Quick Summary:

SPY mixed signals. IWM cup and handle setup. The Weekend video goes over 12 great stocks not on the focus list. AAPL, AIRM, PANW, MNST, SCTY, LDRH and BITA start the week’s focus list.

Video Analysis (5 minutes):

The Weekend Video goes over some stocks ready to make big moves that are not on the focus list below that are worth watching.

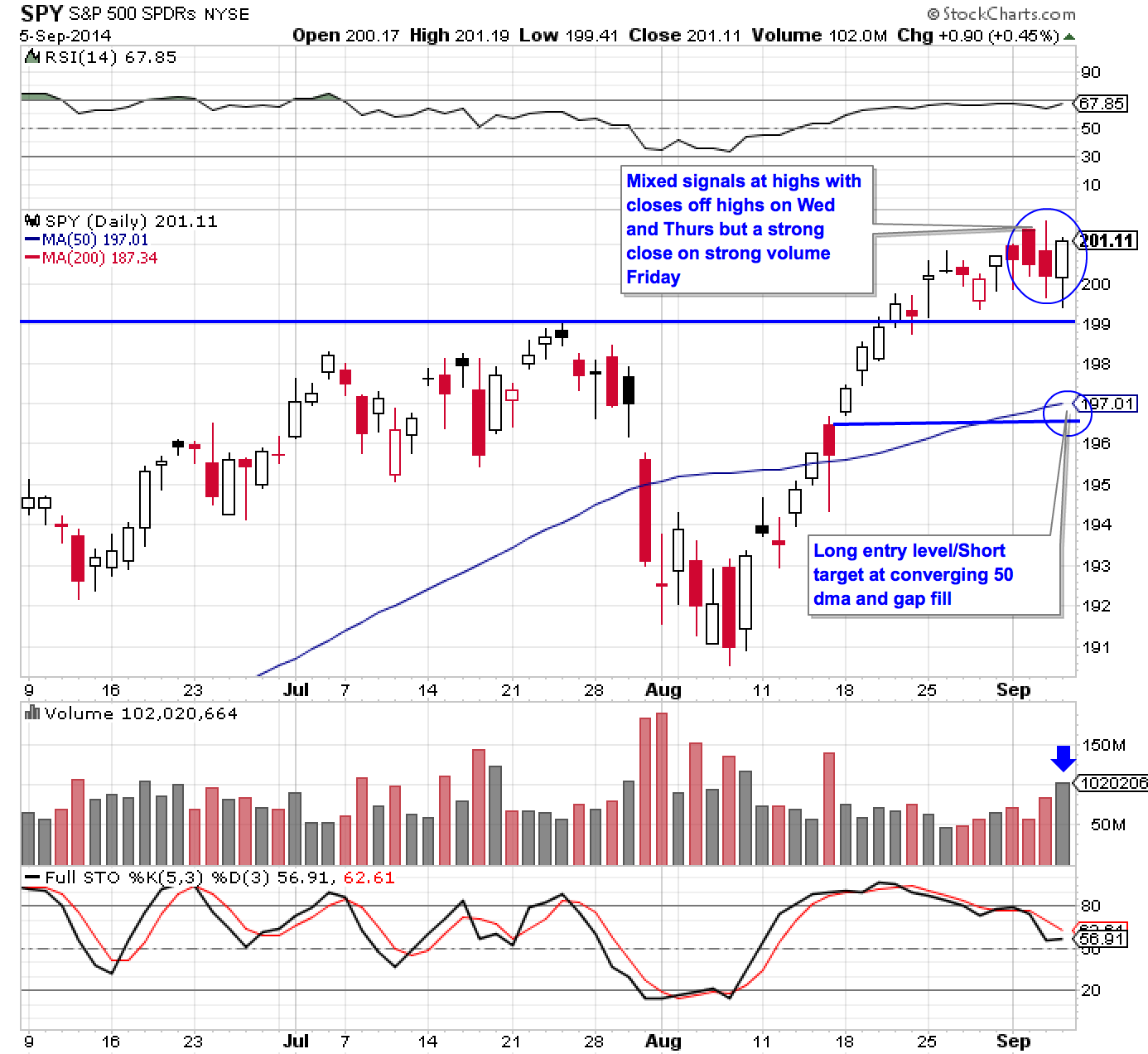

Key SPY Pivot Levels: Round number $200, Old high 199, 50 dam 197.01, 197.50 and $196.50 gap fill and support levels

Under the Hood and Trading Game Plan:

Over the past three days SPY has given us mixed signals. While Wednesday and Thursday gave us two of the worst closes since August 7th, Friday printed a strong close on an uptick in volume. I will continue to manage my short position, but have no bias for my individual stock trades. I will likely continue to trade with smaller position size until there is more clarity.

