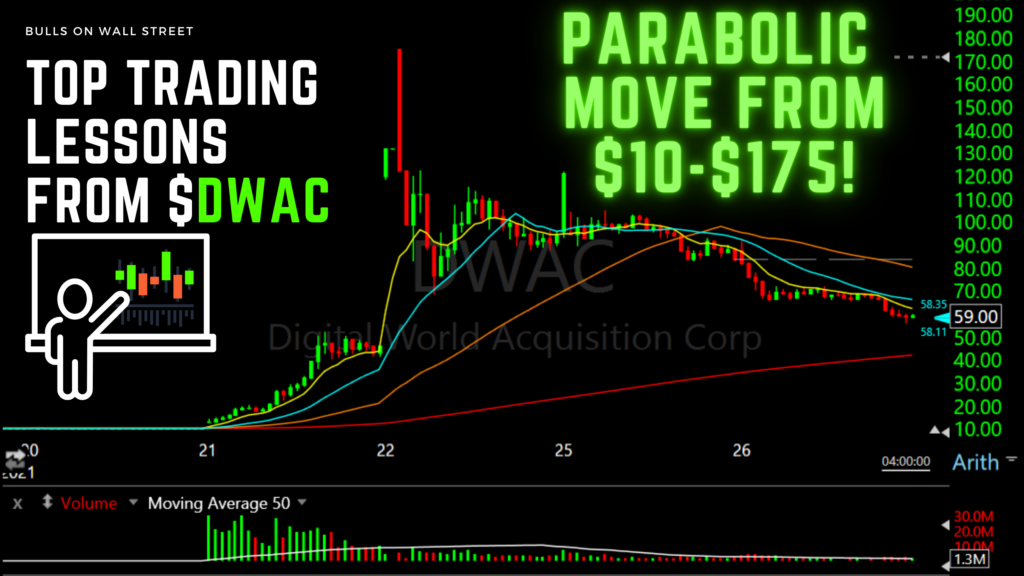

Last week, the move on $DWAC captured the world’s attention. A few times a year, we will get a crazy stock that goes up 1000% in a couple of days.

A crazy move like this always creates a few big winners, but it also leaves a ton of blown accounts and pain behind it. It’s a zero-sum game.

How do you make sure that you are on the right side of parabolic moves like $DWAC?

Today, we are going to cover the top 7 lessons you need to pull away from the $DWAC run whether you traded it or just sat on the sidelines. Keeping these lessons in the back of your mind at all times will keep you safe during the next parabolic move like this, and on the right side to profitability.

