One of the many questions I get from my students is “When can I trade with real money?”.

It’s on every trader's mind as soon as they start learning about the stock market.

Trading is not much different than any other high-paying profession. Education and practice precede the big paydays.

A surgeon doesn’t start cutting people open after watching a few YouTube videos. A lawyer doesn’t start defending people in court after reading a few books.

This blog will help you figure out the best way to launch your trading career:

Why Use Simulated Trading

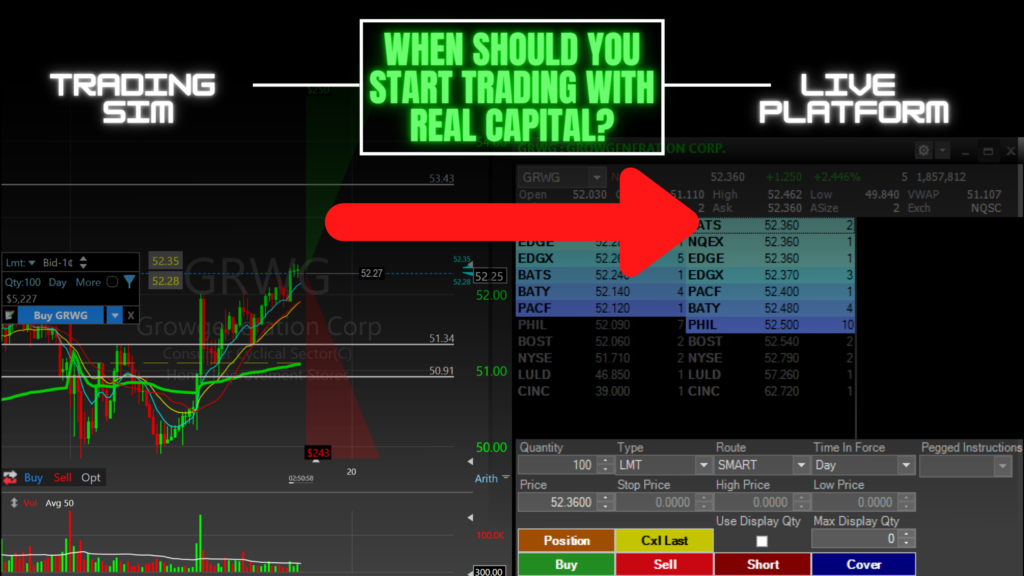

A simulator is a real-life trading platform where we simulate the exact conditions you would see when your trading your own account from the size of the account, commissions, margin expense, etc.

There's no point in trading with real capital if you cannot even make money on a simulator. You need to get used to the motions first. Get used to buying, selling, and executing your trading plan. Get a few weeks of green on the simulator under your belt, then transition to trading with real money. You need to track important metrics like these to refine your trading system before going live:

Simulated trading results don't mean you're ready to make bank. You need to start live trading with SMALL size. Scale slowly. Master your emotions. Get used to having real consequences behind each decision you make. (TradingSim is a solid option to start with)

You literally need thousands of repetitions of practice before you can make the leap to trading without emotion or thought. You don’t just make it to the NBA without thousands of hours of practice. You don’t just become a brain surgeon without thousands of hours of study and practice. Being a trader is no different. Your skill has to be developed and then worked on constantly.

Application vs Knowledge

One of the tenets and promises I expect from my students when they take our Live Trading Boot Camp is that they don’t trade live while the class is on. That’s even for the most accomplished of my students.

Many of the people that take our class have been trading 10 years plus but need to get to the next level. They need to get more consistent or learn to trade larger size or have more setups in their toolbox. But most of them are brand new and so it’s crucial to start off on the right foot and make sure to learn the material and finish the program before one goes live.

The coursework is really only half the battle as that is just book knowledge. You can see a pattern on a bunch of slides in class that I have handpicked but that doesn’t mean that you can trade. A trade has dozens of variables beyond just pattern recognition.

Even if you can recognize the pattern and think you know all the angles can you do it in real-time during market hours? That’s a whole different ballgame.

That’s why we have all our students spend time on a trading simulator. No exceptions.

Student Example

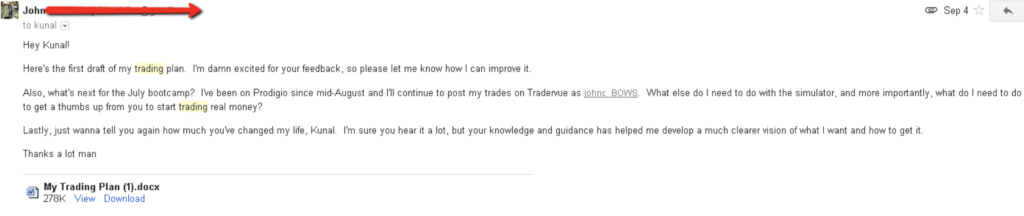

Here is a conversation I had with one of my students John. John had done pretty much everything I had asked him to do and more. He really displayed an incredible work ethic but also his passion for trading on a daily basis:

So is John ready to trade live? Has he done the right things?

I say yes! He wrote me a 16-page trading business plan! All these things are necessary to trade with real money:

- Complete Trading Bootcamp (28 classes 60 days) finish projects/homework/participation in student Discord community

- Develop a toolbox of GOTO trading setups that will allow you to trade in any market condition.

- Build a Business Plan for your Trading Business (if you tried to open any million dollar business you would need a biz plan this is no different )

- Trade on Simulator successfully hitting all metrics (one should be profitable 4 out of 5 days a week for a month )

- Do a detailed review of Trades & archive them in journal format for the teacher to review

So what did John have?

-

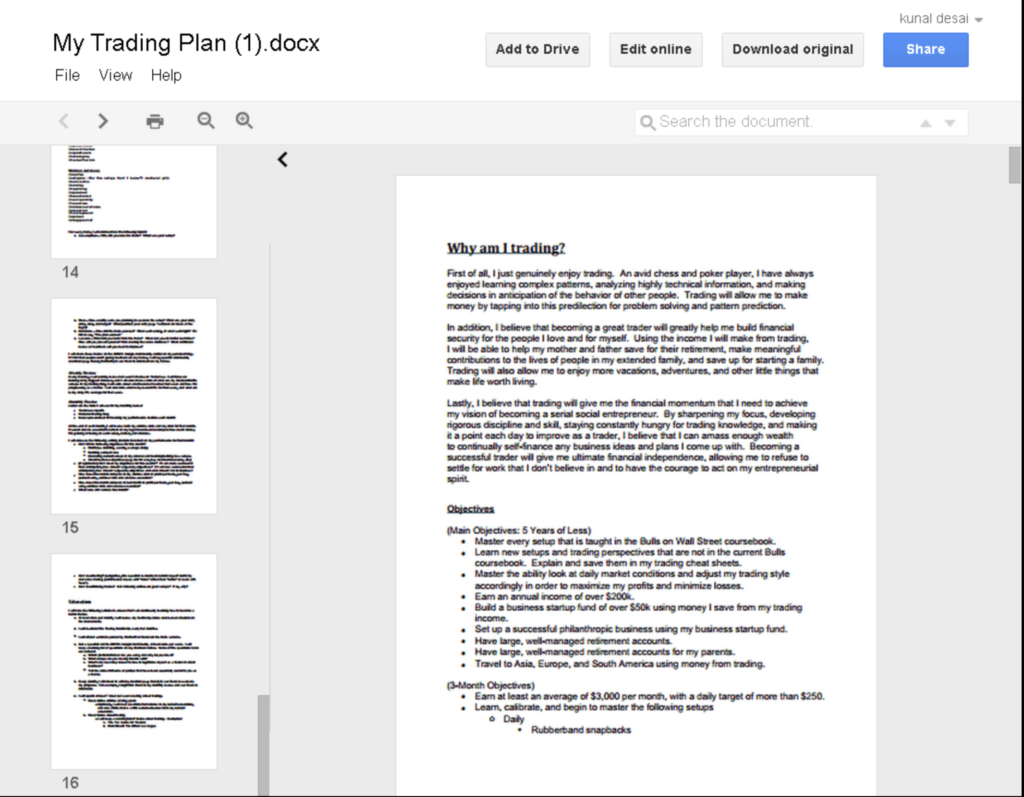

Detailed Trading Metrics

He had all metrics of his trades all archived and journal and tagged by setup on our trading simulator. He knew his win % vs loss % he knew avg gain vs loss per trade and per day. Mastering the relationship between these two metrics is essential for finding consistency.

He also tagged his setups so he knew his win ratio for each setup. A big part of trading is finding your GOTO setups and really focusing on those setups. Cutting out the setups that consistently lose you money or have a less % win rate can really boost your results but you need the DATA!

-

Business Plan- He mapped out a 16-page biz plan

-

GOTO setups: He had detailed reports on which setups he was fantastic on so we know what to trade and what size when we go live.

- Near daily contact with teachers & the community of students. This is huge. You need to totally immerse yourself when learning. Study with those that are on the same level as you, and get mentorship from those more experienced than you.

SO IS HE READY? I think so! This is the gameplan for when someone starts trading live.

The key is to trade small and build the habit of winning and finishing in the green. The hardest part of trading is going from being a losing trader to just finishing green. Even up a dollar. The beginning is not about trying to make 5k in a day. Baby steps.

It’s about building good habits learning to trade your setups to the fullest and extract what you can out of them. When a new trader trades too much size he/she will sell everything too quickly when a stock goes up as they are just trading their profit & loss, rather than the setup. Then if the stock goes down, the loss will be much larger than those small gains they took profit on.

How to Correctly Scale Your Size

Winning is a habit. Trading small size and focusing on being profitable will allow you to scale in a larger size and you won’t notice any emotional impact. As you slowly build size you will see yourself as a big-time trader. The stress of the larger positions will be the same as when you were trading 100-200 shares.

- Trade small- Max 200-300 share size.

- Profitable 4 out of 5 days over 2 weeks then move in size. Every 2 weeks review and add size if successful.

- If weekly stop loss is it work with mentor/peer group on a game plan for next week to pinpoint issues.

- Still archive and journal each trade for review. Keep building your toolbox of setups.

This is the best way I know how to do this. Everyone wants to come in like gangbusters and trade huge size the first week and make a bunch of money.

But it never happened that way. I have seen thousands of traders go overboard and just jump into trading without properly taking these steps and doing the work necessary to be successful.

Not a single one of them succeeded till after they came back into the program and did things the right way with no shortcuts.

Everyone naturally thinks they are very smart and the exception to the rules but everyone at some point will have to do things the right way. Either in the beginning or after a couple of rounds of failure!

Get Early-Bird Pricing For Our Next Live Trading Boot Camp

Learn all the day trading strategies we’ve been using for 2 decades in our Live Stock Trading Bootcamp. Early-bird pricing ends on 2/1!

Click here to join our next Live Trading Boot Camp!