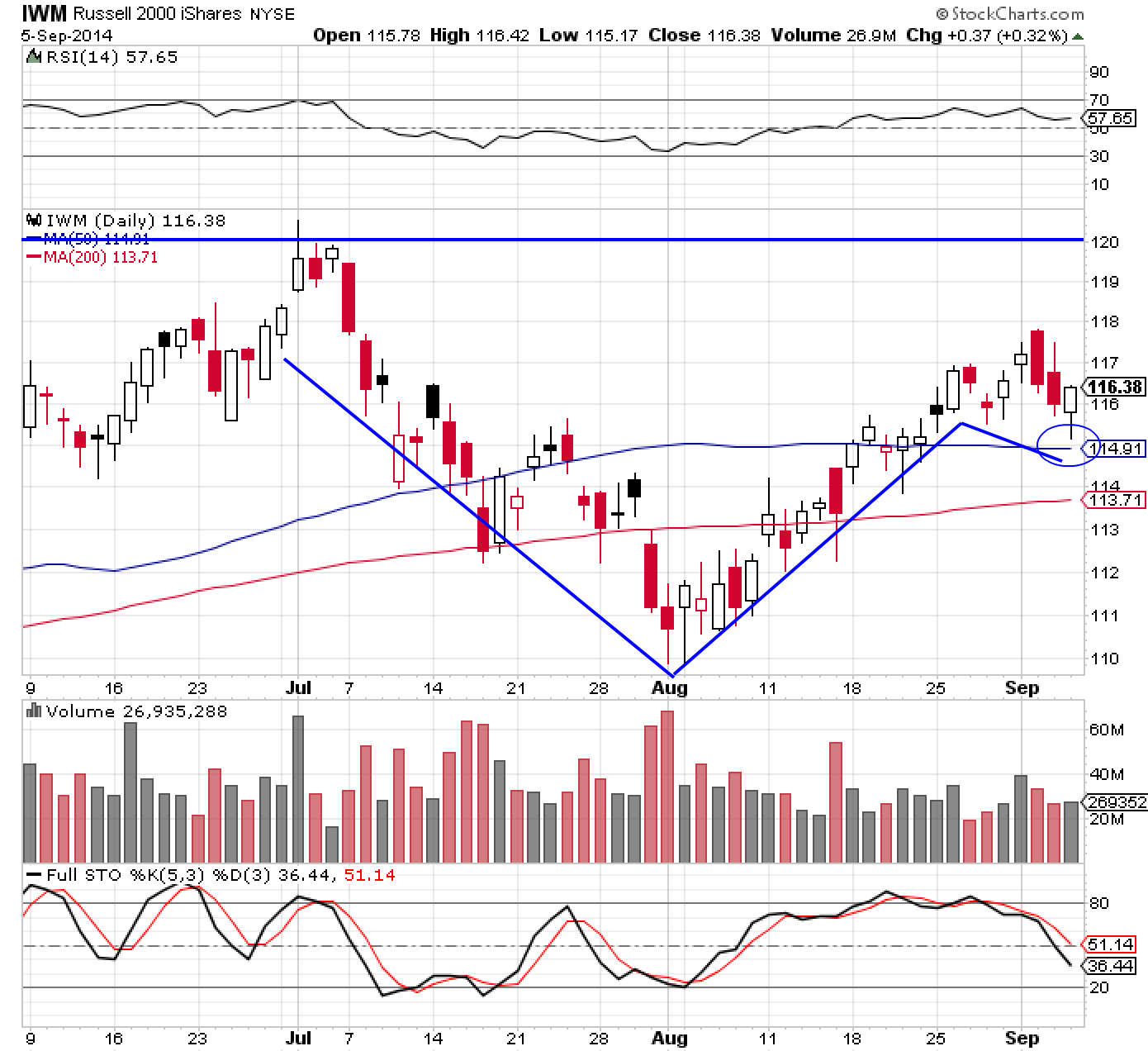

IWM is forming a big cup and handle formation. An entry on pullback to $115, with a stop at $113.50 and target at the highs at $120 gives us a 2.5/1 reward to risk.

Nothing is clear and easy of late. Here, the pattern is excellent, but we have to deal with the fact that IWM is lagging, not making highs while SPY and QQQ have. I pay attention to these issues, but focus more on the fact that I am getting good reward to risk.

The current game plan is to manage the SPY short position. I continue to look for long setups on momo stocks, but will not chase. B

Current Trades

I am still holding SPY short via SPXU and GWPH.

GWPH broke down below the moving averages, and is forming a range here. My stop has been moved below this range, in anticipation of remount of the moving averages. If looking to enter, a remount would give a good entry signal.

The Trade Results Journal/Spreadsheet is up to date.

The Focus List

Finviz link to easily follow the entire focus list. Most positions entry charts remain as annotated earlier in the week.

I am reprinting the MNST/TWTR comparison from the Thursday evening Report because it is one of my favorite setups and somewhat rare (the post breakout rounded pullback). MNST entry on weakness with target at $95.

I have talked about the MNST setup being similar to TWTR’s “rounded” pullback post breakout. Notice just how closely it is following what TWTR did. It pulled back into a rounded formation, started it’s move up, then consolidated a little before moving up again. MNST is at that level of consolidating before the next move up. I am looking for some weakness at $86-88, stop at $84 and target at $95.

