As we move past earnings and into the middle Q1 for 2023, the opportunities in the market are there day in and day out. This is one of the hottest markets we have seen since the crazy bull market of 2021.

Now, to be able to trade the market though profitably, you have to be able to pull these opportunities out of the ‘junk’. Tiy nyst identify the prime setups and best stocks to trade, choosing the wrong stocks has the biggest consequences when the market is flying like it is now.

A method we use to do that here at Bulls on Wall Street is by using and analyzing a concept called Relative Strength.

The focus of this blog will be talking about this crucial concept in detail, how you can use it, as well as some examples of Kunal identifying the best stocks to trade in 2023 based on this relative strength concept.

What is Relative Strength?

Relative strength is a strategy used in trading and investing for identifying value stocks. It focuses on investing in stocks that have performed well relative to the market as a whole or to a relevant benchmark like an indice. This video will explain this concept in more detail:

How Do We Use Relative Strength To Identify Opportunities?

Traditional technical analysis and relative strength tells us that the strongest stocks in a bear market will lead the way when a bull market shift comes. We definitely aren’t in a bull market just yet, but we do have plenty of bottoming and basing in tech stocks, market leaders, and the overall indices.

The concept of Relative Strength tells us that we want to focus on stocks that held up well while the market was getting crushed when the market starts to turn to the upside.

What Stocks Should I Watch now?

Let’s dive into some examples.

There is no question that 2022 was a nasty bear market. Tons of stocks were getting crushed, but a few sectors held up. Oil stocks were one of them Sure, they did have their fair share of downturns and red days, but overall, stocks like $OXY, $XOM, and $CVX did rise and see positive relative strength. Compare the $USO chart below to what the $SPY and $QQQ looked like.

It rose while the market was getting hit, are consolidating now as the overall market starts to base out, and are setting up for another leg up when the market breaks out.

Again, these stocks have ‘relative strength’ to the market, are basing out as the market bases out, are getting ready for another leg higher, and are also in a hot, stable sector. The more factors like this that you can stack onto a trade thesis, the better.

The Base Breakout Pattern

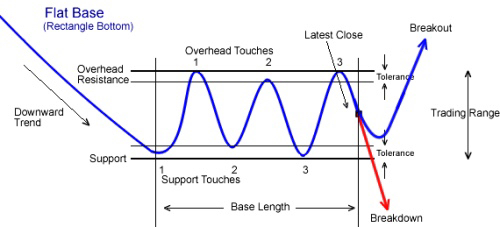

Another way to play the turn of the market to the upside in 2023 is by looking for a little bit of the opposite. You can also on the flip side look for stocks that have had an extremely NEGATIVE relative strength to the market, and have been beat down 75% or more. What we do here is look for a Base Breakout Pattern.:

To find stocks that fit this pattern, we want to see a multi-month base being formed at the lows on the stock, and fit this structure.

These stocks will give you opportunities for asymmetric reward vs risk. This setup allows you to ride short squeezes to the upside, and limit your risk to the downside. Just make sure there is sufficient volume in the stock, as well as a high correlation to a major index that is gaining strength.

If you want to learn other day trading and swing trading strategies to capitalize on relative strength names, enroll in our LIVE 60-Day Trading Boot Camp!

Early-Bird Pricing Ends SOON For Our Next Live Trading Boot Camp

Click here to apply for our next trading boot camp!