Quick Summary:

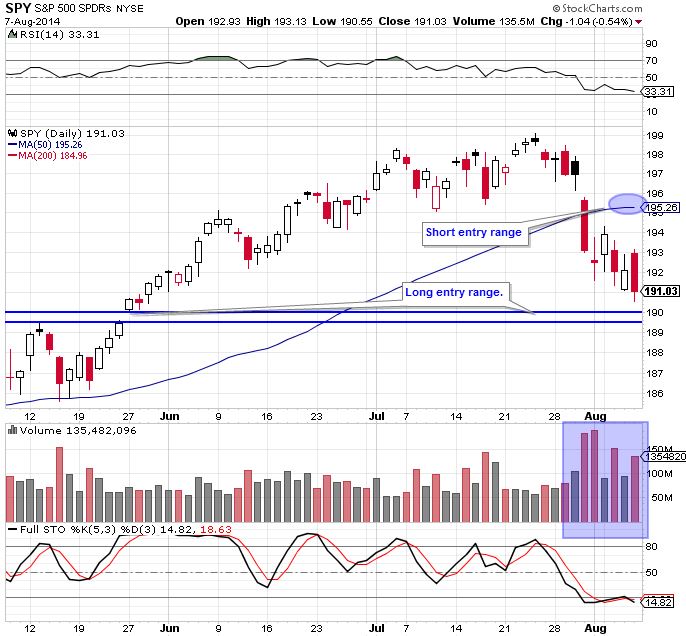

SPY nearing $189.50-190 bounce entry. Video on trader psychology at old highs, not entering at entry point, focus list stocks and the lack of breakouts. New focus list addition FSLR. PNRA and ZU removed. Still watching breakout-pullbacks. TSLA, NFLX, Z and GOOGL all market leaders of interest.

Video Analysis (8 minutes):

Today’s video analysis talks about the market, today’s trades and quickly hits many focus list stocks. There is also talk about the market psychology of traders holding at highs in order to break even (TSLA), when not to enter when given an entry point (NFLX) and examination into lack of breakouts and how that enters into our analysis of the market. All in only 8 minutes.

Key SPY Pivot Levels: 199 : recent old high, 195.26: 50 dma, 190 gap fill and support level

Under the Hood and Trading Game Plan:

We are getting closer to the $190 level for a long bounce entry. I am going to change it up a little and call it the $189.50-199 level. If we would have dropped hard to $190 and stochastics were around 5, I would be all over $190. This slow up and down pullback does feel as “painful” so I am going to try and get in a little lower. I may even stagger in with a half position at $190 and another at $189.50.

I will use UPRO to go long SPY. It is a 3x leveraged ETF that tracks SPY. While SPY was down .54% today, UPRO was down 1.64%.

I will continue to watch and trade individual stocks based on setup, focusing in on earnings breakout-pullbacks. I am watching some short setups but will not short until we get a bounce.

Current Trades

I exited WYNN (loss) and DECK (gain). I entered Z and am still holding TWTR. The trade journal has been updated with all closed positions.

The Trade Journal results

The Focus List

For now I only have the catalyst driven breakouts on the focus list.

EGHT, TRLA, LPNT, UA, ISRG and BIDU are all near entry level on slight pullbacks.

New Additions/Subtractions:

For now, ZU and PNRA are off the focus list. I don’ t like the price/volume action on pullback, though no support violations.

FSLR is back as it remounts moving average on strong volume. Strong remounts of moving average breakdowns often lead to big moves. Looking for a pullback entry on light volume, with a stop around $65 and initial target at $72.

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market.

TSLA printed a hammer near past resistance high. I expect stock to start pulling back. FB pulling back to gapfill. Z is entering buy area on pullback (entered today). GOOGL nearing moving average support at $560. PCLN moved up today, no longer near entry level. NFLX breakout takes it from short to long candidate. See video for reasoning.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way and How to Anayze Your Swing Trade Results It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh).