Quick Summary:

SPY breaks down under key $200 level. Entered SCTY today. Still holding SPY short (via SPXU) and GWPH. New Focus List addition ECTY.

Video Analysis:

No video today.

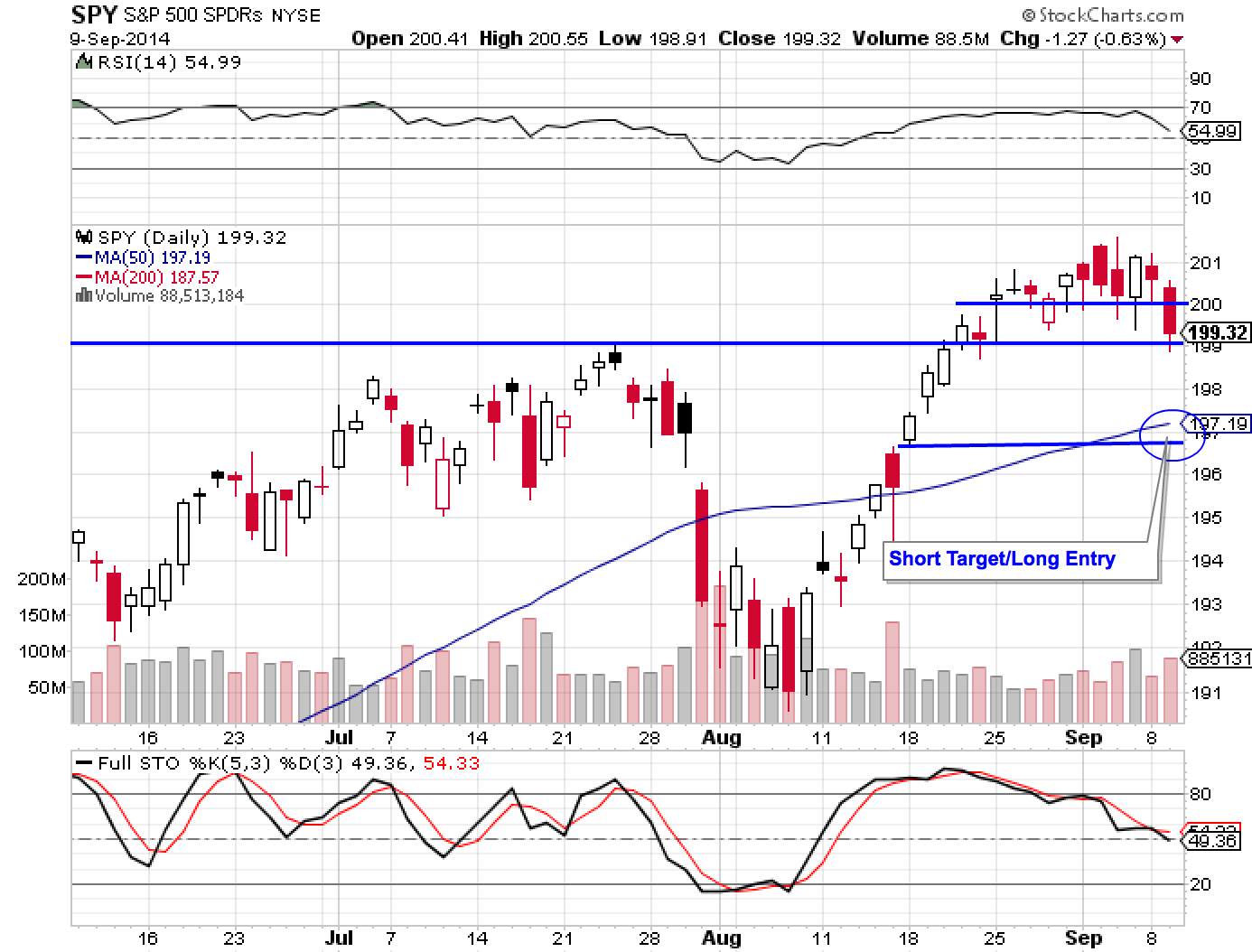

Key SPY Pivot Levels: Round number $200, Old high 199, 50 dam 197.19, 197.50 and $196.50 gap fill and support levels

Under the Hood and Trading Game Plan:

We *finally* got a clean break of $200, and for a time it looked like SPY might even break $199. In the end it closed above $199, but the damage is done. We are starting to see some clear signs follow through for shorts. Knowing this market, I would not be surprised to see some more back and forth before we get more follow through with a $199 break.

Once we get a close below the old high at $199, the 50 dma and gap fill in the $196-197 range will come into play. This is where we should see some attractive entries in momentum stocks.

The current game plan is to manage the SPY short position. I continue to look for long setups on momo stocks, but will not chase. B

Current Trades

I am still holding SPY short via SPXU and GWPH.

Today I entered focus list stock SCTY on weakness. It recently remounted the 50 dma and is now basing above it. As with the rest of my long entires of late, this was a half size position due to the overbought market.

The Trade Results Journal/Spreadsheet is up to date.

The Focus List

Finviz link to easily follow the entire focus list. Most positions entry charts remain as annotated earlier in the week.

Take a look at the link to the focus list above and you’ll see a few momo stocks with ugly bars, like AMZN and BITA. When the market pulls back or corrects this tends to happen in waves. The prevailing wisdom is to look for the stocks that acted well, but my experience is these guys often are the next to drop. For that reason I am going to stay away and just watch, unless intra-day action tells me different. Instead, I will focus on the most recent breakouts that have a strong catalyst and volume.

New Addition:

ECTY broke out of a range going back to May on strong volume.

DGLY still looks good but I’ll wait for more of a pullback. See yesterday’s chart.

Short Setups:

My focus now is shorting SPY via SPXU

Market Leaders

Every one of the market leaders pulled back today. AMZN was hit hard enough that normally I would consider removal since it was already somewhat broken. However, since it may be an over reaction to the AAPL phone payment news, I’ll continue to watch it over the coming week or two. I did this with CAT, which I use as a gauge of industrial type stocks, and it bounced back before I had the chance to remove it. PCLN is also on a short leash.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way and How to Anayze Your Swing Trade Results It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh).