Is the end of the pandemic market near?

This week gave us hope that the answer is yes!

On Monday Pfizer announced they have developed a vaccine that is 90% effective. The market wildly over-reacted to the upside, but it was not a full blown “all systems go” market move. Certain industries popped, while others dropped.

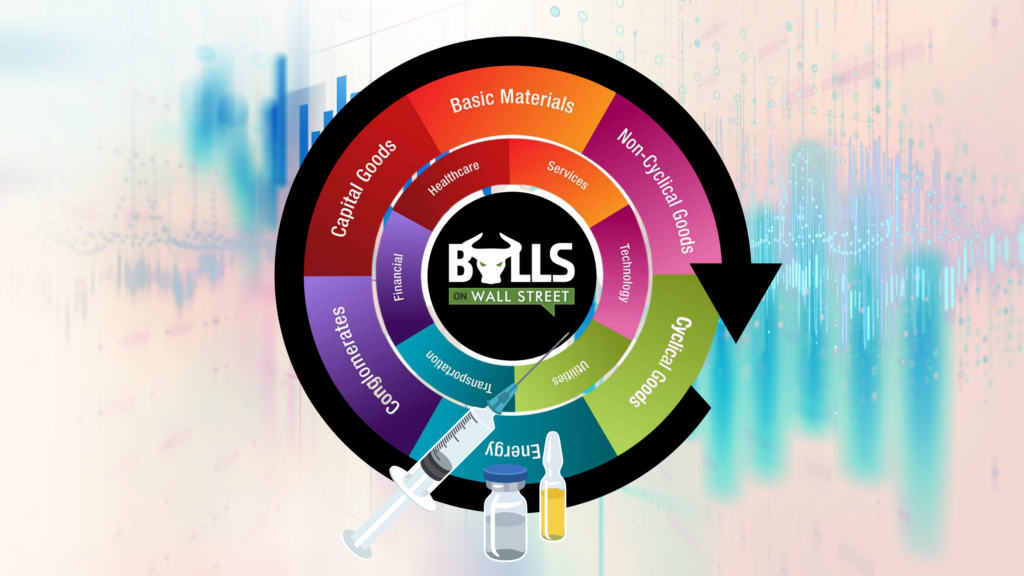

This is illustrated by the split between small cap ETF IWM and tech focused ETF QQQ.

IWM closed Monday up and eye popping 3.6%, while QQQ ended the day red. The hardest hit areas were those that benefited most from the “pandemic” market: software, cloud and work and do from home related stocks. On the flip side, industries that have been crushed over the past nine months, like airlines, casinos, leisure and restaurants, broke out of beaten down ranges.

Now the big question for swing traders is whether this leads to a sustained rotation from tech into the “beaten down” industries.

In today’s video, I review each of the major beaten down and tech industries. We analyze the technical patterns and potential trades going forward.

Let's see where the different industry ETFs are at. Tech vs "the beaten downs" https://t.co/ibdw0kybud

— Paul J. Singh (@PaulJSingh) November 13, 2020