A lot of you have asked about what rules I follow as a trader – that’s a great question! Having and following rules is a great way to keep yourself out of trouble. When I was first trading I didn’t have any rules: one week I’d try something, the next week I’d try something else. I was always jumping from one system to the next, trying to make sense of it all and find something that worked. It was only when I began to trade with Kunal, and then became his first Bootcamp student, that I learned a system that worked consistently.

The rules below will give you an idea of how the Bulls trading style works, but if you really want to understand it – and take your trading to the next level – you need to sign up for the upcoming Bootcamp. It starts on the 28th of September and goes through every aspect of the Bulls system. It’s the same material I learned and use every day. Email me mb.willoughby@gmail.com if your interested in learning to trade or trying out the Bulls room

Here are my rules, hope this helps!

1. The number one mistake and usually the biggest mistake that new traders make is adding to losing positions. Sure, doing this will bring the cost of your trade down and give you a better average cost, but is it a good idea? Or are you just adding a larger loot to your losing trade? In my opinion, its the latter..and is something that you want to avoid. If you are in the boom room you probably have noticed that we rarely average down on a stock.. if we double up or add to a position its always when we are already ahead on that stock. The reasoning is simple, if the stock is going against you already to make you think its a good idea to average down then its probably a busted play anyways! The only time its ever a good idea to average down on a stock is if you are swing trading and have a plan mapped out. If you are day trading, then there is no logical reason why you should average down on a losing position.

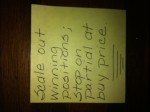

2. Scale out of winning positions with stop at buy price on the rest. Kunal taught me this rule and its a great rule to do.. that way you never give back full profits on a stock that you are up on. Obviously there are certain markets where its better to trade fast and just sell your whole position, but for the most part, when market is good.. this is your best game plan. You maximize your results that way.

3. Never double dip in a stock that you made money on same day unless you have a logical reason. I see this happen all the time and I used to do it all the time. Its an emotional trade. You enter a stock.. you sell it for a nice gain.. and it keeps going up… so you buy back in and get a terrible price only to watch it fall back in your face. Avoid!

4. Never hold thru earnings or FDA decisions.. total gamble. Might as well put your money on black or red.

5. Never short strong stocks before the afternoon session. This is a personal rule but one that I love. Stocks with news/pr/earnings behind them can run huge in a day.. especially if they are low float. So never think to yourself.. there is no way this stock can go any higher today.. cause I promise you it can! Just look at $SUPN, $ROSG, $HEAT from the past.. The thing that I have found is often these guys will run up huge in the mornings and finally breakdown late day.. wait for that setup before you short them. It will save you a lot of $$!!

6. Never trade out of boredom, you must have a setup and plan.

7. Cut losses fast, small losses are ok.