Trading IPOs is fun and sexy. Part of the allure is that they often involve big names and popular products that everybody knows. However, that does not mean you should be trading that “it” company.

Yet many traders become mesmerized by the allure of the stock and even experience FOMO (fear of missing out). They trade IPOs without actually understanding how to trade them. While trading IPO’s relies in many of the same concepts we use for trading any other stock, there are some rules and go-to setups particular to an “IPO trade”.

One of my favorite setups for trading IPO’s is the “IPO squeeze play”. This setup usually happens within the first year of a stock’s IPO. I scan for stocks that are beaten down and have slowly formed a base that shows underlying accumulation, or buying interest. Once we have that, we wait for a break of a key range. That’s were we pounce. If the stock has some short interest, even better. This can lead to some amazing squeeze plays.

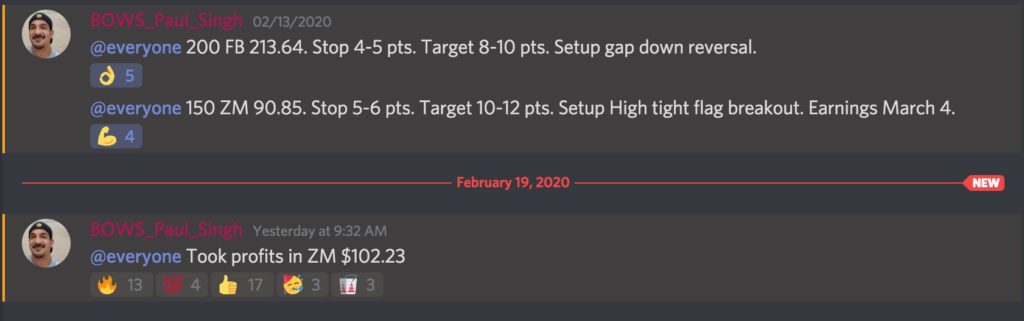

A recent example of this setup was our ZOOM IPO squeeze play. Our swing members were alerted to this setup as the stock broke the top of a ranging flag pattern.

We took profits as the stock popped to the top of the previous IPO high. The trade was good for a 10% plus gain off of a three day swing hold. Notice how quickly the stock “squeezed” once it broke the range. This is the beauty of the IPO squeeze. The stock either moves big and quickly to your target range or fizzles out right away for a small loss. You either get a quick big win, or a small loss. It’s the perfect swing trade.