The breakout remount setup just might be my favorite setup. Let’s discuss how and when to trade it and go over and example of a current trade and breakout-remounts that are setting up.

Any time there is a big market selloff like we are currently experiencing, you will see stock after stock violate key support levels. It doesn’t matter how good a stock is, if the market pulls back hard it’s likely to get take down with the market.

When I see momentum leaders get taken down with the market, I keep an eye for moving average remounts. The idea here is that there was an over reaction, the Street figures it out, and soon enough the stock is back on track.

While it’s tempting to try to get “value” and buy at the depressed prices, this is often a losers game as the trader gets into “catch a falling knife” mode. I like to wait for actual confirmation that the stock is back on track, by allowing the stock to remount they key former support level. This is often the 50 day moving average.

Take a look at this article laying out the breakout-remount setup.

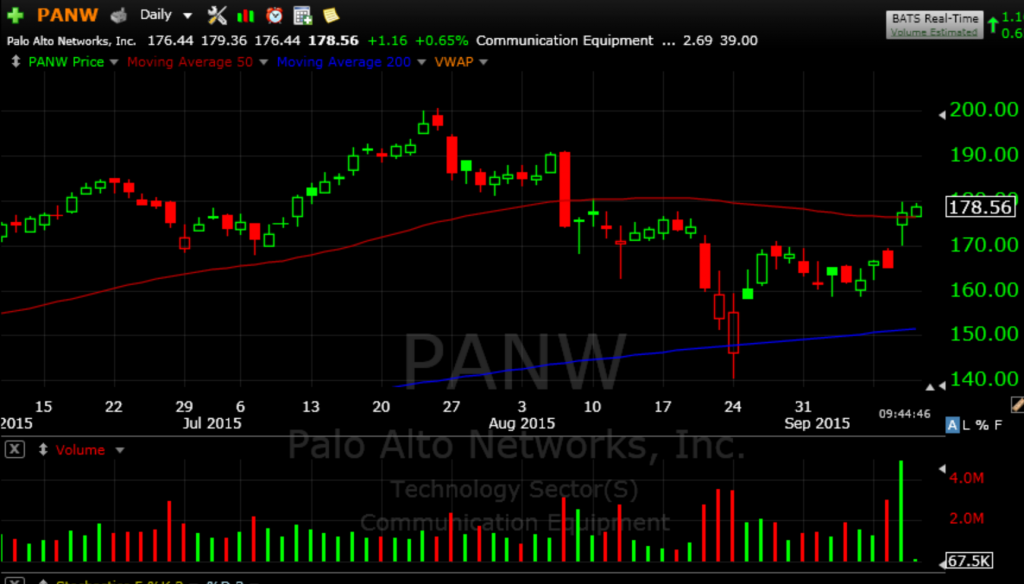

Recently I entered PANW on remount (Trade Report members were sent a trade alert). This is a typical remount entry. As of this writing, the stock is up 5 points from entry level.

Now let’s take a look at some breakout remount plays that are setting up.

TSLA is basing just under the 50 dma. I am watching for a close above this level.

SHAK broke out and stalled at the 50 dma. It is now pulling back, digesting the breakout. Again we stalk for a close above this level.

SGEN has already broke above the 50 dma. We now watch to see if it holds this level and will look for a good entry point.

Skilled swing traders have a toolbox full of different setups they trade in different markets. The skill is not knowing the setup, but how to trade it and when to pull it out of the chest. The current market is an excellent one for monitoring breakout-remounts. Master this setup for explosive gains.

Watch this EPIC WEBINAR where Kunal and I discuss trading in volatile markets and much, much more.

My focus list is, market analysis and trade alerts are all featured in the Market Speculator Part-Time Swing Trade Report. If you would like to receive the swing trade report and alerts, sign up for the free trial. Follow me on twitter or email me at SinghJD1@aol.com