The market has begun to rollover. While I dislike trading a market that has topped out and is floundering, when it finally flips there are a few powerful counter-trend trading strategies you can utilize. I’ve made several notable trades over the last few days, including $WLL, which I covered Tuesday. Today, I’ll be talking about a trade in the gold ETF $NUGT, which I made $4k on.

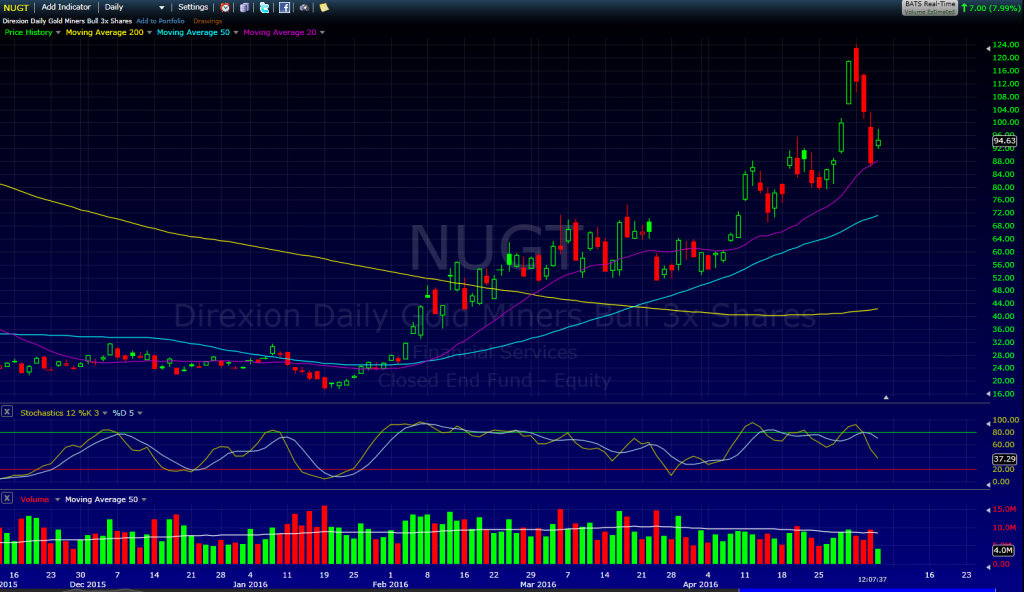

As with $WLL, $NUGT skyrocketed in a short period of time. Like a rubber band, a stock (or $ETF) can only be stretched so far, so fast before it snaps back. Running from $20 to $120 in four months definitely counts.

Another important component of this type of rubberband snapback trade, though, is that it went parabolic at the end – a 50% increase in just a few days. That kind of spike is unsustainable and even the strongest of stocks usually retrace part or all of that move.

Once I saw that setup on the daily chart, I began watching the intraday action. Monday provided just what I was looking for, as it gapped up, spiked, and then failed. A gap up on day one or sometimes day two of a run are bullish, but after so many days up, they become very bearish. This is exhaustion gap and must be faded. This is one of my favorite day trading techniques

We shorted in the $120s and covered down into the flush. As the day went on, we continued to reshort as it broke over the VWAP and then back under again. This is called a “remount,” and is a great strategy for getting additional plays out of downtrending stock.

I put together a quick video to walk you through the details of these trading strategies and how I used them with $NUGT.

[screencast url=”http://screencast.com/t/MJERl6FfJ” width=”” height=””]

Don’t forget, I’m holding an educational webinar next week with Paul Singh – check it out!

If anyone wants to learn more about our trading classes feel free to email me kunal@bullson.ws anytime! Our 60 day bootcamp starts in a couple weeks. This class will take a student from A to Z on day trading strategies and swing trading.