Quick Summary

SPY is overbought. I went short today. Exited all long positions for nice gains due to overbought conditions. Focus list positions WLB, FB, WYNN, along with ETF IBB, IWM and some market leaders all require pullbacks. I will exercise patience here. I do not want to chase and am willing to miss moves.

Trader Education:

I am going to start the report discussing trading journals and how to use them for this Report. I created a journal for keeping track of the trades made here. All of you should keep a detailed journal similar to this one. Every trade you make should be entered and always contain the stop, target, risk ratio and trade setup.

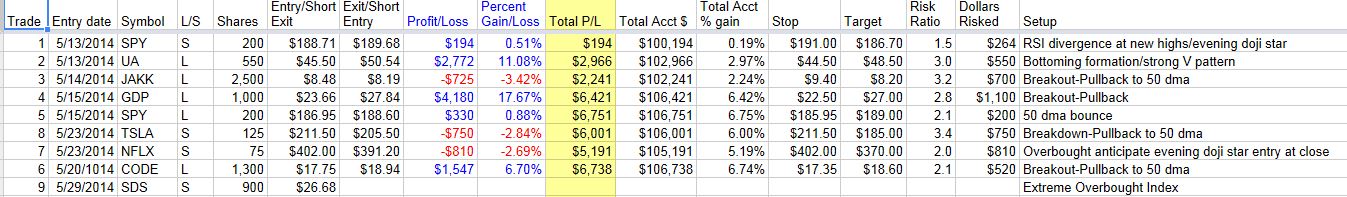

Here is the journal for all Trade Report trades since inception on 5/13/14:

Before we get into how we use the journal information, let me explain some basic sizing trade rules. The Report started at $100,000 with $200,000 margin buying power. Most positions will be between $20,000-$30,000 in size. In alerts I don’t list position size since they all will be in this range. If I am upping a trade size significantly, I’ll mention it. Dollar risk will generally never go above 2%. So far the most has been 1%, with most between .5-1%. Note that inverse ETFs (short market by going long the ETF) will be listed as S (short) even though it is a long position. Commission fees, margin interest and taxes are not factored into these results.

The first two things I look at when assessing my results is the win rate and size of wins versus losses. The current win rate is 62.5% (5 wins, 3 losses). The average win size is +1804 and average loss is $761. I always want my wins to be at least 2 times bigger than the losses. Currently I am at 2.32 which is right where I want to be. I don’t care too much about win rate (I am fine with a 35-40% win rate if my wins are 2-3X bigger than losses). I just need to know that if my win rate is lower, I need my win/loss spread to be higher.

Next I look at the setups to see what is working and what is not. If a certain setup is not working, I look into whether it is the market or mistakes on my part in taking the trade. If it is the market, I check these trades and make note that a certain market might not be conducive to a certain type of trade. After a significant period of time and trades, I break down my stats for each trade setup.

After enough time has passed I go over each trade (monthly or quarterly). I check the setup and trade management to see what I did right or wrong. I also give each trade a grade. For instance, I give my first trade a C- though it was a gain (I don’t feel I managed the position correctly). However, all of my losses were A-/B+ trades. They were good setups that didn’t go my way, and I managed risk properly.

I suggest you keep a journal similar to this one. If you have any questions or comments, let me know.

The Trade Report Journal can always be accessed via this link and will have all past and current positions.

The Market

Key Pivot Levels:

192.37: new high resistance

190: old high

187.30: 50 day moving average

181.31: recent low

181-184: plenty of buying in this range.

Under the Hood:

SPY gained about a point today and is at extreme overbought levels. Stochastics are at extreme overbought levels at 95 and the gap between price and the 50 dma is widening. Every once in a while when we are overbought I will throw bollinger bands on the chart. When price touches the top an pierces the band, that’s a sign that we should snap back and “reverse to the mean” soon. Take a look at this SPY chart again, which shows a 70 percent win rate over the past year when we get to these types of extreme levels.

Trading Game Plan:

I took a key from yesterday’s plan and went short SPY today, via inverse ETF SDS, as noted in the alert. Three more alerts were sent out, exiting UA, GDP and CODE for strong gains. Normally I would move stops up and “let them ride” a little more, but with these overbought market conditions I decided to exit.

IWM is still keeping up with SPY and is enterable on a pullback near the 50 dma.

Over the past year, we have had 10 instances where readings hit 90. If we entered short at the moment the red and black lines begin to touch, as is happening now, a short trade would have been successful 7 out of 10 of those trades for a 70 percent win rate. The odds favor shorting.

I have exited all longs and the SPY short is my only position. I am looking for a pullback for long entries again.

The Focus List

The focus list is small as I wait for pullbacks.

WLB is building a base here. Target is recent high at $32, stop is around $28.50. Entry at $29 offers 6:1 reward to risk ratio.

WYNN and FB are showing similar patterns and need to pullback for entry. Entries, stops and targets remain unchanged from yesterday

The Watchlist

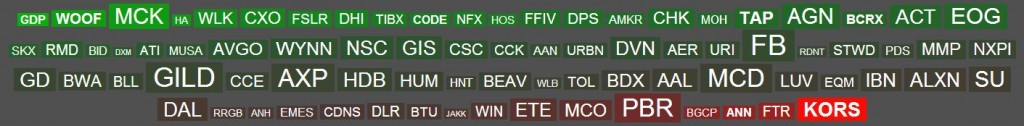

There were a few breakouts today (WOOF, MCK, HA, WLK, DPS), and ANN, PBR and KORS may be close to breaking down. The rest are trading within ranges.

Click here and scroll over ticker to see thumbnail chart

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market (TSLA in recent months).

NFLX and PCLN continue strong moves with no desire to pullback. GOOGL, GS, AMZN and FB continue to build strong bases from bottoms. CAT and TSLA are still being watched as short plays. GMCR moves closer to filling the gap entry.

Sector and International ETFs

Biotech is putting in a chart formation very similar to other market leader that formed big head and shoulders pattern, but within that pattern have a nice long setup. Price has remounted the 50 dma and needs to pullback for entry.

Current Trades

Entered SPY short position today via SDS. No other positions as 3 were exited today for nice gains.

If you liked this you can get a 7 day free sample by CLICKING HERE. New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh)