Quick Summary:

SPY analysis is mixed. . Exited AAPL Friday. Current trades SPXU, NOV (short), TWTR (long). Watch video of focus list AIRM,YELP,FB,TRLA,FSLR,BCRX,BMRN,BLUE,INSY,TRGP,NLNK,NFLX,UA,Z,WUBA,ISRG,BIDU,TSLA

Video Analysis (7 minutes):

See Focus List Section

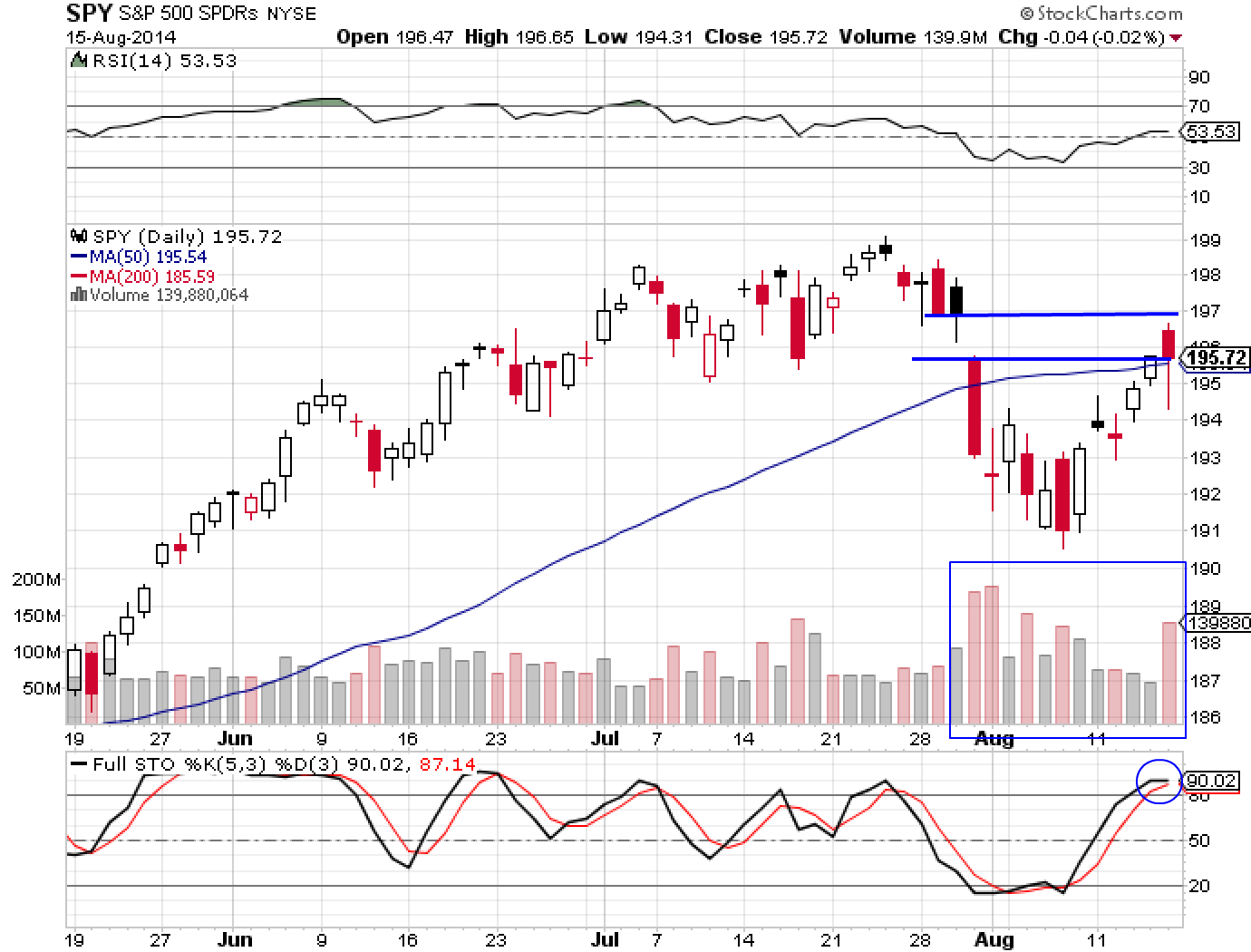

Key SPY Pivot Levels: 199 : recent old high, 195.54: 50 dma, 190 gap fill and support level

Under the Hood and Trading Game Plan:

Right now SPY is a riddle wrapped in a mystery inside an enigma (any Churchill fans?). We got some excitement last week, and now SPY has me perplexed. Friday we went from “SPY might be breaking out”, to “SPY reversed and is breaking down” to a close that left me saying “what the what?”.

The close is a ball of confusion. Bulls can say we closed above the 50 dma, handling the best that the bears had to offer, a long tail hammer candle has formed and new highs are within reach. Bears can say SPY still closed off it’s highs, stochastics are overbought, overall breadth still stinks, there is a lack of breakouts during a very good earnings season, the volume pattern is distributive, and the hammer candle formed at the top of a pivot rather than the bottom.

We have to keep any bias out of this and recognize that both have valid arguments. The best bet is to watch closely and not make any big bets until we have some clear direction. Hopefully Monday or Tuesday gives us a clue. In the meantime, take some stabs both long and short.

Take note of this. I have no problem adjusting my analysis or previous bias. I am not a bear or a bull. I am a trader trying to make as much money as possible risking as little as possible. If a pundit or one of the Twitterati wants to call me wishy washy, let them. While they hide their trades and yap, we’ll flash our results and million dollar smiles.

The game plan is to watch and manage the short SPY trade (SPXU) and our long positions. For individual stocks I continue to focus more on long setups featuring momentum stocks and earnings breakouts.

Current Trades

On Friday I excited AAPL at $98 for a 2:1 gain. I am still holding SPXU (short SPY), NOV (short) and TWTR (long).

The Trade Journal results

The Focus List

The focus list has 18 stocks that I really like and I’ve had a tough time narrowing it down. Please try to watch this video (7 minutes), as I analyze every one of them. As the week progresses I will key in on fewer focus list stocks.

Focus list stocks: AIRM,YELP,FB,TRLA,FSLR,BCRX,BMRN,BLUE,INSY,TRGP,NLNK,NFLX,UA,Z,WUBA,ISRG,BIDU,TSLA

Thumbnail charts of focus list to quickly view and analyze setups.

Short Setups:

My focus now is shorting SPY via SPXU.

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market.

Z, NFLX and FB can all be considered focus list stocks. TSLA and GOOGL are nearing entry levels as well.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way and How to Anayze Your Swing Trade Results It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh).