What a year it’s been in the stock market. Insane moves are becoming ordinary. We’re at the point where a stock doubling in price is barely newsworthy.

To grow as a trader, you need to study and learn from the past. These patterns repeat themselves. In order to capitalize in the future, you need to study charts consistently to prepare yourself.

These stock charts from this year will provide you some lifelong lessons:

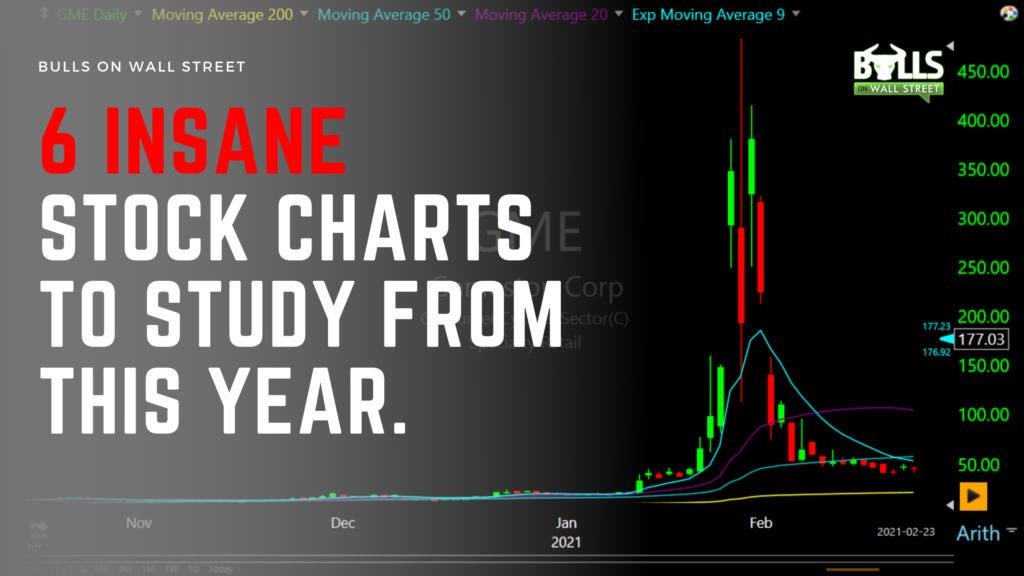

$GME

Let’s start with the meme stocks. $GME has been the most talked-about stock this year. It started with the legendary run from under $5 to almost $500 in just a couple of weeks back in January. It’s a company with awful fundamentals in dying industry that retail traders have flocked to as a way to squeeze shorts “stick to the suits.”

While I don’t understand how enriching the $GME and $AMC executives and institutional shareholders is achieving this, let’s focus on the take away:

Pigs can fly. Anything can happen once you enter a trade. Stocks can stay irrational longer than you can stay solvent. Many short sellers got wrecked on this because they did not manage risk. That is your number one priority on every trade.

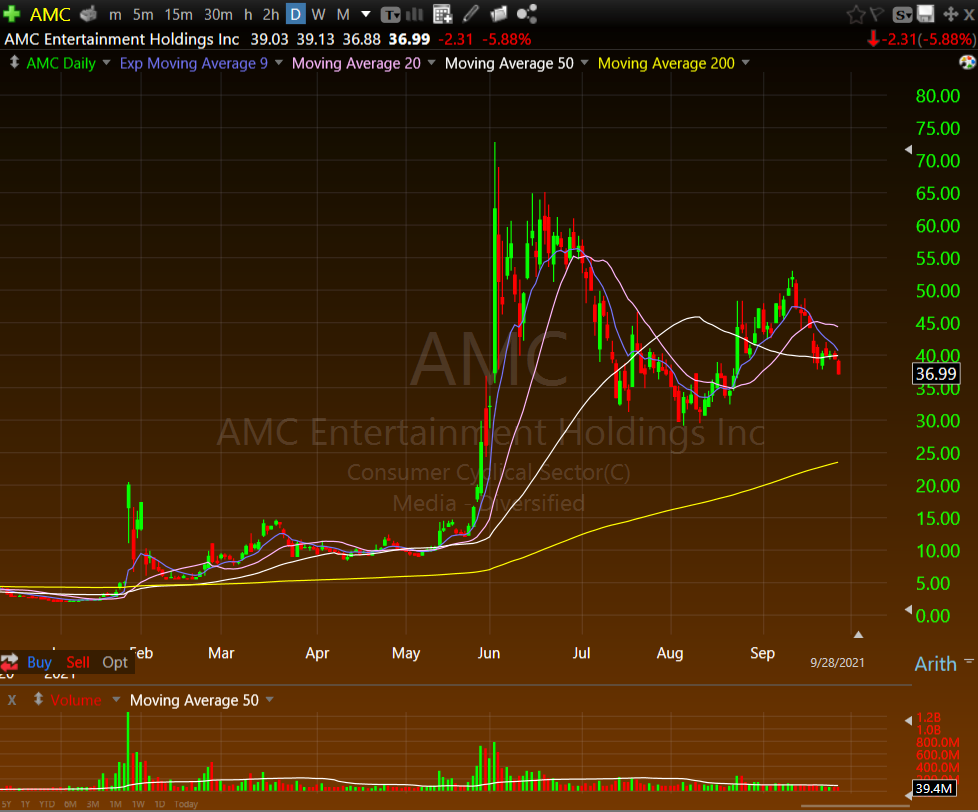

$AMC

$AMC was trading under $5 in Feburary. When $GME ran $500, $AMC saw a nice move to $20. $AMC had its blow-off top at the end of May, where $GME had it in February. Similar story to $GME: Bankrupt company that got bought up enthusiastic retail traders, and shorts got annihilated.

