Quick Summary:

The recent high, 20 dma and 50 dma, are key SPY levels. We get aggressive if pullback to 50 dma. IWM still has good volume pattern, near major support. Focus List: IPXL, AMZN, BKS, CTRN, EZCH, WLT, WLB. Market leaders pulling back toward major support levels. Continue to monitor 5 category watchlist. ETF list shows strongest ETFs over past week compared to market. Good indicator of money flow.

The Market

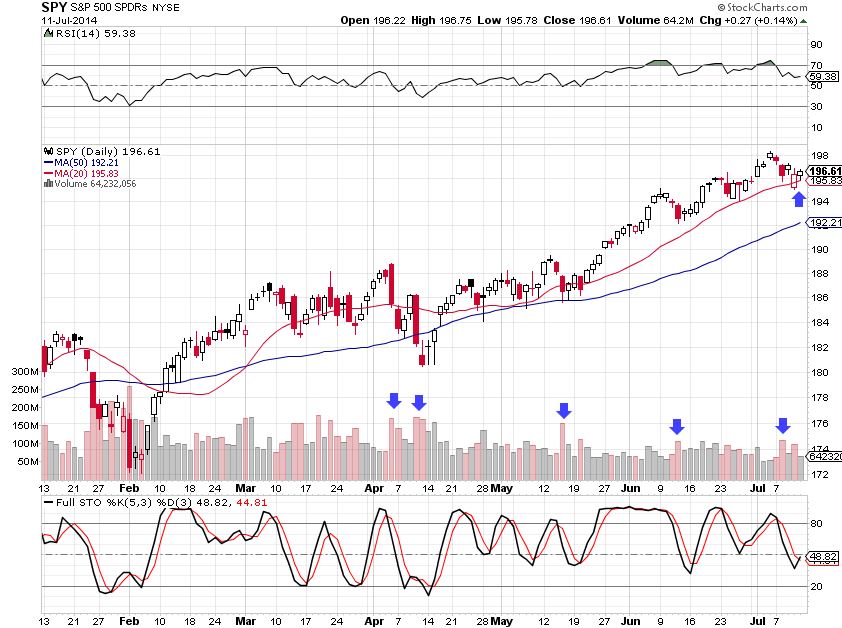

Key SPY Pivot Levels: 198.20 : new high resistance, 195.63 20 dma, 02: 50 dma

Under the Hood and Trading Game Plan:

Please read this Report from last week if you have not already, along with the update with stocks. It still important and still very much applies.

SPY is holding the 20 dma moving average like a champ, though there is not a strong indication it will continue to do so. Notice the continued trend of high volume down days with very few high volume up days. At some point the market will pullback hard. We must wait and see if this is that time.

The 20 dma is not an area to go all in with long entries. However, if the 20 dma breaks, the next target will be the 50 dma. At that level, stochastics should become oversold (under 20) and we can get more aggressive with long entries.

So this week we are looking at 3 things: 1) the 20 dma holding or breaking 2) the recent high at $198 and 3) the 50 dma. We will only get aggressive if we get near the 50 dma or break or break to new highs.