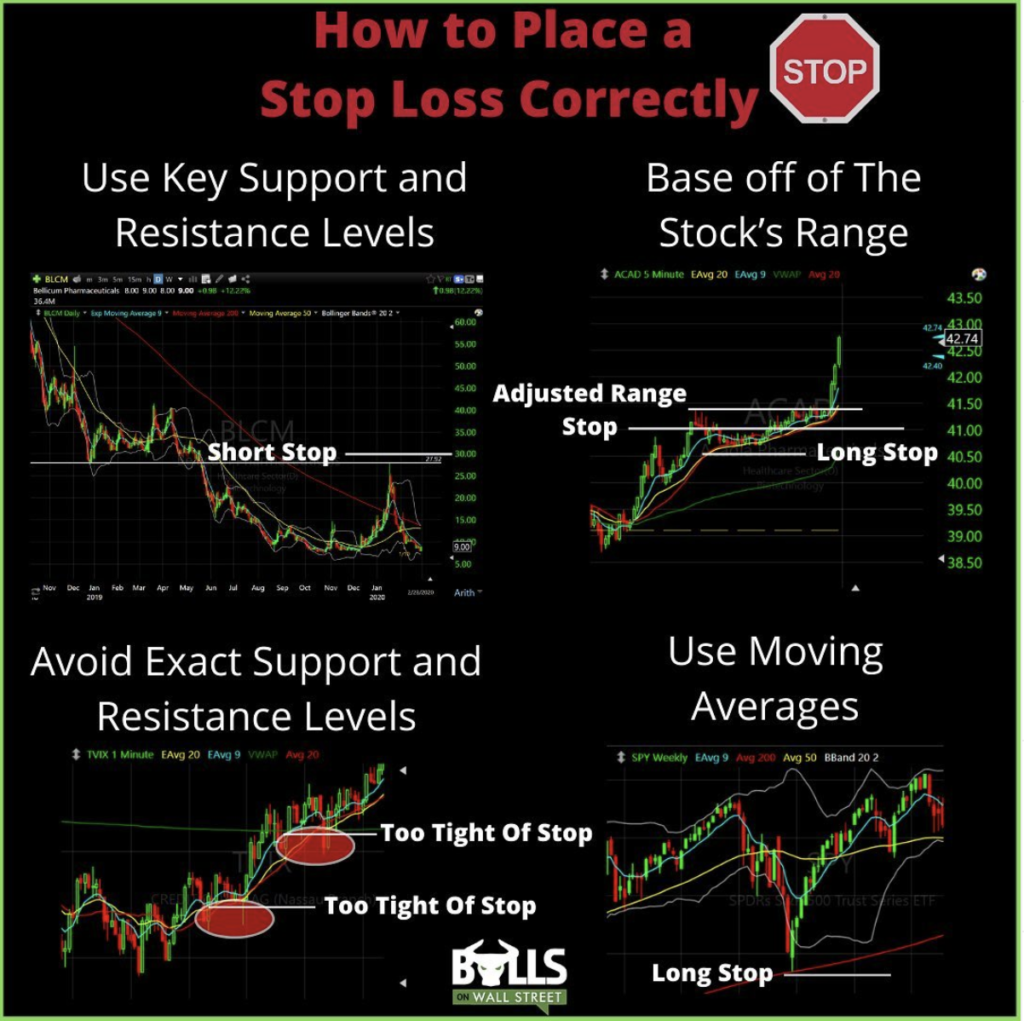

Always Respect Your Stop

Without a stop, months of great trading can get undone within a few minutes.

Plain and simple.

If you were short $DWAC or even $PHUN (the stock that moved in sympathy to $DWAC) and didn’t have a stop in or respected it when they were making new highs, you can easily blow your account… QUICKLY. Always have your stop established on every trade, and respect it if it gets to that level, especially if you are using a mental stop over a hard stop. Use these strategies for placing your stop loss correctly:

Trade With No Bias

This stock trapped many with political biases. When you are trading, you have to leave political views, beliefs, emotions, and biases at the door when you sit down at your desk. Trade the chart.

If you get overly short OR long-biased in any stock, it can be catastrophic for your account and cause tons of issues. Biases and beliefs seeping into trading fog your decision-making abilities and restrict you from making sharp decisions at all times. Trade the chart only, and leave beliefs behind.

