Sell off day in the Market.

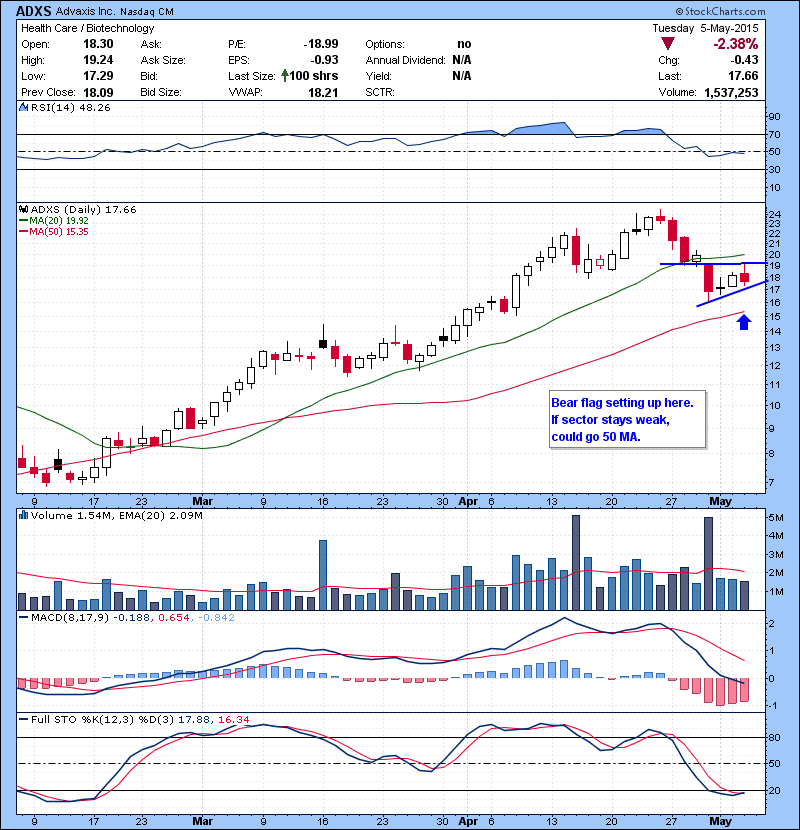

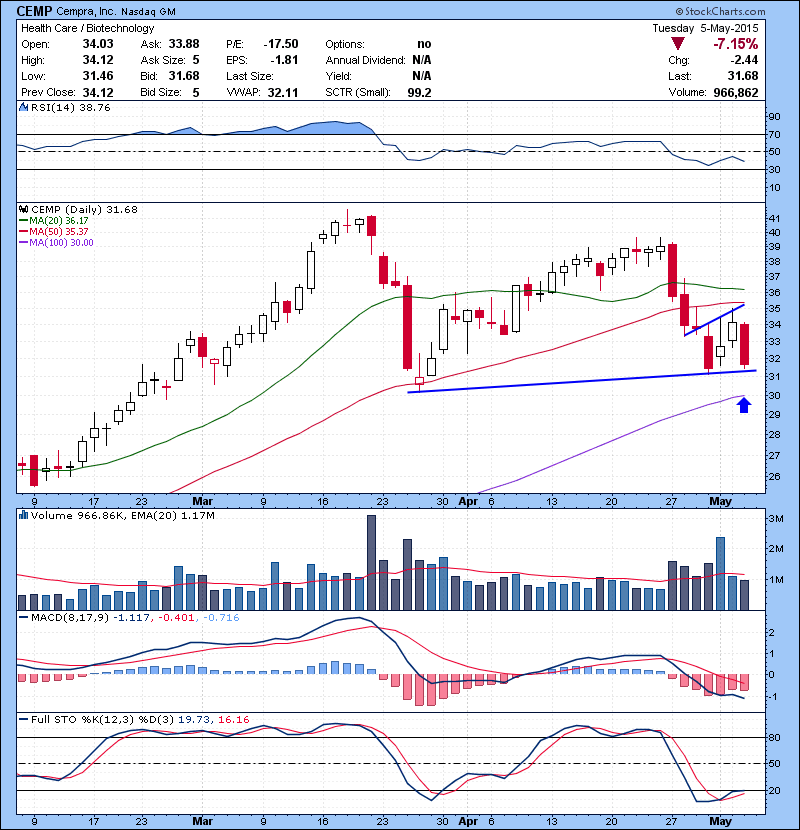

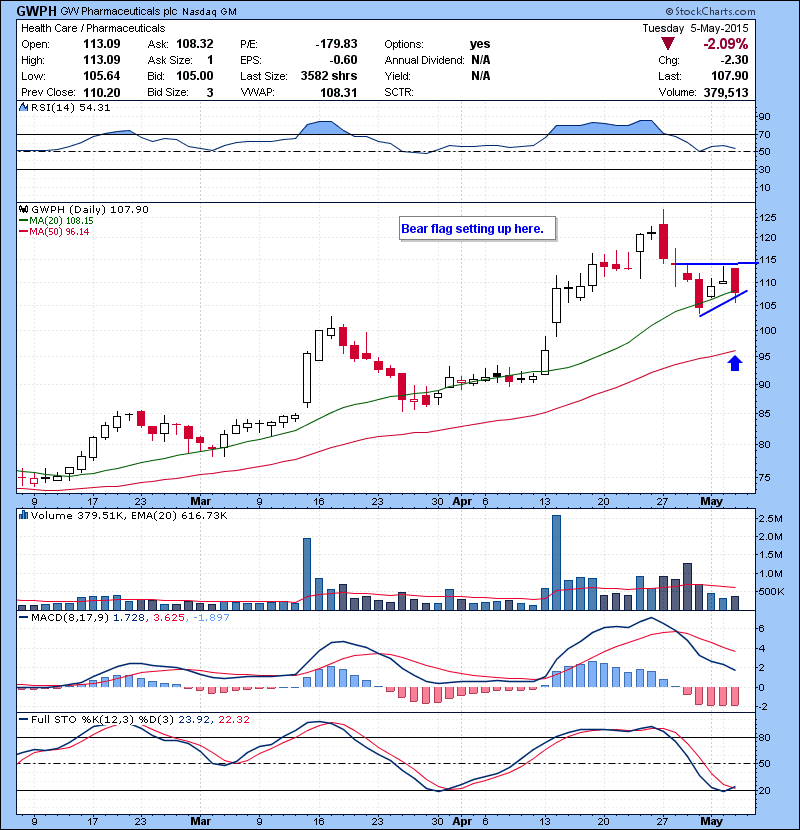

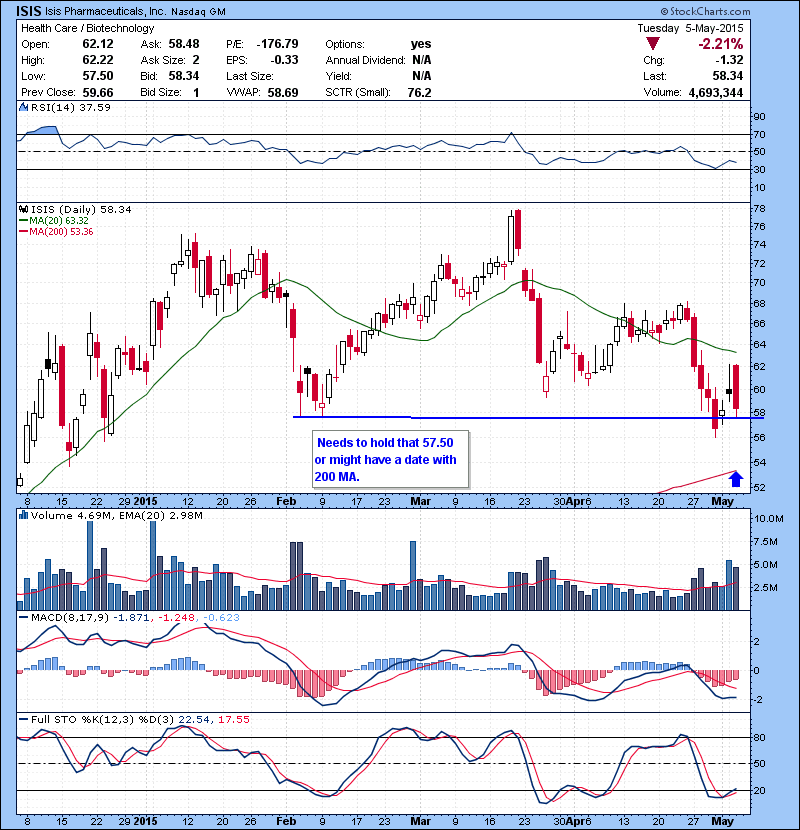

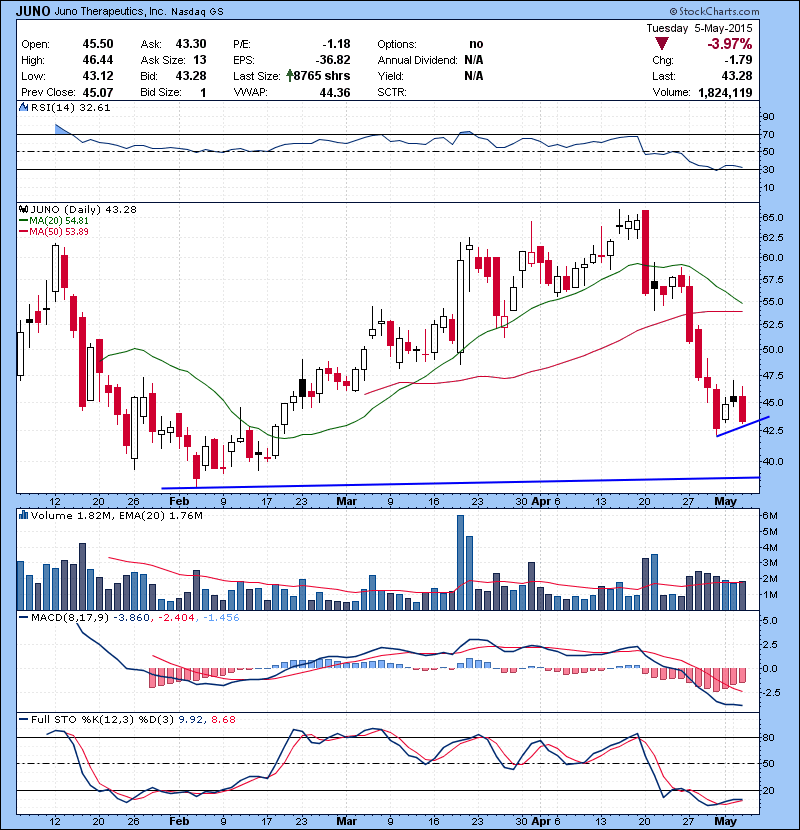

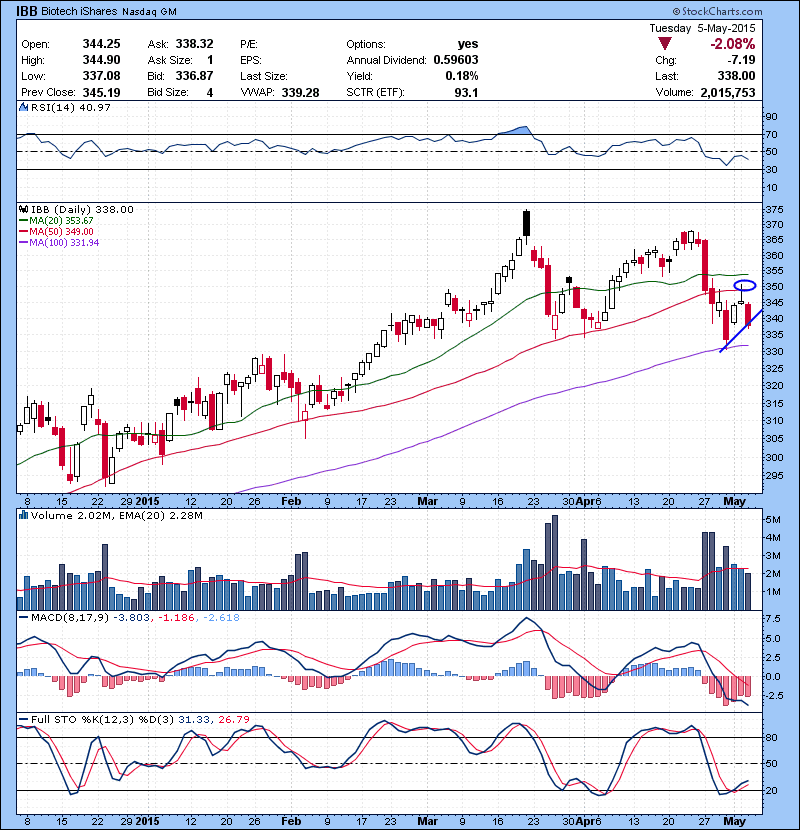

SPY still in the lower range and trend line support. This trend line has been working