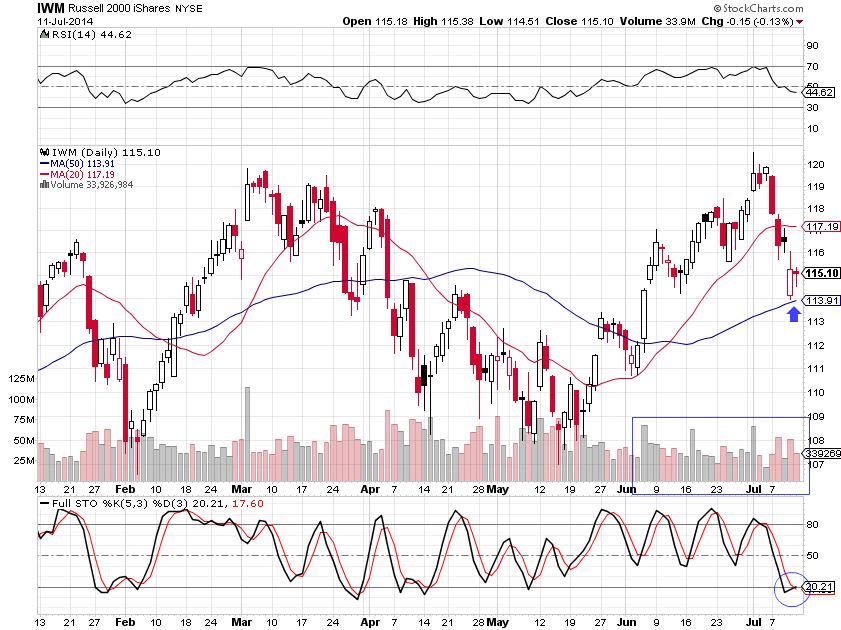

Where SPY’s pullback has been shallow on higher volume, IWM is pulling back hard on relatively lower volume. This hard pullback might actually be a better buy because of this. Yes, it has pulled back hard. However, volume relative to it’s volume on the rise up is lower. Let’s monitor the 50 dma this week.

The overall game plan is to remain cautious. I won’t be making any aggressive plays until I see some real clues. Until that time, I will reduce position size and take some stabs, both long and short.

Current Trades

I exited DUG a little short of target for a $1252 (5.72%) gain. This win wiped out 3 of the small losses from last week, which is very much in line with my overall trading strategy. I am still bullish on this inverse ETF, as it shows a nice bottoming pattern with good volume, and may consider it on pullback.

I am still holding AAPL short.

Here is the Trade Journal. It is updated with everything but the current open AAPL short.

The Focus List

Last week we talked about having a few stocks in five different categories to key on, but no real entry level focus list stocks. With the pullback and many stocks pulling back to key support, or breakouts that have pulled back, I am going to include the regular focus list this week. Below is the list of stocks to monitor (if you like, otherwise I am monitoring it for you).

While IPXL broke through the 20 dma, it seems to be holding well at old highs, just above the 50 dma. I like this on entry between $28.20-29. Stop under 50 dma and target near old high around 31.

AMZN broke out on Friday on tremendous volume. Entry on pullback toward bottom of breakout bar. Stop under 20 dma. Target must be twice stop.

BKS broke out to new highs and has pulled back into a trading range above the 20 dma. Entry $21.90-22.30. Stop under gap at $20.50, or 20 dma. Adjust target according to stop level (must be 2x stop amount).

Another good breakout-pullback candidate with an excellent volume pattern. Entry here. Stop around 21. Initial target 23.

EZCH nice pullback to old trading range after breakout. Excellent volume pattern. Entry here or on pullbc to 20 dma. Stop under 20 dma. Initital target 28-29.

WLB breakout to new highs after putting in a hammer candle a few days ago. Entry on pullback. Stop under 20 dma.

WLT looks like it is putting in a bottoming formation. Excellent volume within the range. Entry in current range with stop under range. Initial target in the 7-8 range depending on entry and stop.

Here are the categories we started watching during last week’s pullback. Click on stocks for charts.

1) get extremely oversold and near major support for bounces (rubber band setup) I am not just looking for oversold readings here, I am looking for extremes. We are not there yet on most of these. There needs to be more selling, price nearing important support levels, and extreme readings. At that point we increase the probability of a bounce. If SPY can pullback to the 50 dma (see chart below), a bunch of these will setup. GWPH, IPXL, KS, EZCH, Z, TWTR, YY, Z, TSLA

2) stocks and sectors that are holding up well (possible rotation or new leaders) Energy, metals, gold, silver, apparel BKS, FANG, PTRY, BWLD, CTRN, TAP, CODE, GMCR, X, FCX, XOM, COP, CZRO, NOV, CLR, AA, MATX

3) stocks that reverse off big down days intraday (hammers) UAL, LUV, JBLU

4) Select shorts AAPL, AKAM, KS, SDRL, GRMN, MSM, SDRL (GOOGL removed)

5) Pullback shorts (bounce to resistance after big drop–often was a rubber band trade) We need to wait and see for this list. Many will come from the stocks that bounce after extreme drops. Big Drop – – -> bounce – – -> short setup if bounce on weak volume and price action

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market.

Most market leaders are holding pullbacks and within range. No breakdowns. AMZN just broke out and is a breakout-pullback candidate. Z printed an interesting shoert term reversal hammer candle on Thursday.

ETF/Sector Analysis

Here are the 30 best sectors last week compared to the market. This is a good way to analyze where money is flowing. Over the past month I have been most focused on individual equities and only used sector analysis to find good stocks. When the market is working itself out, I like to move toward ETFs. This week I will work on a go to ETF list for the near term.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way. It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh).