Patterns within a stock can help you optimize your entries by gifting you a precise high probability entry point that has dual functions. First, the likelihood of a successful trade increases the more the pattern has proved itself reliable. Second, and most important, the pattern gives you the structure for a defined low risk entry.

The Remount Setup

One of these high probability patterns is playing out right now in Apple.

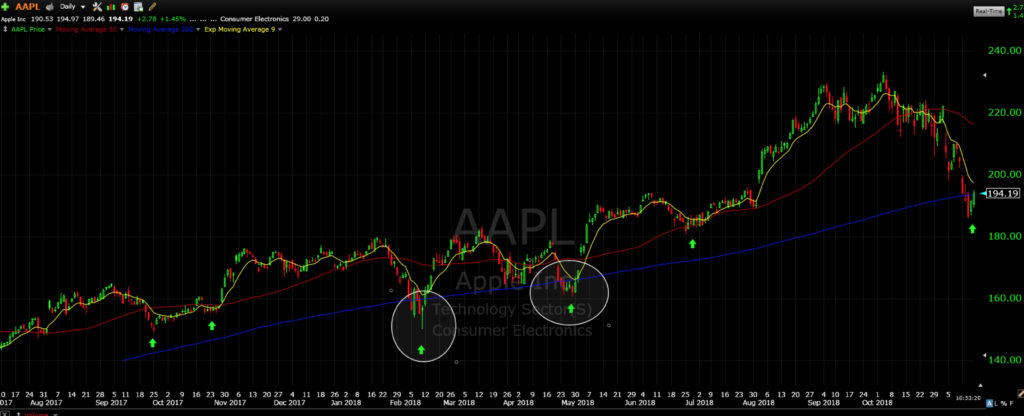

Let’s take a look at how Apple has reacted recently to both it’s 50 and 200 day moving averages by studying this chart:

The red line is the 50 day moving average and the blue line is the 200 day moving average. Notice the green arrows on the chart. Each time Apple has “violated” this levels by price breaking below the moving average, and eventually “remounted” or closed above those levels, it lead to a quick retest of highs.

Each of these entires lead to a winning trade low risk and high reward trade if you entered on the remount of the moving average.

Apple Entry Plan

Apple might be setting up for another remount entry. Here’s the video analysis of the setup plan. Notice the focus on precise entry points and risk analysis.

Two days ago the stock closed below the 200 day moving average and is now getting close to remounting that level. A close above $193.75 triggers a remount. This entry offers great Reward on Risk because we can set a stop below today’s low at $188 and set a reward target at $215, which is near the 50 day moving a average.

We are risking 6 dollars to make 19 dollars, which amounts to 3:1 reward to risk. So in other words, if you buy 100 shares of Apple you are risking $600 to make $1900.

That’s a money setup!

Swing Trade Service

This swing trading service is great for those that work and can’t monitor the computer all day. We have in-depth nightly reports on the gameplan for the day/week and all stock picks that I trade will be alerted and emailed to you.

Check out the Swing Service HERE

Follow me, Paul Singh AKA “TheMarketSpeculator” on Twitter or email me at SinghJD1@aol.com