Remember when we said not to panic during the Brexit selloff?

Today’s winning biotech exit trade puts into practice the level headed, systematic approach to trading selloffs we laid out in early July. While everyone else was busy making haphazard trades based on fear, greed and CNBC, we used sound post selloff strategy.

In today’s video I show you exactly how and why we picked biotech ETF $LABU as one of our post selloff monster trades.

Key learning points include:

1) the importance of relative strength

2) why swing trading is more than just setups

3) how elite swing traders layer market analysis with stock specific setups.

Watch, learn and let us know what you think!

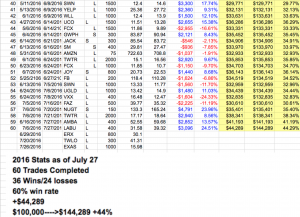

Today’s Treat: The updated 2016 Swing Trade Report Stats:

Remember members of the swing service get all of these trade alerts intraday in real time.

This swing trading service is great for those that work and can’t monitor the computer all day. We have in-depth nightly reports on the gameplan for the day/week and all stock picks that I trade will be alerted and emailed to you.

Check out the Swing Service HERE

Follow me, Paul Singh AKA “TheMarketSpeculator” on Twitter or email me at SinghJD1@aol.com.