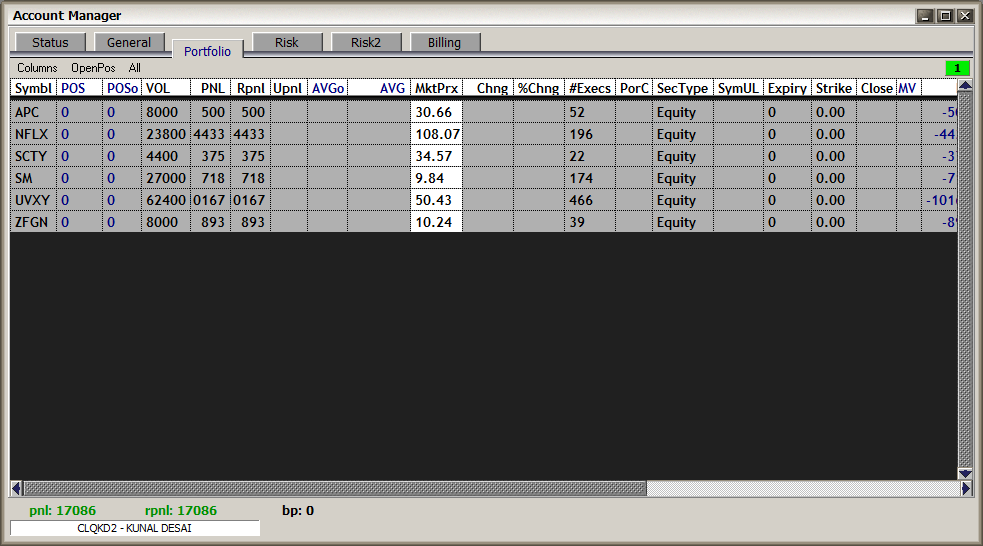

Yes, you read that right – nearly $30k in just two days! Yesterday, I closed out with $17,000 in profits, primarily trading $NFLX and $UVXY. This is one of my favorite day trading setups. If you are going to day trade its important to have a toolbox of techniques that you can you use in any type of stock market. This market has been weak and using volatility is a great way to take profits on these strategies

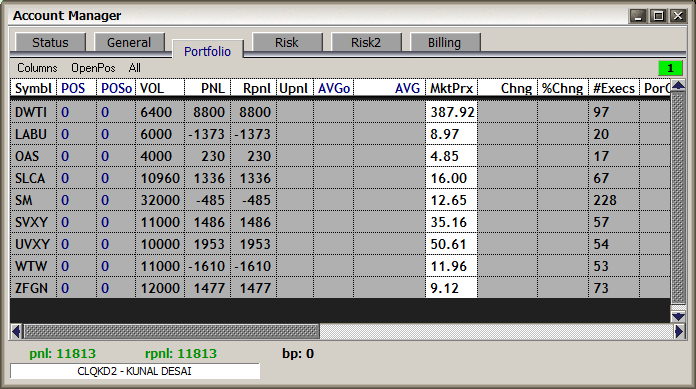

Today, I made $11,800 trading $UVXY, and also $DWTI, which is a crude oil, inverse ETF.

There are some valuable lessons to be learned here. I have been watching (and shorting) the market for the last month as its been in free-fall. It’s been approaching a significant support level. It broke through that level, flushed, and then rebounded. This happens often; a highly-watched support level will be broken, creating a bear trap, then bouncing back up through the support level.

But, it’s important to find the best stocks and ETFs for your style of trading. Rather than trading $SPY long, I short $UVXY. The $UVXY ETF, which is a leveraged ETF that tracks volatility, provides a lot more power than $SPY. As a short term momentum trader, that’s what I’m looking for. I recorded a video to explain in more detail.

Today was very similar; I shorted $DWTI, which is an inverse ETF correlated with crude oil – when crude goes up, this goes down hard. As I saw oil bouncing today, I shorted this for significant gains.

Of course, I’ve been making the majority of my money lately on the short side, which is why I held this webinar on profiting in bear markets. The webinar is over, but you can still access the recording HERE.

If you have any questions at all hit me up at kunal@bullsonwallstreet.com!