I put together a list of my favorite trading rules. I actually have these on sticky notes on my computer now to remind me! It sounds stupid, but it helps! Email me at maribeth@bullson.ws if you’re interested in learning to trade or trying out the Bulls chat room

1. The number one mistake that new traders make is adding to losing positions. Sure, doing this will bring the cost of your trade down and give you a better average cost, but is it a good idea? Or are you just adding a larger figure to your losing trade? In my opinion, it’s the latter, and is something that you want to avoid. If you are in the Bulls chat room you probably have noticed that we rarely average down on a stock; if we double up or add to a position its always when we are already ahead on that stock. The reasoning is simple: if the stock is going against you already to make you think it’s a good idea to average down then it’s probably a busted play anyways! The only time its ever a good idea to average down on a stock is if you are swing trading and have a plan mapped out. If you are day trading, then there is no logical reason why you should average down on a losing position.

2. Scale out of winning positions with a stop at the buy price on the rest. Kunal taught me this and it’s a great rule to follow – it prevents you giving back full profits on a stock that you are up on. Obviously, there are certain markets where it’s better to trade fast and just sell your whole position, but for the most part, when the market is good, this is your best game plan. You maximize your results that way.

3. Never double dip in a stock that you made money on in the same day unless you have a logical reason. I see this happen all the time and I used to do it all the time. It’s an emotional trade. You enter a stock, you sell it for a nice gain, and it keeps going up…so you buy back in and get a terrible price only to watch it fall back on your head. Avoid!

4. Never hold through earnings or FDA decisions – it’s a total gamble. You might as well put your money on black or red.

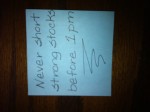

5. Never short strong stocks before the afternoon session. This is a personal rule but one that I love. Stocks with news/pr/earnings behind them can run huge in a day, especially if they are low float. So never think that there is no way a stock can go any higher, because I promise you it can! Just look at $SUPN, $ROSG, and $HEAT from the past. I’ve often found that these guys will run up huge in the mornings and finally breakdown late day. Wait for that setup before you short them; it will save you a lot of money!

6. Never trade out of boredom. You must have a setup and plan.

7. Cut losses fast. Small losses are OK!