The lesson is the same thing is $GME: Manage risk, prepare for all scenarios. For the retail traders who are holding $AMC and $GME: These are great short-term trading opportunities, not long-term investments. Nail and bail, don’t stay and pray. These will eventually come down to Earth.

$PLUG

$PLUG is an EV battery manufacturer that went on a massive run leading up to the election and afterward early this year. It is a classic example of the “sell the news” play. Biden’s presidency was anticipated to be favorable to a variety of EV companies because of the policies that were expected to implement.

It had a massive run-up into the inauguration. As soon as that happened, the massive sell-off in the whole sector begin. This is a pattern you will see over and over again: Buy the rumor, sell the news. Don’t get caught in the hype and buying into highs.

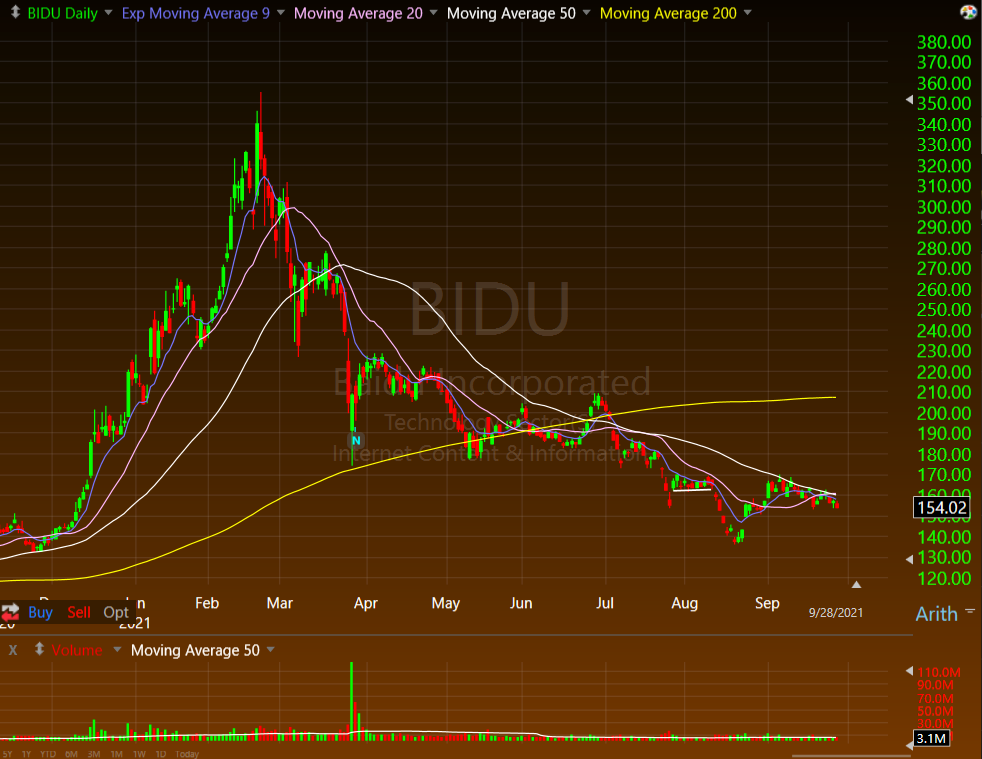

$BIDU

We choose this chart to show the power of sector rotation. $BIDU is one of the leading stocks in the China communication sector. Like with EVs, it was a hot sector at the start of the year. And then ALL the air came out of all the China names. Once all the good news is priced in, the sellers come pouring in. It’s hot till it’s not.

$MRNA

One of the stocks of the year. With it’s vaccine rollout, it has been on a non-stop uptrend for months. It has been a daily stock for day trading for us, offering great range and liquidity. The top may be in, who knows. But it will still offer great shorting opportunities.

$UPST

Upstart is great company in a promising sector that has been red hot all year. Similar to $MRNA, a daily trader for us in recent months, it was trading at $30 at the start of the year, and is now trading over $300. It is a stock to keep on your watch list every week, it has great range and liquidity. Keep an eye out for these momo names, they can make or break your trading year.

Make sure to study hundreds of charts a day. Build muscle memory for patterns.

Live Trading Classes From Experienced Traders: Join Our Live Trading Boot Camp

Space fills up fast in our boot camps. Apply for your seat to see if you qualify!