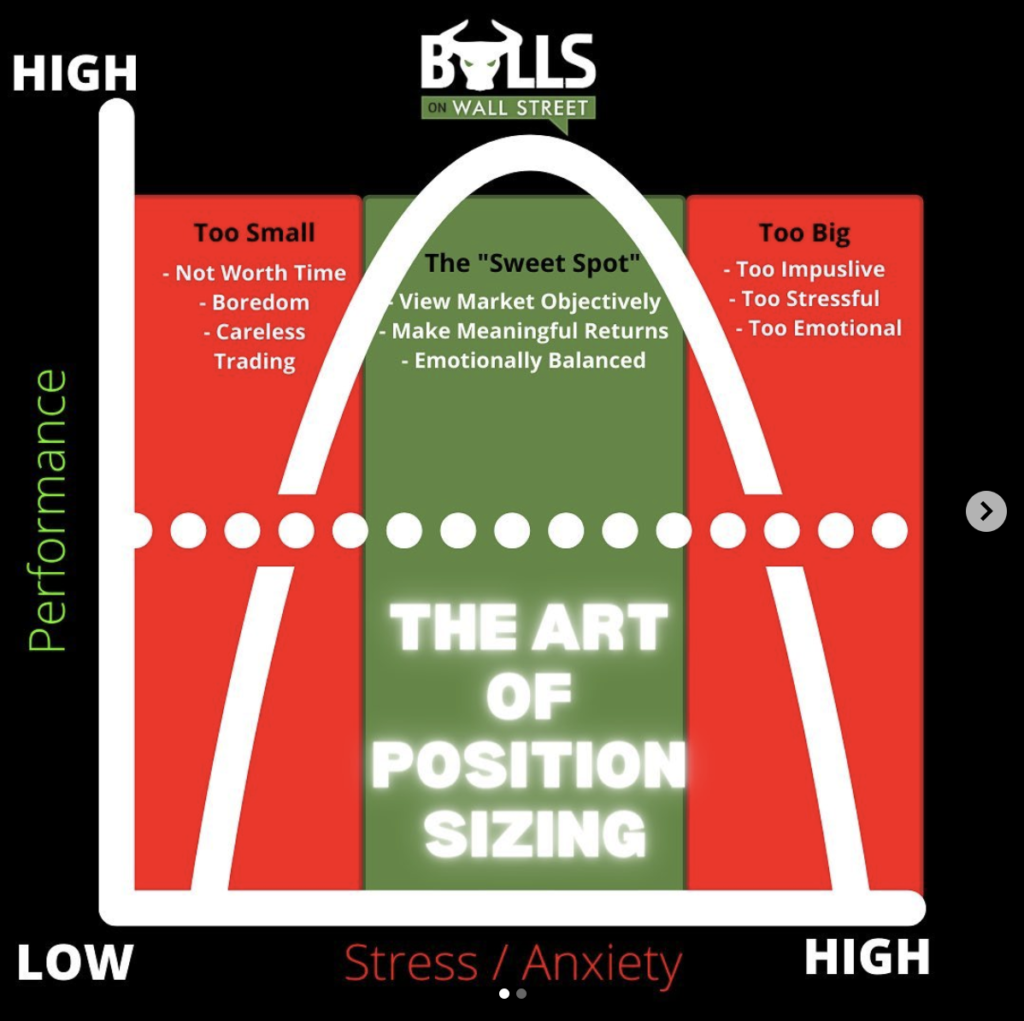

Pay Attention To Sizing

Sizing up too much on a trade can be devastating to your account when a stock goes against you. Always make sure to be consistent with your sizing parameters, and never get overly confident in a move. Even if you were oversized in $DWAC and were long the stock, one quick downtick can blow your account and leave you bag holding. Keep the size consistent, respect your stop, and trade with a clear mind.

Take Volume Into Account

$DWAC on day 1 and 2 traded extreme volume.

Day 1: 498 Million Shares

Day 2: 133 Million Shares

Whenever a stock trades extreme volume like that, especially on day 1 of the move and doesn’t roll over, that is a very bullish sign. There was a ton of demand in $DWAC, especially on day 1, and little supply. Being aware of that situation will help you avoid taking the wrong side of the trade. Day 1 short setups are risky on these type of plays. The probability of them rolling over on the first day of a strong movie is much lower than day 2-4.

If you know there is an overwhelming demand for the amount of supply out there on the market, then naturally, the price will rise. Learn about the concept of float rotation. Economics 101.

Be Careful With SPACs

You can trade SPACs (Special Purpose Acquisition Companies, learn what they are here) consistently and effectively, and we do frequently here, but you have to be careful if you don’t know what you are doing. You have limited data fundamentally and technically to base your trades off of when trading SPACs, so you have to pay attention to volume and price action, and also make sure to size down.

Never Underestimate a Stock

Never underestimate a move a stock can make. It doesn’t matter what the stock is, who owns it, who runs it, and what its’ story is. Any stock can go parabolic… FAST. Hit and run is the best attitude, don’t stay and pray. I took a quick bounce play on it last Friday after it dumped from $170 to $85:

This is a day trade not an investment. You don’t need to be right about the company in the long-term to capitalize on momentum in the short-term.

Never Chase A Stock

You chase you die. Avoid the FOMO. Chasing a stock that has gone parabolic can leave you holding the bag easily at the top. Wait for a dip, and get in on a strong technical setup. Be more fearful of chasing then missing the move. Patience pays.

Live Trading Classes From Experienced Traders: Join Our Live Trading Boot Camp

Space fills up fast in our boot camps. Apply for your seat to see if you qualify!