Quick Summary:

While the market pullback was small, many momo stocks were hit hard. We watch for a deeper pullback. GS and FUEL removed from focus list. AAPL negative divergence setup. Comment on taking small shots. Today’s trades: TSLA, BWLD and FANG.

The Market

Key Pivot Levels: 198.20 : new high resistance, 195.16 20 dma, 191.18: 50 dma and old high

Under the Hood:

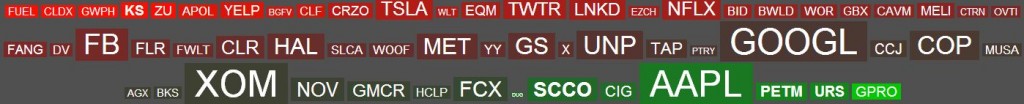

A headline from Business Insider read, “It was an ugly day for momentum stocks.” With the sound of a headline like that you would think the market tanked today, yet it didn’t. SPY was down only .35 percent. Any normal day it would be a slight pullback from highs. However today felt different. As this section is titled, “under the hood” there were a lot of momo stocks that took hard hits today. From my own newly developed watchlist, 22 of the 59 stocks had greater than 2 percent losses. Market leaders and momo stocks like NFLX, GWPH, YELP, TSLA, TWTR, LNKD and Z all dropped with the type of pullback bars we don’t want to see during buyable pullbacks. This is not what we would expect from a day where SPY was down only .35 percent.

This leads me to believe that we will see the 20 dma in SPY before 200. From there we must see if the 20 dma holds.

While SPY and QQQ had modest pullbacks, IWM did have a big pullback. No supports were violated, but it’s not what you want to see on a pullback to support.

Trading Game Plan and Current Trades

By now most of you know that I like to take stabs or shots at setups even if something about it is flawed, like the market not cooperating or going against the trend. I have no problem taking small losses. While I am going to pair back entries, I will take a shot now and then. Today I did that with TSLA, BWLD and FANG. My strategy with this is to expect a small loss, and play it in one of two ways. Use a stop tight enough that I am not hurt if stopped out, as with TSLA today. The other is to lower position size and use a slightly wider stop so I don’t get taken out with the market, but can hopefully stay in the trade when it bounces.

So the current plan is to let things play out, but take a shot if it’s a really good setup.

I entered FANG and BWLD today, and still holding them along with MUSA and DUG. I entered TSLA and was stopped out a few hours later. You should have received alerts with information, charts, stops and targets.

Here is the Trade Journal updated with TSLA trade.

The Focus List

Focus list removals: GS and FUEL (though I will monitor to see if it remounts the moving average).

TSLA and GWPH have violated support levels, but have support levels in play for deeper pullbacks.

A possible short setup:

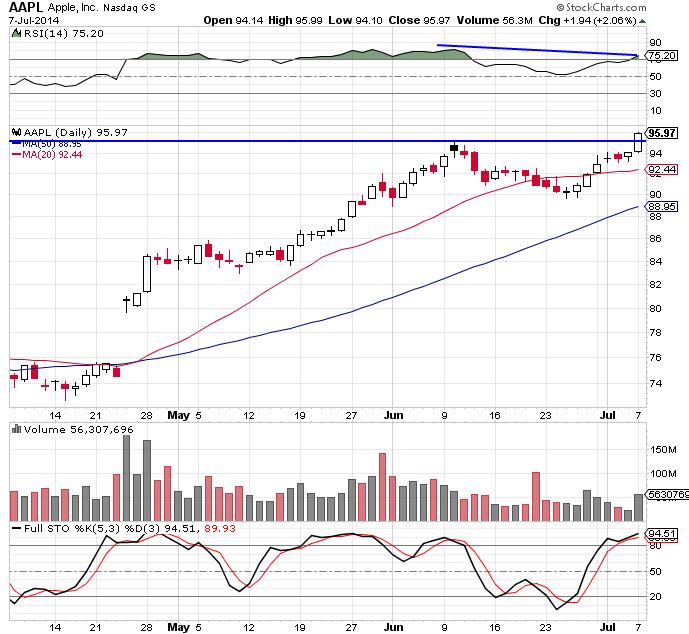

AAPL hit new highs today, but is showing a negative divergence (RSI at new high is lower than at old high). A close under the old high sets up a classic short setup.

The rest of the focus list remains the same, though I am watching YY, HAL, CLR and TAP closely.

See yesterday’s Report for Focus List setups.

Click here for Finviz charts.

Watchlist

Not a lot of green today, though URS, PETM, AAPL and GPRO were very strong.

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market.

No support violations, though Z, NFLX and TSLA were hit hard. Let’s see if any setups emerge over the coming days. Often other leaders will follow once a few get hit hard.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way. It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh)