2486 gain trading Brazilian ETF $BRZU while the rest of the market chops around in an unforgiving range.

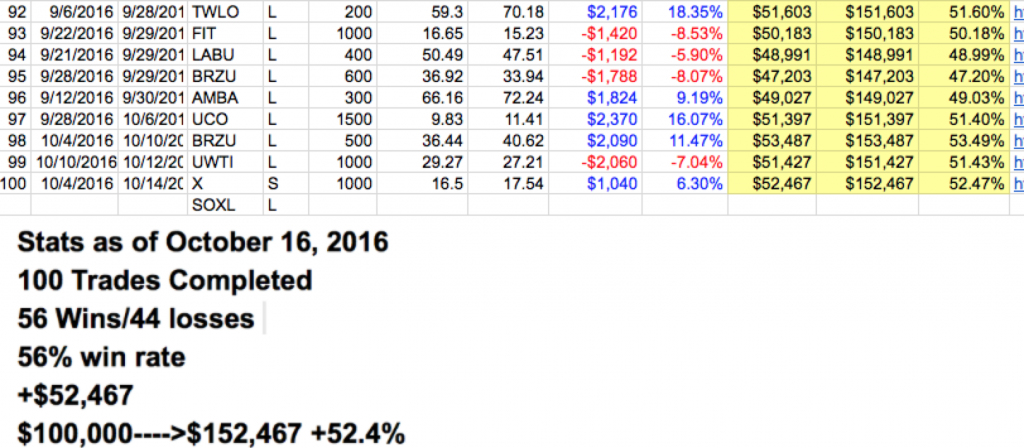

Here is my 2016 Trading Stats (+52% vs SPY 6%)

Trading relative strength is not as complicated as it sounds. In fact, it’s actually quite simple if you use this 3 step approach:

- Scan the strongest sectors over a given timeframe (sector relative strength).

- Pick the strongest stocks within the strongest sectors (stock relative strength)

- Apply the Trend-Pullback Setup.

In today’s video, I show you exactly how I seemingly had a crystal ball and entered traded Brazil just before it made a monster move.

You will learn how to:

- Find relative strength ETFs

- Use market analysis to time positions

- Trade Trend Pullback setups

- Use the 9ema for entries

- Exit a trend pullback trade

Remember, members of the swing service get all of these trade alerts intraday in real time.

This swing trading service is great for those that work and can’t monitor the computer all day. We have in-depth nightly reports on the game plan for the day/week, and all stock picks that I trade will be alerted and emailed to you.

Check out the Swing Service HERE

Follow me, Paul Singh AKA “TheMarketSpeculator” on Twitter or email me at SinghJD1@aol.com.