Business as usual for active day traders, buy ETF’s at intra day hard selloff for scalp, red to green ,green to red,sell/short the rips with defined risk/reward in mind.

6 Seats Left in Our Next Live Trading Bootcamp!

Our next Live Trading Bootcamp is around the corner! Learn the trading strategies we have been using for the past two decades. Only 6 seats left, and space will fill up fast!

Click here to Save Your Seat for Our Next Trading Bootcamp!

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Get started on the right path to trading success. Get access to our accelerated day or swing trading course with over 20 hours of content, access to our trading chatroom, live market commentary, and much more. Learn what it takes to succeed in the best profession in the world.

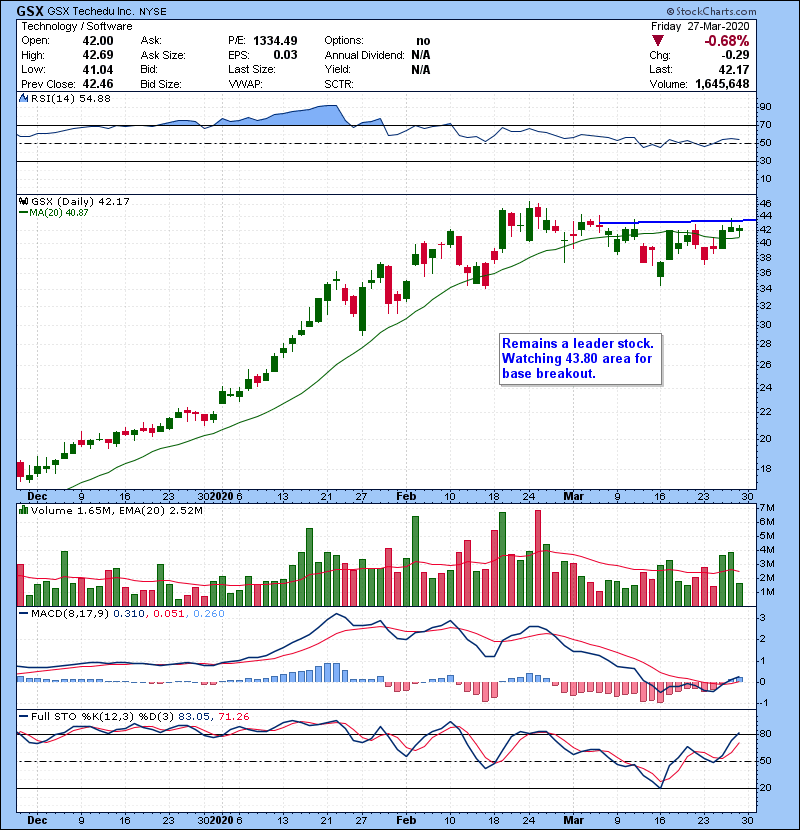

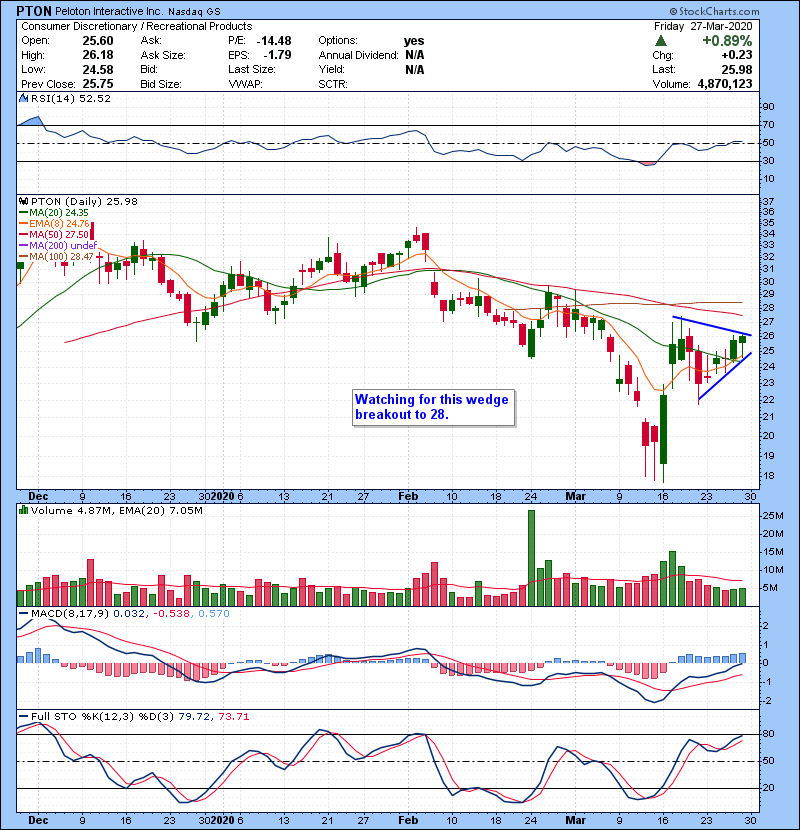

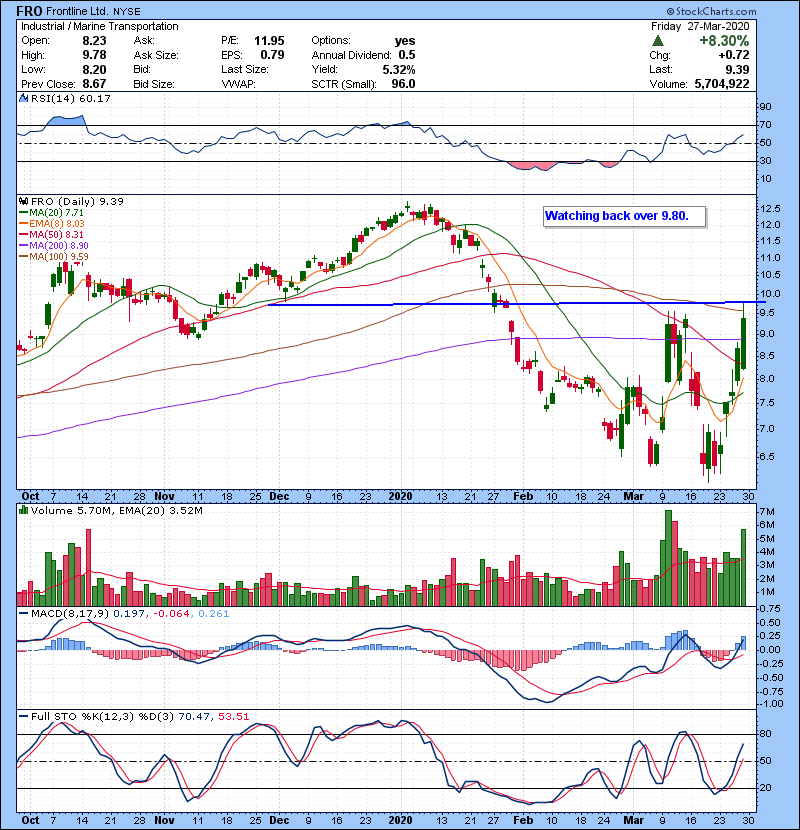

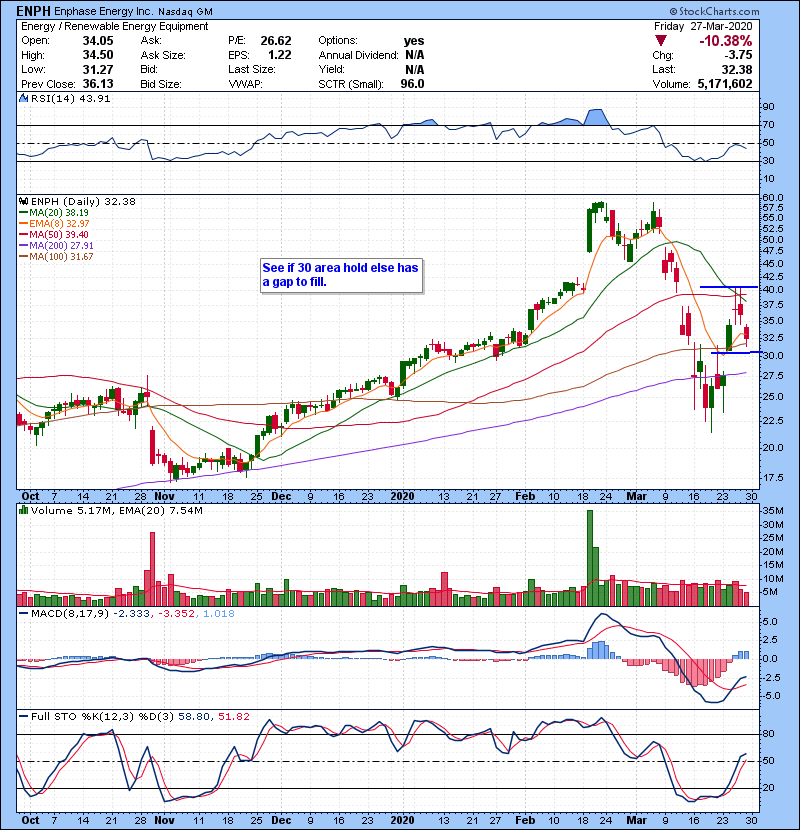

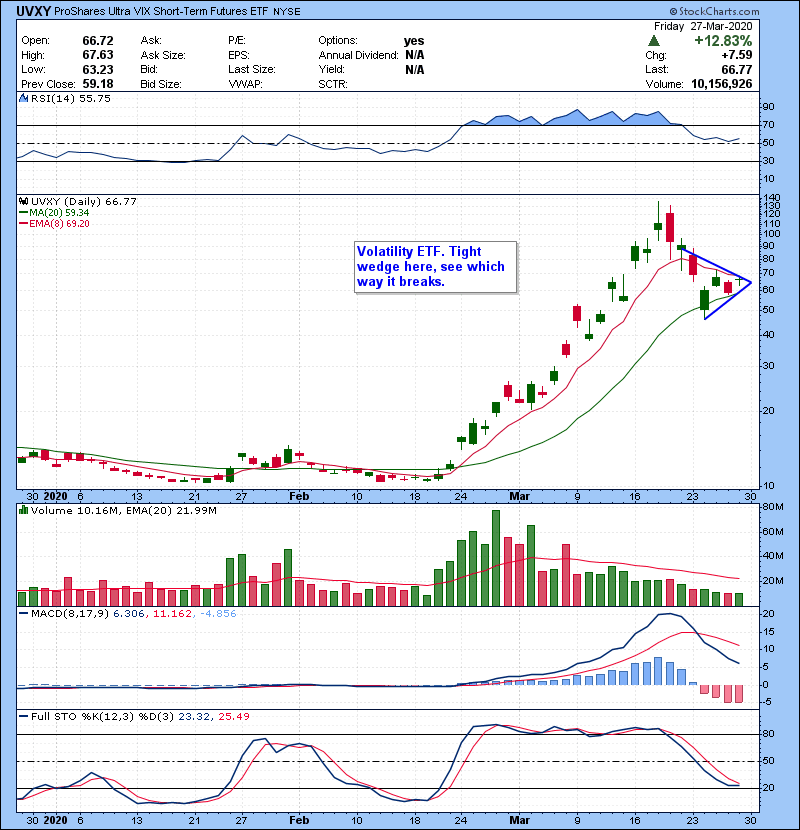

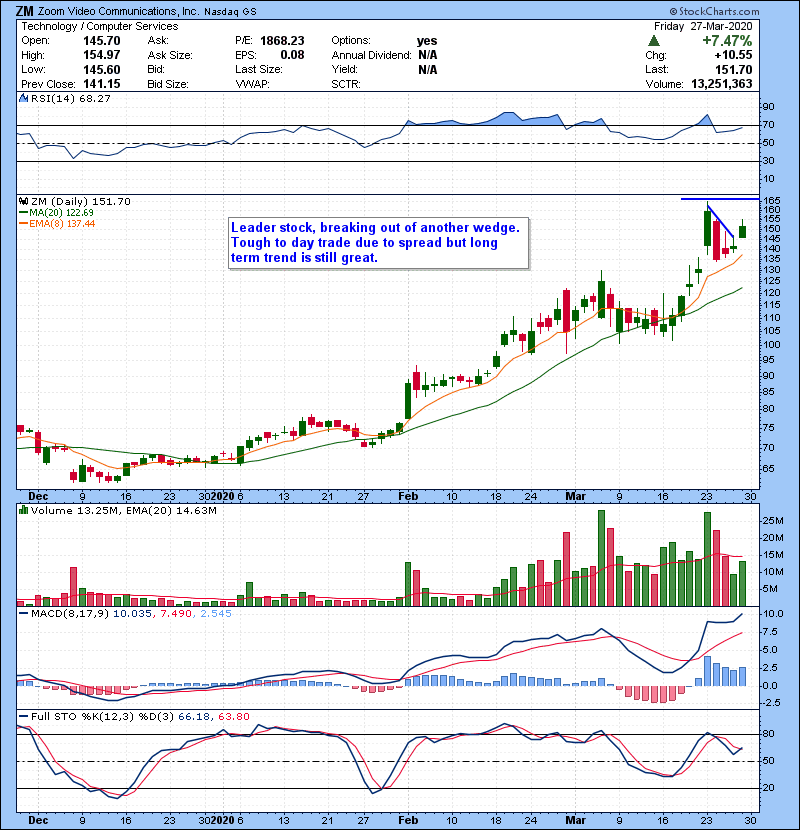

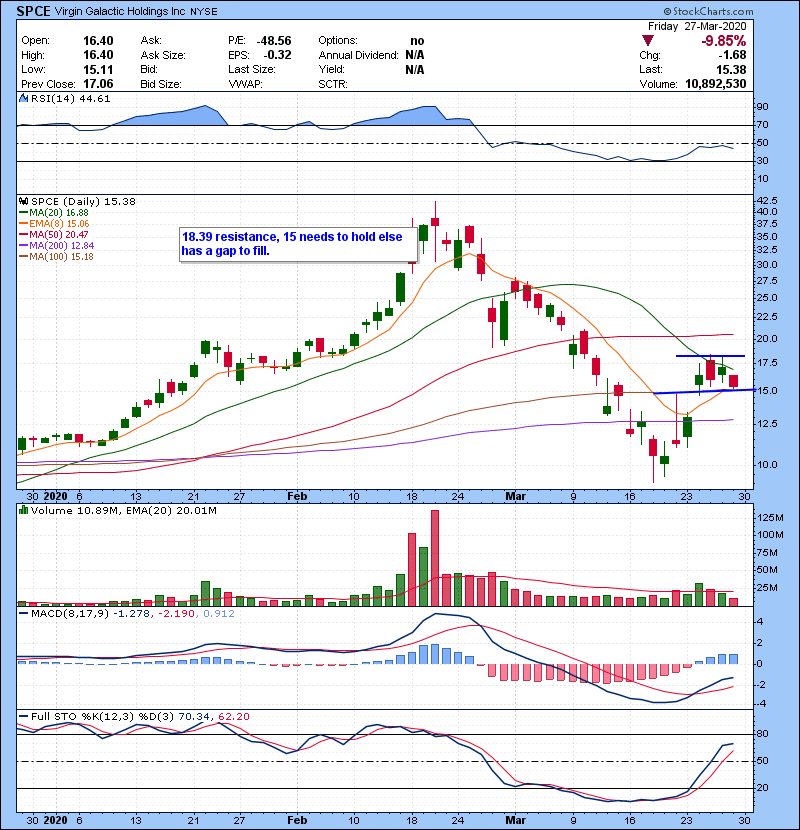

Here is the watch list and game plan:

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

6 Seats Left in Our Next Live Trading Bootcamp!

Our next Live Trading Bootcamp is around the corner! Only 6 seats left, and space will fill up fast! Learn the trading strategies we have been using for the past two decades.

Click here to Save Your Seat for Our Next Trading Bootcamp!