as bounce area for many times. It will be interesting to see if it bounces here yet again or go for 100 MA 106 area.In my previous post i wrote,”The quality of the bounces in biotech lately is not that impressive yet as we are having big volume wide range sell off days and low volume small range bounce days. So they still remain volatile and can be traded in both ways”. We got our wish last two days!

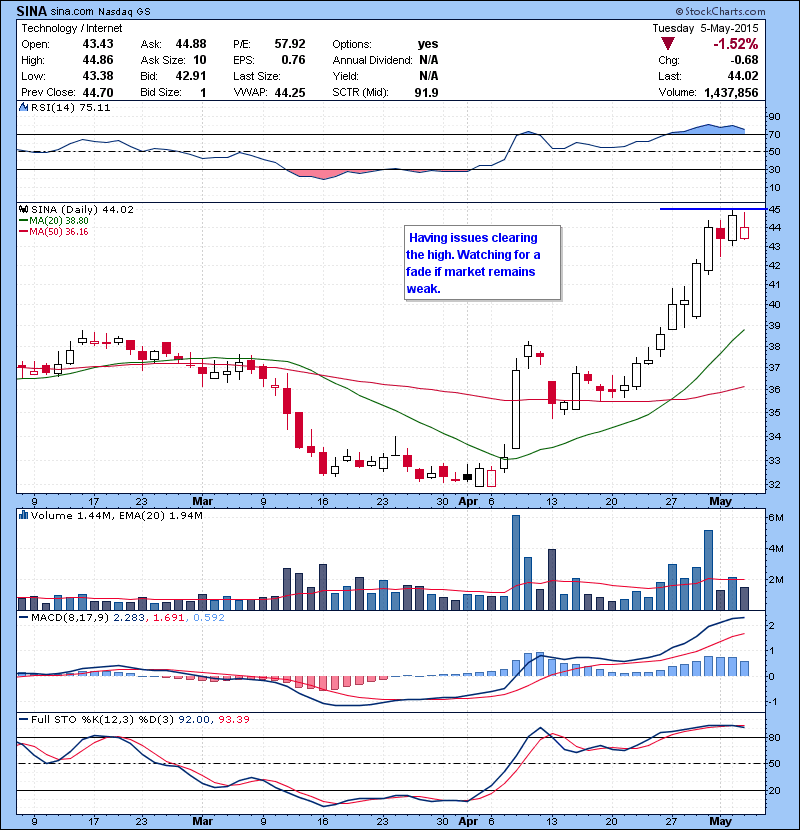

We had our one day bounce Monday and we were trading long in the chat room . Ugly reversal at 50 MA and we had a continuation down move on Tuesday and we were back to shorting Bio’s in chat. Many biotech charts looks broken. IBB had it’s first oversold bounce on 100 MA. It has a bear flag formation now and looks to be heading lower. I am hoping for green to red type moves at open to load up some shorts again. If you are struggling with your trading or learn how to trade you need to join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our trade alert services and chat room , take a free trial! Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.