The holidays are right around the corner. For many new traders reading this, this will be your first time trading during the holidays.

Besides the festivities, this period has historical significance for the stock market. Summer trading is usually slow. Things tend to pick up in the fall and get ignited by the holiday season, which usually gives us a huge wave of activity that carries us through the winter.

Approaching the holiday trading season especially as a new trader can be exciting. Action picks up, stocks are flying everywhere, and opportunity is around every corner.

Today, we are going to cover some of the top things that you need to be aware of this holiday season to make sure you trade effectively, safely, and profitably:

NEVER Chase

Fomo is high during the holidays. Opportunity is everywhere. There are stocks gapping up and running hundreds of percent on repeat, and to any trader, missing out on those moves hurts.

That is where the FOMO starts.

The reality is you will not catch every runner. You will miss massive moves. But that is part of trading. You have to force yourself to move on to the next opportunity and not get entangled in stocks that already ran. If a stock is already big, do NOT chase. Wait for the next one.

Do not let greed and FOMO take advantage of you this holiday season when the markets are hot. Buy at support, sell at resistance. If a stock has already gone parabolic, walk away, or look for the easy short later down the line.

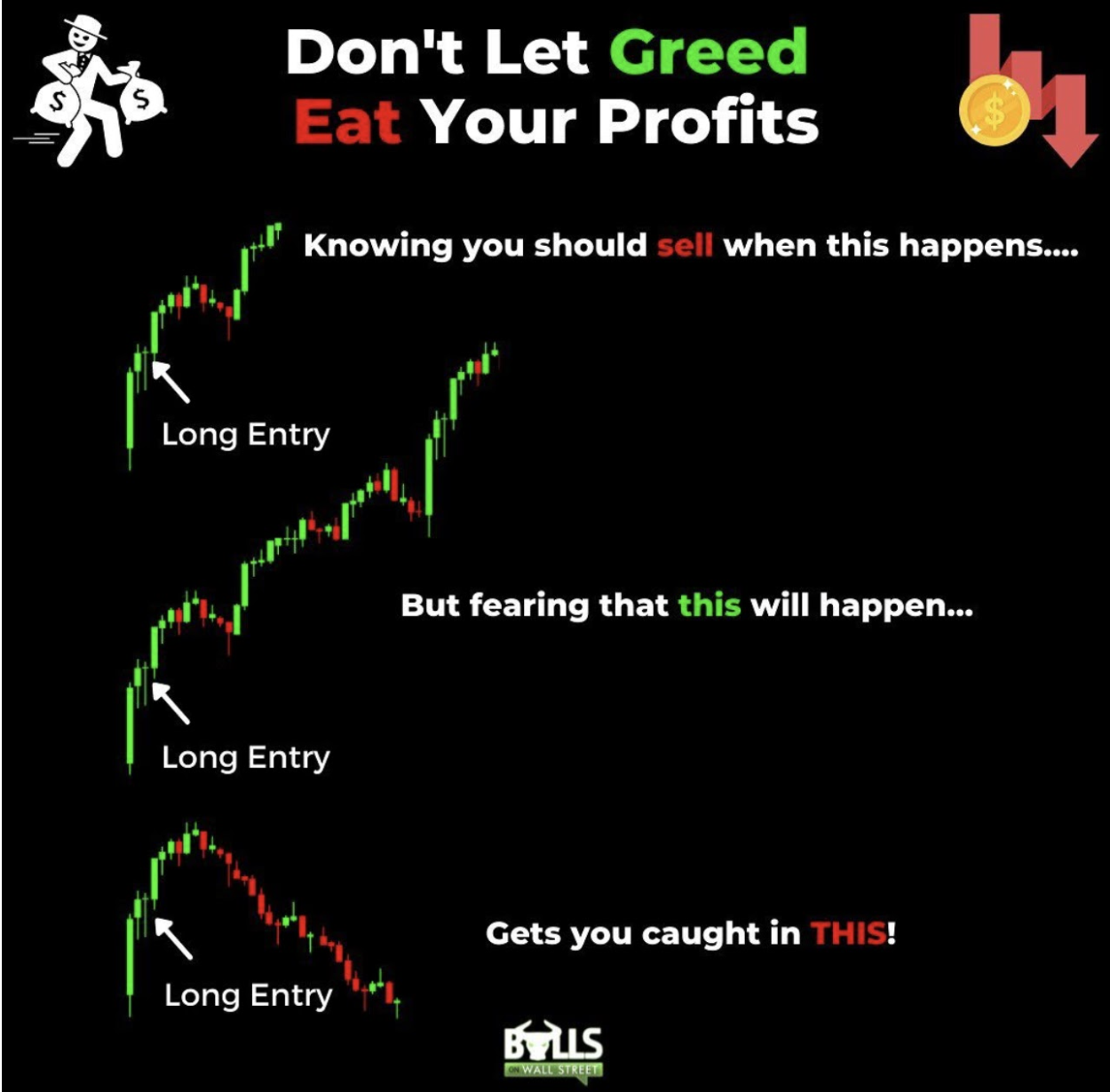

Always Lock-In Gains

If you are in a stock and it goes parabolic, take profits. Always pay yourself along the way. It is easy to allow greed to slip in when you are up big on a stock, especially if you have missed out on a bunch of prior runners and feel FOMO creeping in.

Be emotionless when you trade no matter how hot the market is. Don’t be greedy, and make sure to take profits and trail your stop at the spots you know you are supposed to every time.

