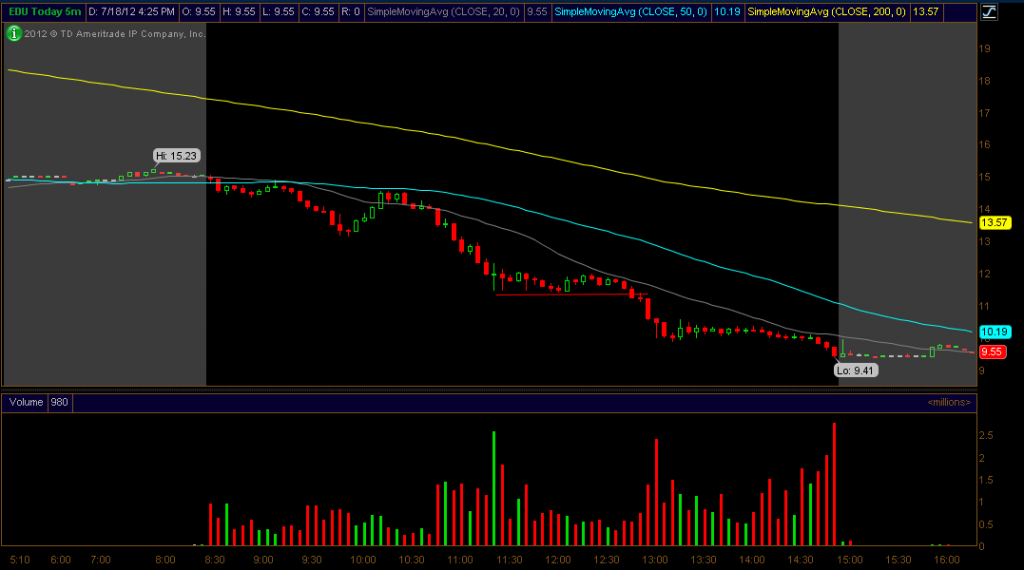

The majority of the time, your biggest percentage gains come from daily charts. However, when you get a stock with major momentum and news behind it, you can hit huge winners on the stock trading off the intraday chart. Our good friends over at Muddy Waters put out a hit piece on $EDU today (7/18/12), causing the stock to tank. The stock fell pretty hard after the release of the article so it was tough to chase it. What you should do instead of chasing is wait for an intraday setup on the chart and then hammer it. When looking at $EDU, I saw multiple taps of that $11.4 area. Remember, the more times a stock taps an area of support, the more powerful the breakdown will be. $EDU tapped $11.4 nearly five times before snapping it. The break of that level caused more panic in the stock and it closed at $9.5.

$VVUS had the same look intraday, with multiple taps at that $28.8 area. So if that had snapped, it would have been a similar story. We didn’t take the trade on this one, but it’s a good chart to look at and see where the breakdown would have occurred had it broken.

I can teach you all about intraday shorting (and a lot of other setups and techniques!) – email me at maribeth@bullson.ws