SCTY remounted the 50 dma. Friday held the breakout candle but swayed below before closing above the moving average. Entry here with stop below Thursday low around $68. Target $77 gives 3:1 reward to risk.

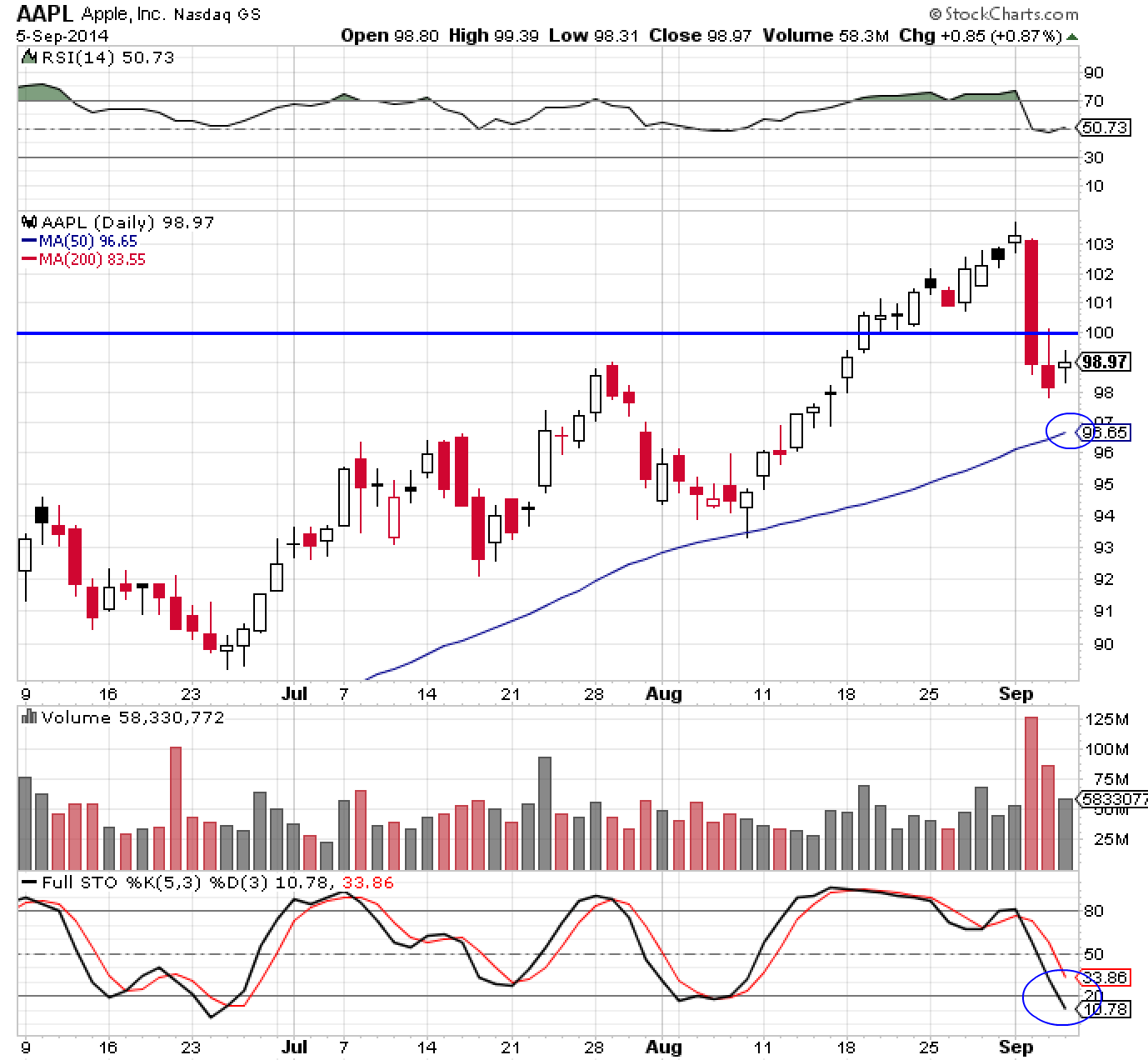

AAPL broke down hard from highs, taking out the key $100 level. A pullback to the 50 dma would likely create extreme oversold stochastic levels. Entry in the $96.50-97 range would offer a low risk entry in expectation of bounce.

PANW nice breakout pullback setup. Entry in the $85-86 range, target $92 and stop at $83.50.

AIRM is still trading within the post breakout range. Enter at bottom with target at top.

BITA pullback to $85-86. Target at $95 and stop at $80-82.

LDRH is in a bottoming formation and looks ready to break a 6 month range high.

Short Setups:

My focus now is shorting SPY via SPXU

Market Leaders

Most market leaders are acting in tune with the market and look ready to pullback. PNLN has broke down and close to being removed from the list.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way and How to Anayze Your Swing Trade Results It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh).