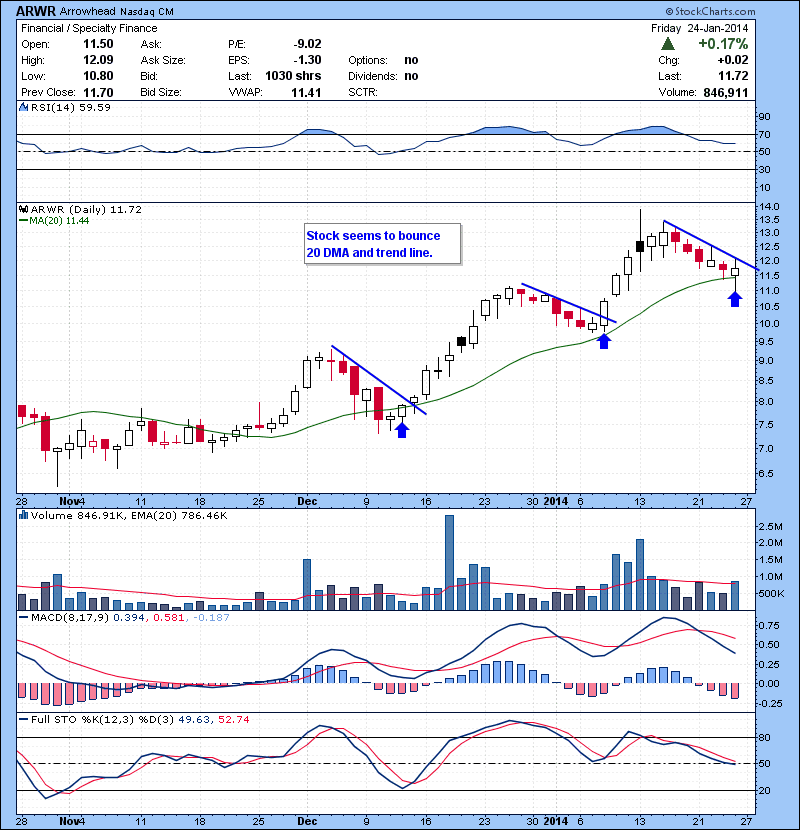

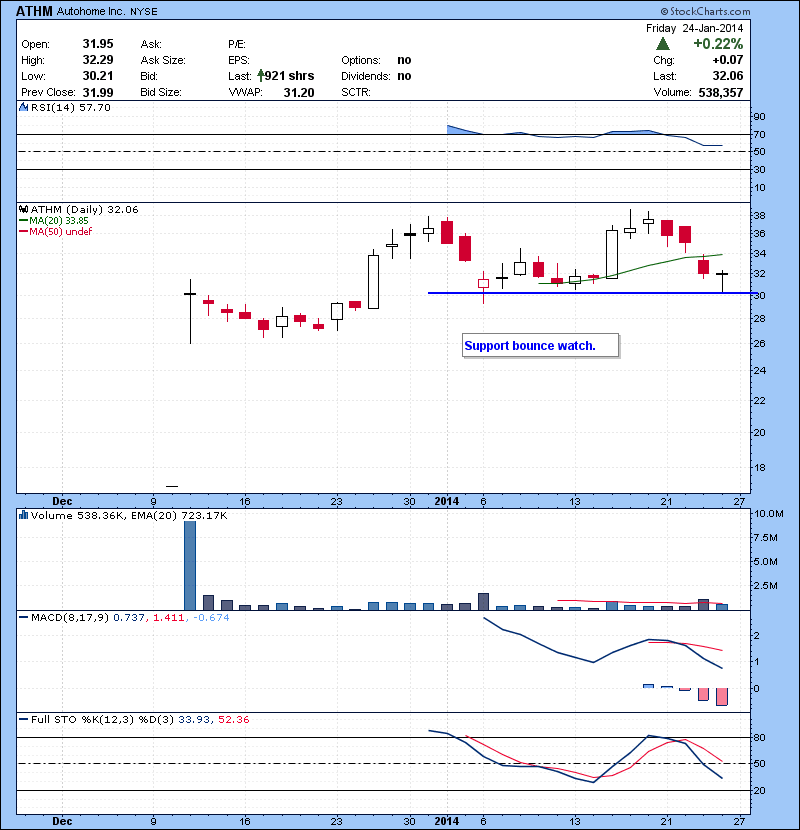

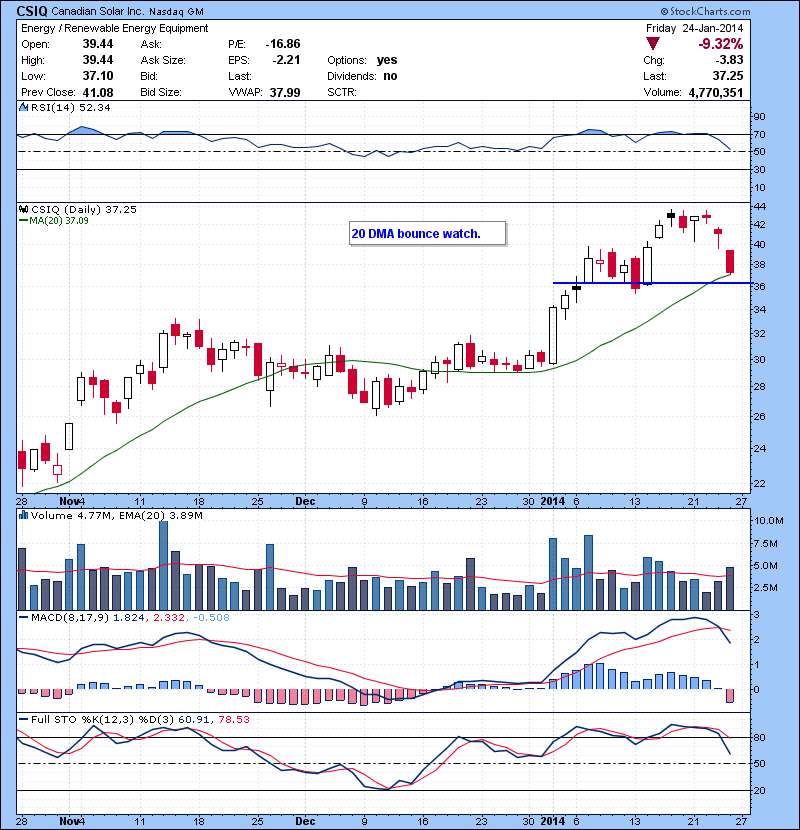

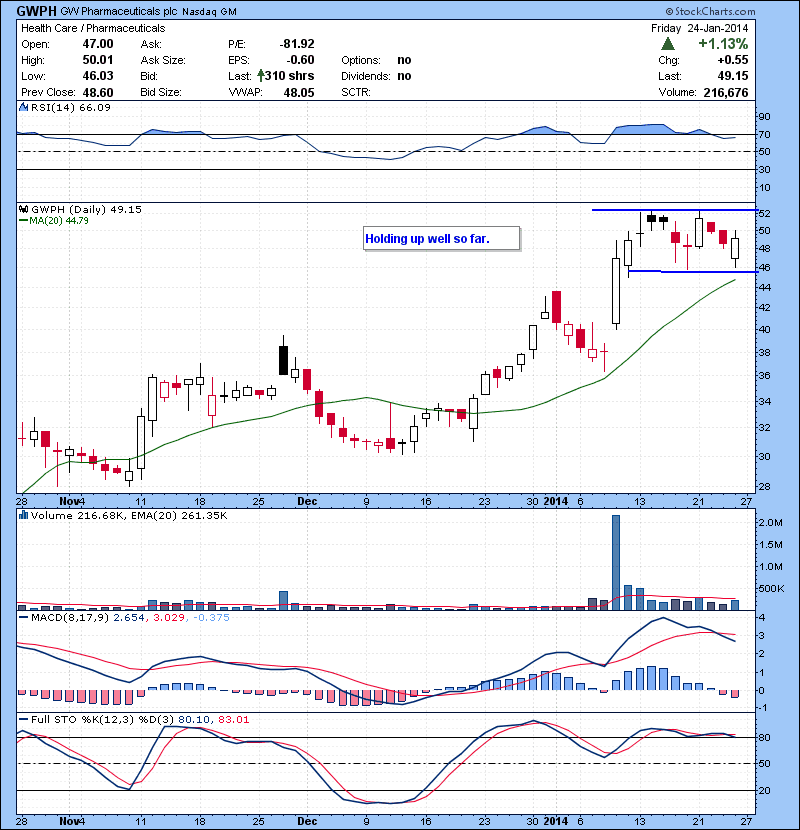

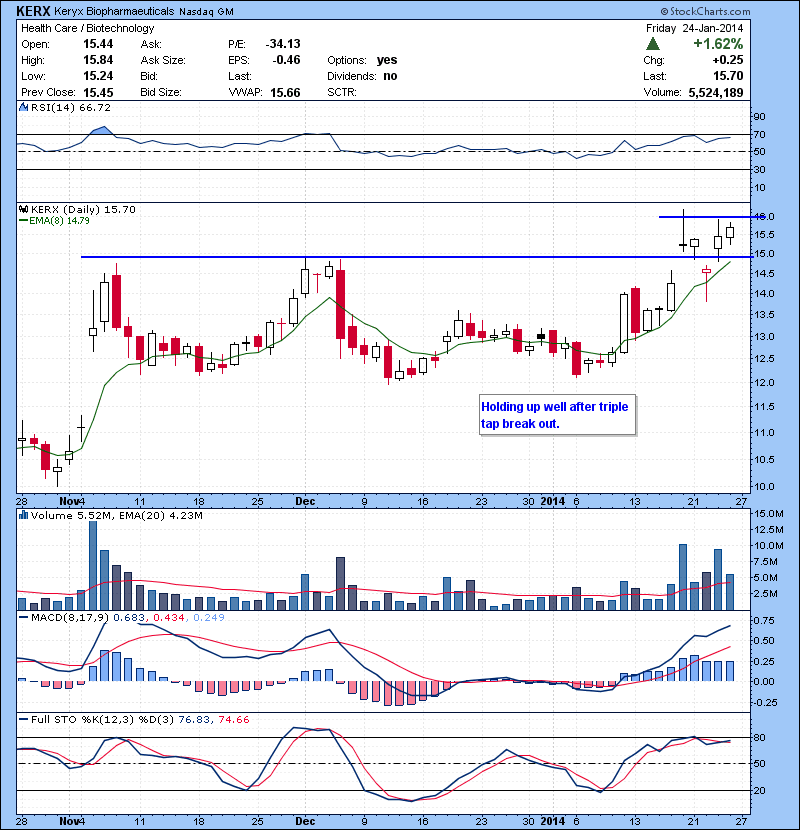

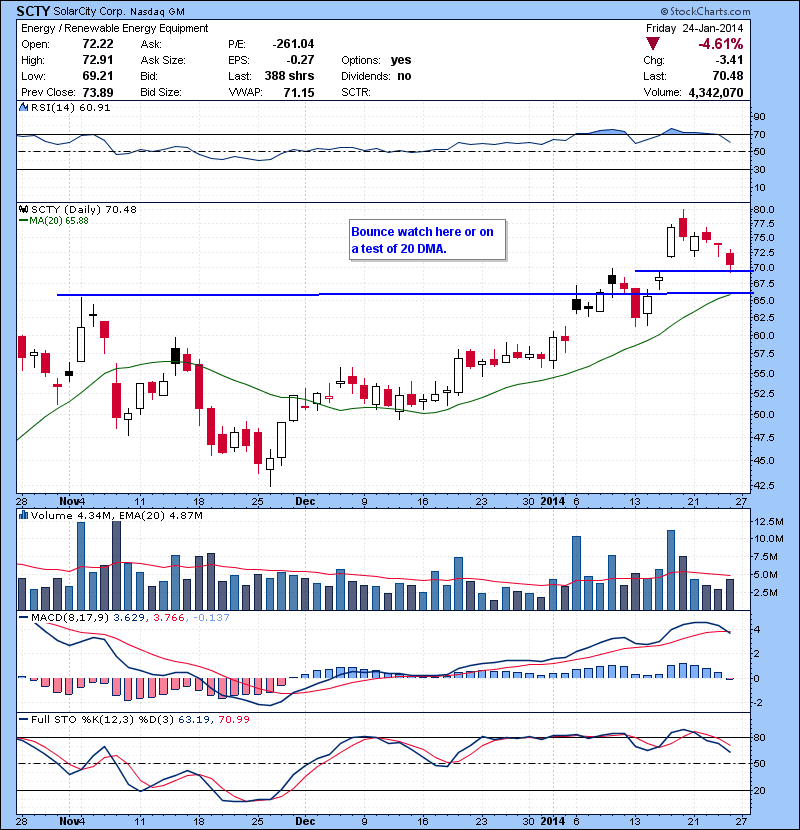

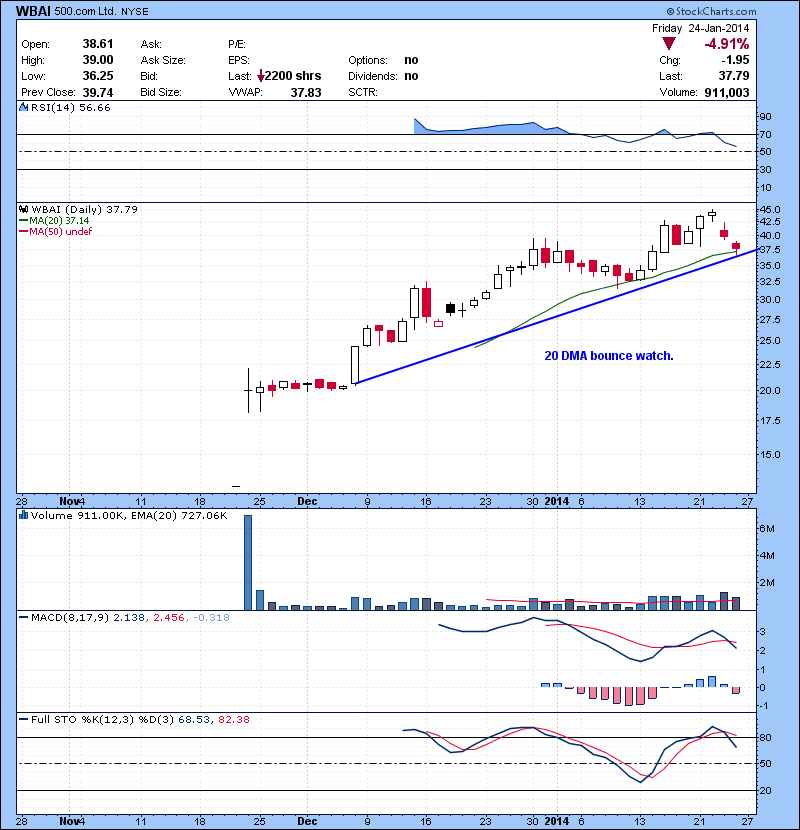

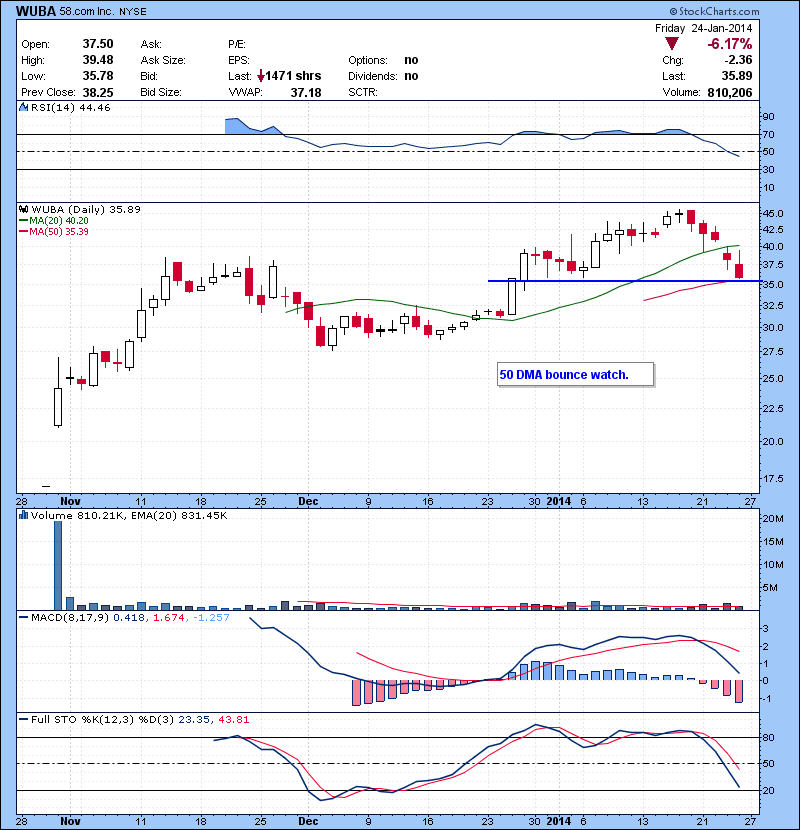

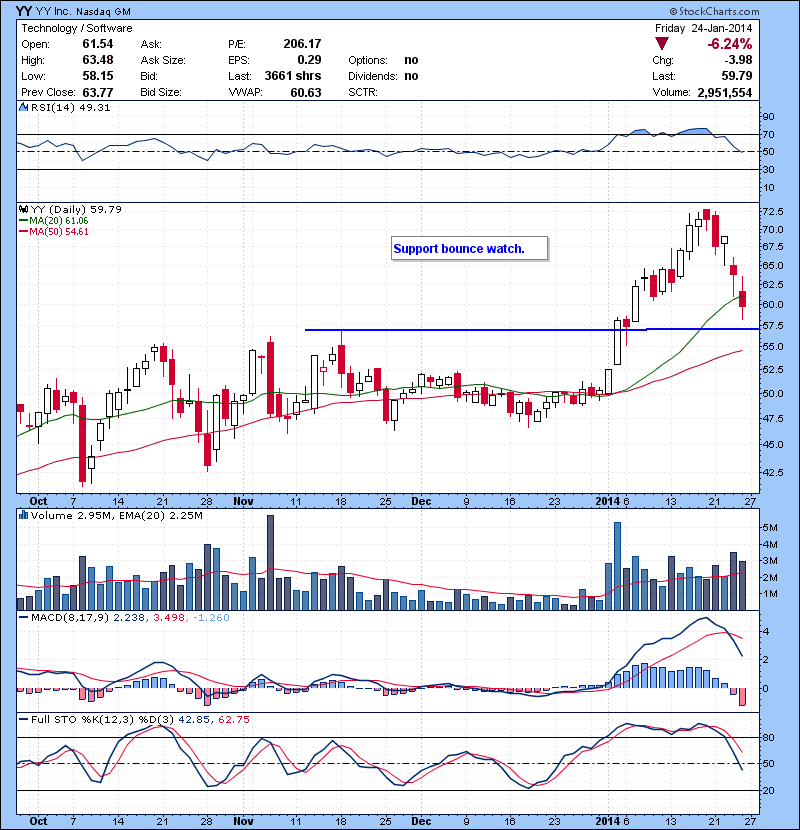

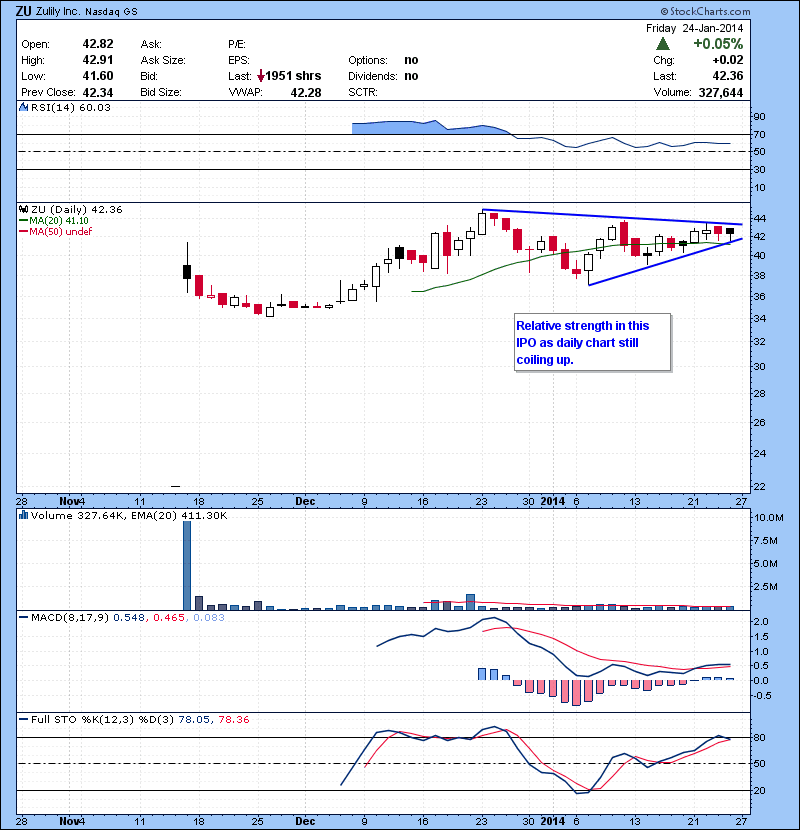

Big sell off in Market as all the indices moved through Bollinger Band on Friday. After this sell off i wouldn’t be surprised to see maybe a small gap up on Monday due to short term over sold charts. Ideally if we open red on Monday ,there might be a good chance Bulls will try to work on a bounce ay some point. Watch list contains mostly support buy and some stocks that are are still holding up relatively well. At Bulls, we try to ride momentum both ways whether via long or when momentum leaves we will ride the short wagon. Our goal is to train traders to keep their losses small and squeeze out as much as they can from the gains. Trading great risk to reward setups is key and that is exactly what you will learn if you come try us out. Kunal is on video all week all day giving out the alerts live and teaching while he does. We are offering a two week free trial for any new prospective members.Email me thenyctrader@gmail.com

Follow me on Twitter and StockTwits @szaman