Keep An Eye On Small Caps

Small caps during the holiday season tend to get a good boost, especially after earnings season concludes in November.

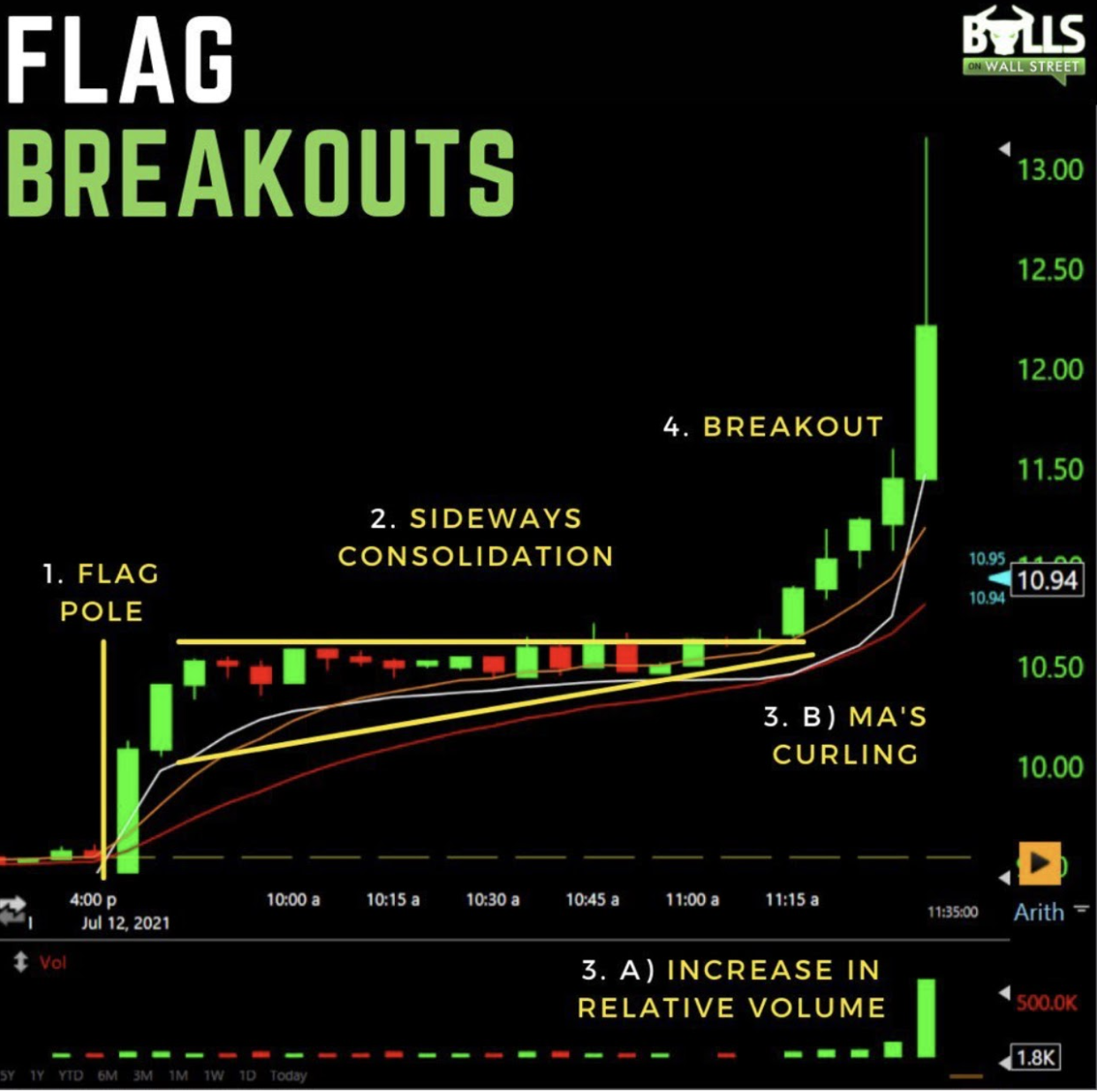

Keeping an eye on low floaters that are gaining extreme relative volume and are breaking out of key consolidation. Be patient for the entry. Chasing on the long side can be especially dangerous with small caps as a majority of the moves are manipulated, exaggerated, and manufactured. They don’t hold up for long.

Be Aware Of The Santa Rally

The ‘Santa Rally’ is a typical occurrence every year. It is basically a ‘calendar effect’ that involves a rise in stock prices during the last 5 trading days in December and the first 2 trading days in the following January.

Historically, 76% of the time over the course of these 7 days stock prices rise on average, which is much more than the average of any other 7-day period during the year. The price movement has to do with many large-scale funds moving inventory around and covering shorts, as well as a rise in retail trading interest.

Just beware that during that window, typically, momentum is on the bullish side.

Don’t Fight The Trend

Shorts during this time of the year can get extremely stubborn. With a ton of opportunity on the long side and many stocks rising in price, shorts may get lured into some sticky situations.

If you are shorting anything, whether it is a large or small-cap stock while the market is hot, be careful. Make sure to always have your stop in, trade with a clear mind, don’t fight the trend, and clear your head of any biases.

Live Trading Classes From Experienced Traders: Join Our Live Trading Boot Camp

Space fills up fast in our boot camps. Apply for your seat to see if you qualify!

Click Here to Save Your Seat