“For those that are prepared, a bear market is not only a calamity, but an opportunity.” John Templeton

Recently I released our member only group mentorship session to the public for one simple reason: In this historic and volatile “corona” market, it is more important than ever that you know exactly how to trade a bear market. I am here to help. Today I am going to show you exactly how I put some of those lessons into practice with our winning Netflix trade.

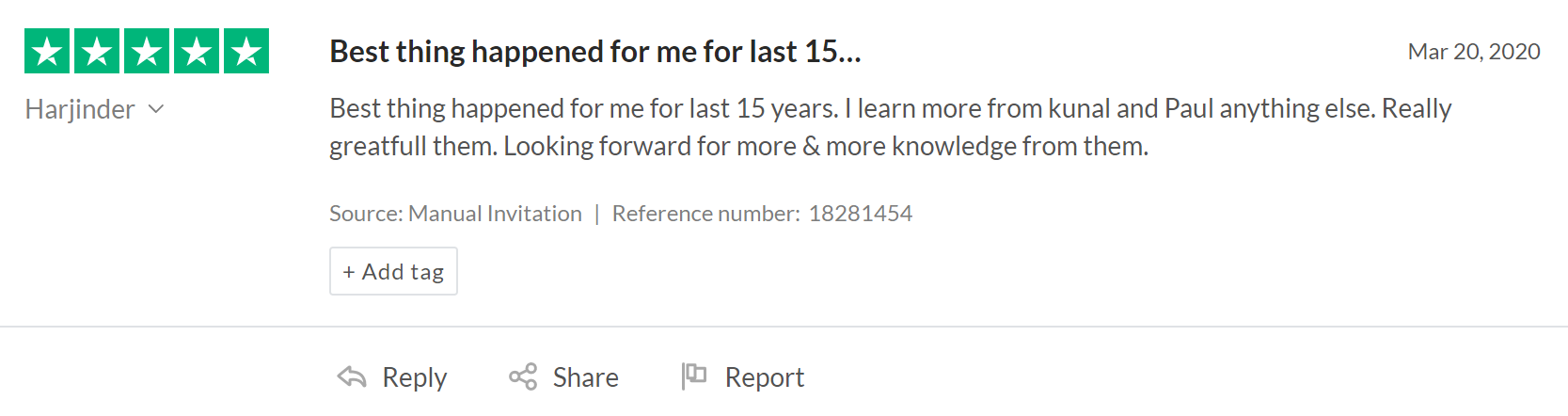

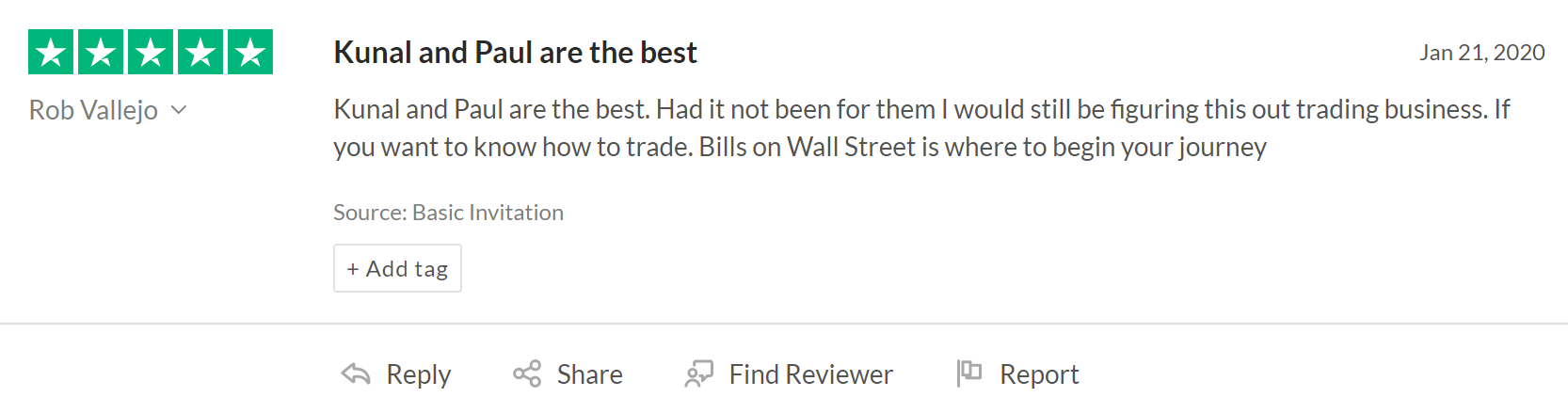

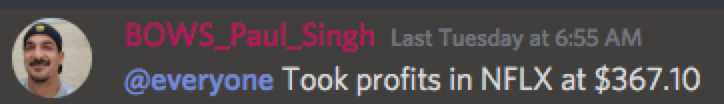

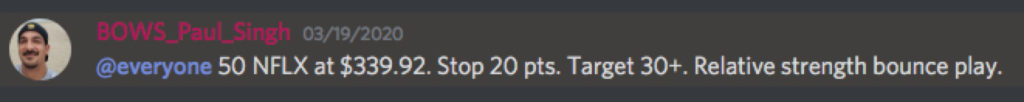

Members were alerted of these trade in our swing trading service and chatroom.

The Bear Market Playbook

The playbook for the Coronavirus bear market is complex, but for our purposes today can be broken down into these three simple strategies.

- Develop 3 different lists of stocks

- Beaten down stocks

- Relative strength stocks that are mostly “coronavirus” plays

- The “usual suspect” momentum stocks like Apple, Tesla and Google.

- Trade the following setups from these list

- Rubberbands longs

- Dead cat shorts

- Momentum continuation in either direction

- Manage risk ruthlessly, trade small and with less frequency than normal

Relative Strength and Chill

The Netflix trade came from our “coronavirus” relative strength list.

The list is made up of stocks that are doing better than the rest of the market, otherwise know as showing relative strength. Netflix is on the coronavirus list due to expected subscriber growth as more and more people are stuck quarantined at home during the pandemic. It’s the “stuck at home” stock.

The chart below illustrates just how strong Netflix has been in comparison to the S&P 500. Notice that the red line (Netflix) has outperformed the blue line (S&P 500) by 13%. This is what we in the biz call relative strength.

The Story of the Netflix Trade

Relative strength is what put Netflix on our radar. Next up we had to wait for the right circumstances to trade it.

We entered when Netlix gave us a textbook “rubber band setup“.

The Trend: Like the rest of the market, even many relative strength stock were taken down with the market. Netflix was no exception. However, as we have already shown, the stock held up better than the market did as it pulled back.

Notice the big green candles under the 9ema. This was our first clue that conditions were improving. The big green candle at the bottom of the circled area below was our potential low.

The Setup: Now with the initial trend stalled, we were on the lookout for a rubber band entry trigger. We got that on the remount of the 9-ema (yellow line) on the date of our entry, March 19th. While our setup entry trigger was was complete, we now had to have a plan to exit.

The Trade: Once in the trade, we targeted the previous gap down level, with the ability to adjust if the market shows strong signs of continuation. We did receive a strong market signal, so we sold out at the target level. It happed to be right near the highs before a pullback.

This endeded up being a textbook rubber band setup that was executed with patience and strategy. It an example of how our alerts and many of our members have outperformed the market

(****insert images from chatroom of members posts)

Swing Bear Market Class

Get ready for something you’ve been always waiting for! April 12th, we will be announcing the new launch of our Bear Market Swing Trading course taught by none other than Paul Singh live over 3-days, stay tuned over the coming days for information on how you can be the select few to gain access to this course.