Quick Summary:

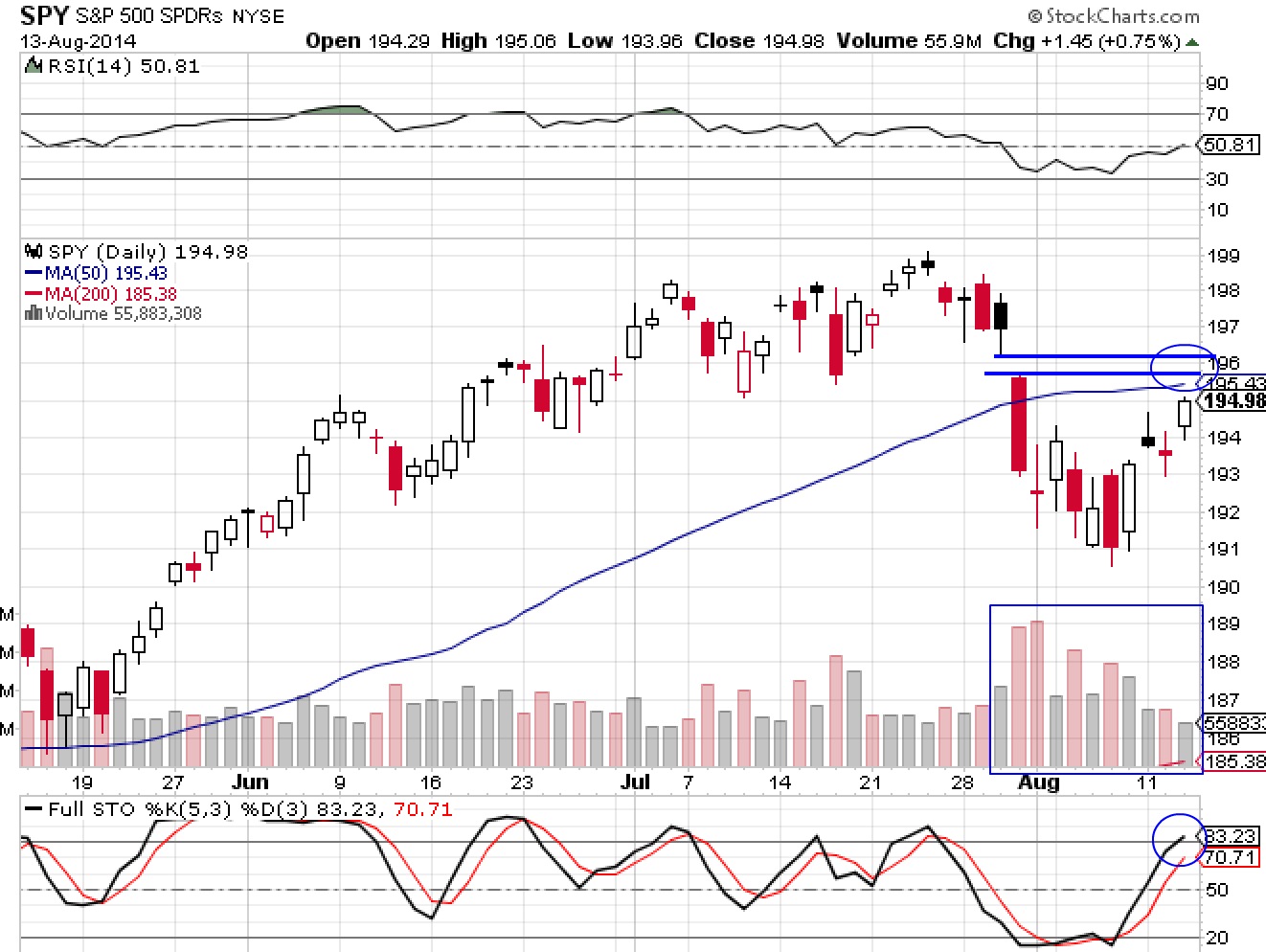

SPY short entry at $195-196. Focus list stocks near entry: BIDU, AIRM, NFLX, FB, ZU, YELP, GOOGL, UA, ISRG, WUBA, ESNT. Entered NOV short today, still holding AAPL and TWTR.

Video Analysis (4 minutes):

The intra-day video hits many focus list stocks and SPY.

Key SPY Pivot Levels: 199 : recent old high, 195.43: 50 dma, 190 gap fill and support level

Under the Hood and Trading Game Plan:

SPY is moving close to short level. The moving average is at $195.43 and gap fill at $196, while stochastics are in overbought, but not extreme levels. I will try to enter short at as close to these levels as possible.

I will use SPXU to short.

A number of focus list stocks are near entry, but I will be very selective with the anticipated pullback of these overbought conditions.

Current Trades

I am still holding TWTR and AAPL. AAPL is moving steadily toward the target level.

Today I entered focus list short setup NOV short. You should have received an alert. Stop is between $83.75-84 and target is $76-78.

The Trade Journal results

The Focus List

For annotated charts with entries, see the report for Monday.

Focus list stocks near entry levels: BIDU, AIRM, NFLX, FB, ZU, YELP, GOOGL, UA, ISRG, WUBA, ESNT. We have talked about entries for all of these.

New additions:

Both new additions are regulars, GOOGL as a market leader and YELP, which was a short setup. Both stocks broke out over resistance levels that have changed the nature of the stocks. Both are entries on pullback. GOOGL on pullback to moving average, around $580-583. YELP $71.50-72.50.

Short Setups:

While the short list is still viable, except YELP, my focus now is shorting SPY via SPXU.

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market.

GOOGL just broke out of of the upper channel of the trading range and is now a focus list long setup. Entry on slight pullback. FB moved up and is still long on weakness. NFLX is forming a high tight flag setup post breakout.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way and How to Anayze Your Swing Trade Results It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh).