Stock Chart Patterns: The Complete Guide for Technical Traders

How many times a day on social media are you shilled a magical stock chart pattern that can instantly make you a consistently profitable trader?

While chart patterns are useful for providing information about a stock’s trend, they alone will NOT make you a successful trader. This is one of the biggest misconceptions new traders have, that we are going to correct today. This blog will show you the difference between a chart pattern, and an actual trading strategy, and what goes into making a successful, high-probability trade.

Here is what you need to know about chat patterns and the truth about their effectiveness:

Understanding Candle Sticks

Every chart pattern is made up of candlesticks. Before getting into the effectiveness of chart patterns, let’s start with the basics in case you are new. Candlesticks are the language of technical analysis and are the building blocks of every pattern. Understanding them is important for having a basic understanding of technical analysis:

Remember: Always give more weight to candlestick shapes in the HIGHER time frames. A 1-minute doji close is 100x less significant than a doji close on the daily chart.

What Are Stock Chart Patterns?

Now that you have a basic understanding of reading candlesticks, let’s dive into the basics of how to read stock chart patterns.

Patterns are the distinctive formations created by the movements of stock (or any market) prices on a candlestick chart. Patterns can indicate the potential of an upward or downward price move in the markets. A classic chat pattern many know of is the flag pattern:

Easy and simple to trade, right? Unfortunately, when people show you this they cherry-pick the best ones. The overall context of the stock determines the probability of a chart pattern working or not. The pattern by itself is meaningless. The truth is, to be consistently profitable you need to consider way more than just chart patterns.

Do Chart Patterns Work?

While chart patterns can indicate a significant change in supply and demand in a stock, they alone are NOT a reason to enter a trade. Chart patterns are NOT a trading strategy. A real trading strategy accounts for multiple variables in the markets, not just one. Strategies are backed by data. Strategies consider multiple market variables and the bigger picture of a stock.

The Bigger Picture

Trading is so much more than just patterns. If it was, no one would work a regular job! There is a lot more to consider in a trade than the chart pattern:

- The bigger picture trend of the stock (daily, weekly, monthly)

- News catalysts, past or upcoming

- Proximity to moving averages

- Oversold or overbought indicators

- Liquidity, spreads, volume

- Stocks history of momentum

- Macro-market conditions

To name just a few. When you are a trader, you are like a lawyer building a case. You gather as much evidence as you can before you start prosecuting or defending. You don’t launch a case with just one piece of evidence!

Watching Out For Hindsight

Chart patterns look obvious re they breakout or break down, is it so obvious? Don’t letool you into believing that was a high probability setup. The bigger picture tells you whether a chart pattern SHOULD work or not. Trading is a game of probabilities, not definites. This one chart of a head and shoulders pattern does not mean every time you see this pattern you short:

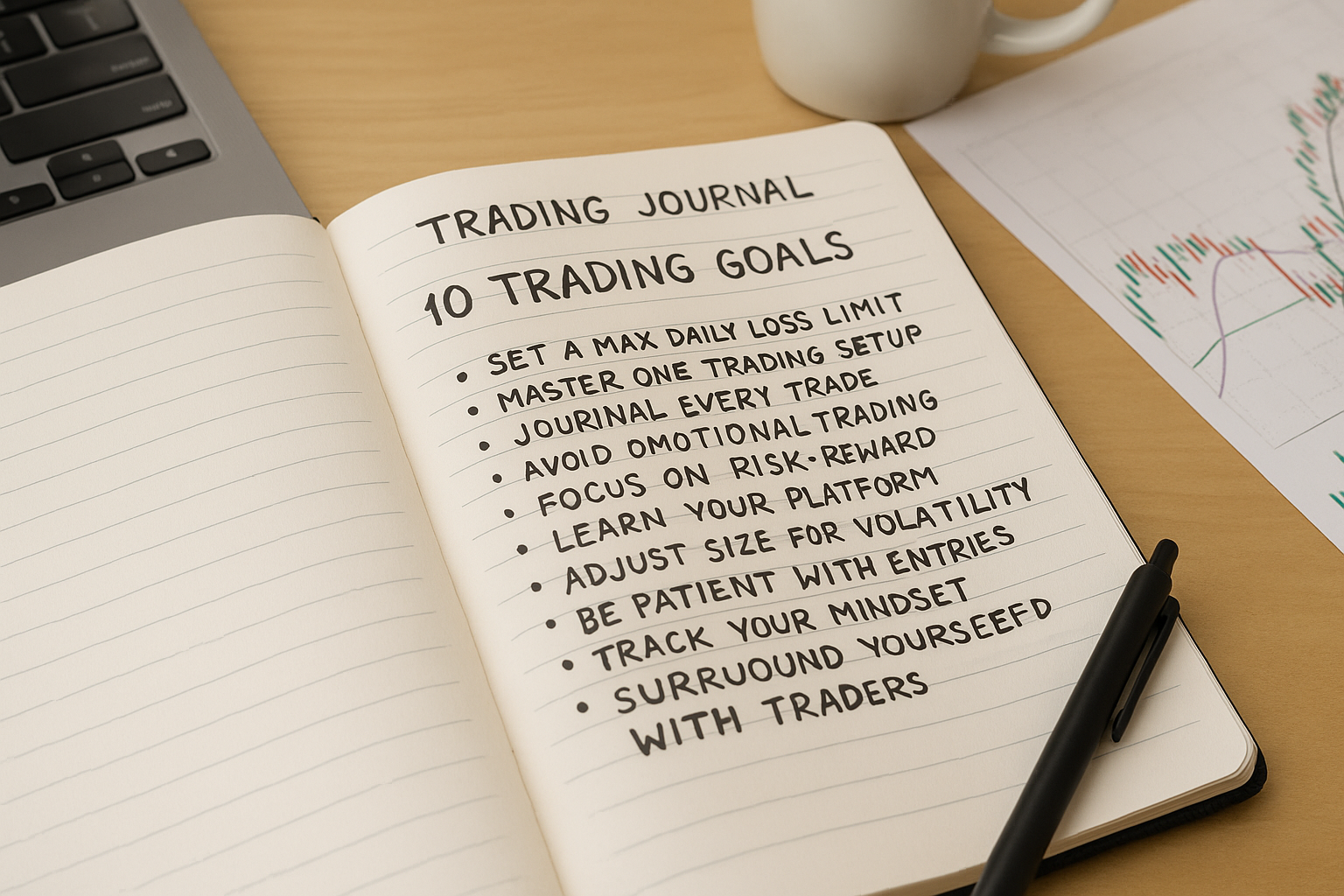

Instead of saying head and shoulders is a sell signal, back it with data to include the whole context of a stock. Backtest and look at past scenarios. Instead, you may find a head & shoulders is a high probability sell signal after a stock is up more than 100% in the past week, and is up 3 consecutive days in a row. That is a high probability strategy, not just a pattern. Journal your trades to see which strategies you perform best with. You only need to execute ONE successful strategy to become a consistently profitable trader.

Takeaways

- Patterns by themselves are meaningless

- Consider the whole context of a stock

- Don’t let hindsight determine what was the right course of action

- Track data to find the right strategy for yourself

We teach over 18 different day trading strategies in our live trading boot camp. Space fills up fast in our boot camps. Apply for your seat to see if you qualify!

Click Here to Save Your Seat

---

About the Author

Kunal Desai** is the founder of bullsonwallstreet.com teaching trading strategies since 2008. His 60-Day Trading Bootcamp helps traders build real-world skills in pattern recognition and execution it is currently one of the world's longest running day trading courses going strong since 2008!

.png)