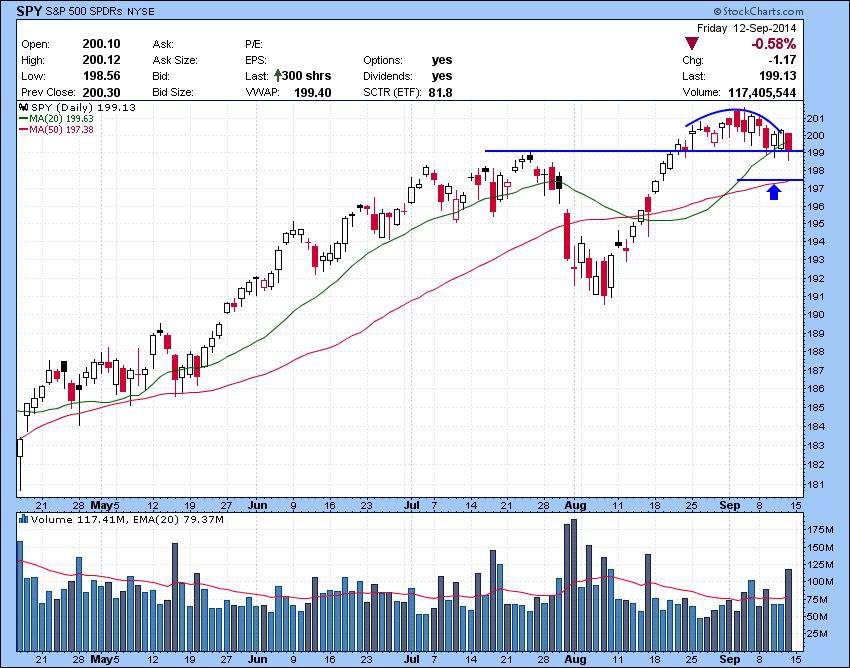

Down day in the Market as SPY finally closed below strong 20 MA support. Next support is on 50 MA 197 /197.50 area.

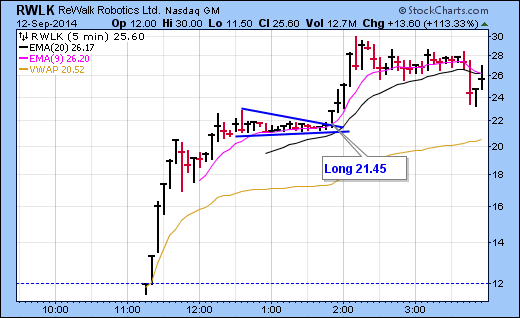

Even in broader market weakness, plenty of low float or IPO stocks stock in play , Speculative money still out there,iIf you see IPO name like RWLK, it went from $11.50 low to $30 in one trading day ! As always out trading still going be focusing on momentum stocks that are in play on the day. Another great week in Bulls chat room with real time alerts gaining $11,900 for the week!If you are struggling with your trading or learn how to trade you need to join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders.

Also if you are interested in our trade alert services check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

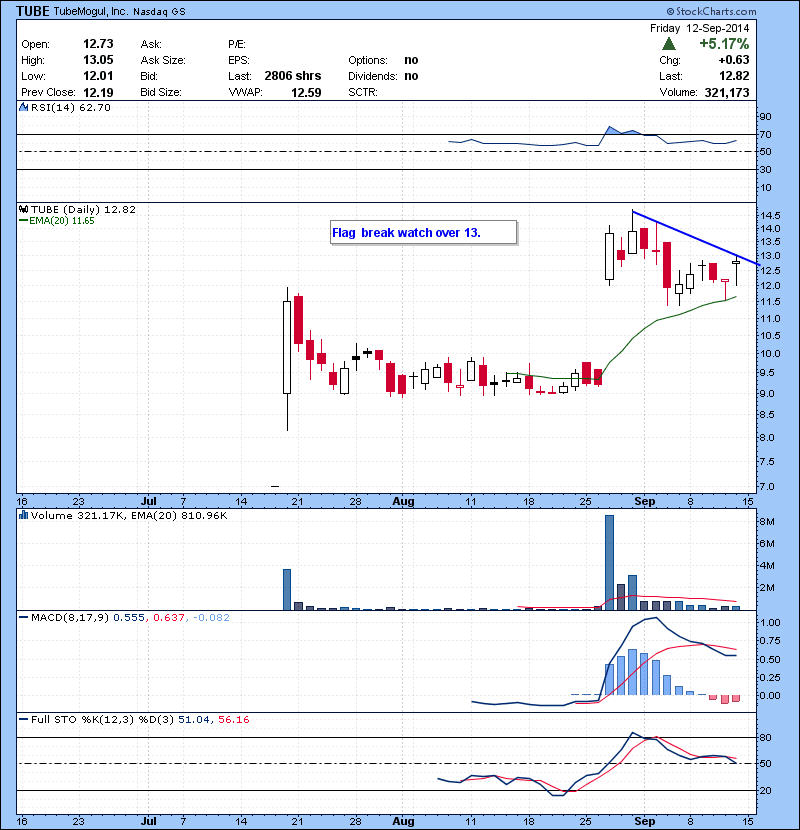

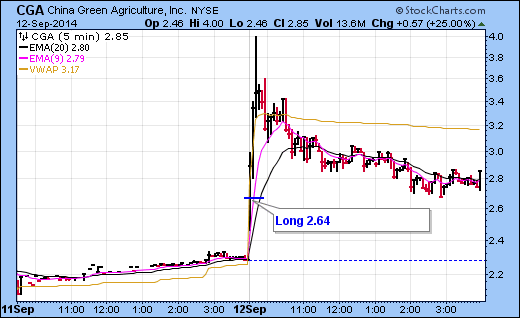

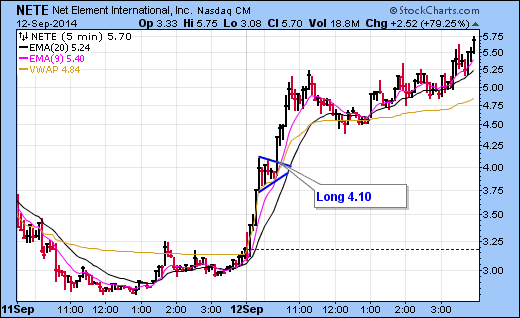

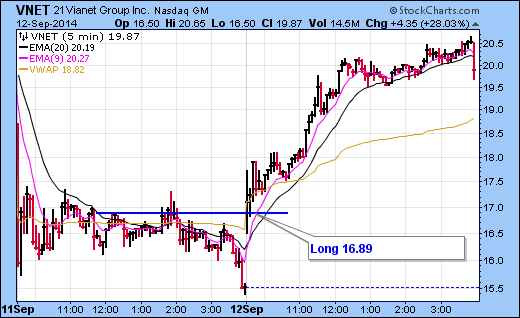

See below some of the entries and intraday pattern we played in the chat.