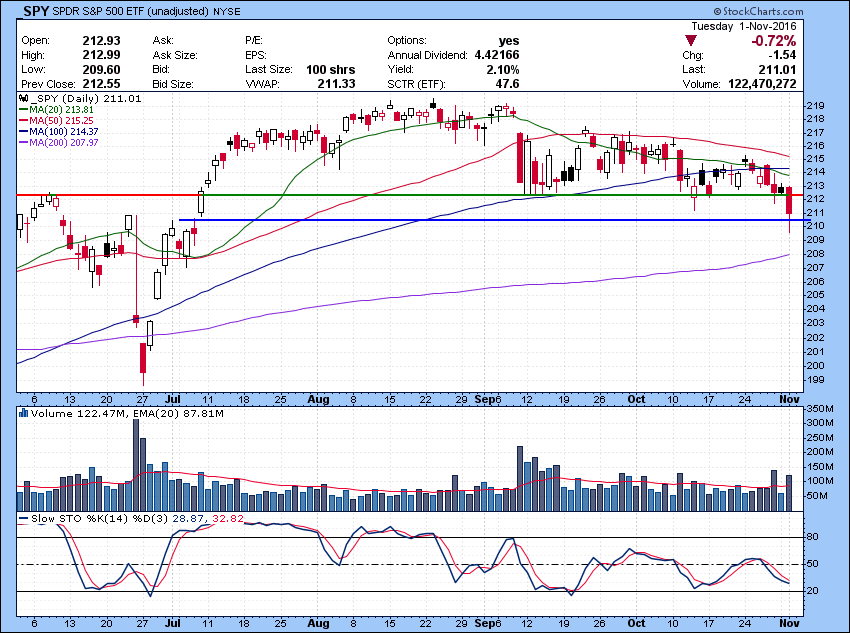

Ugly day for the Market as SPY finally caught up with “worrisome signs” that I have wrote about.As i wrote on a earlier post “small cap IWM chart broke down Thursday,that itself a major technical break down that might lead other indices to follow” and here we are.

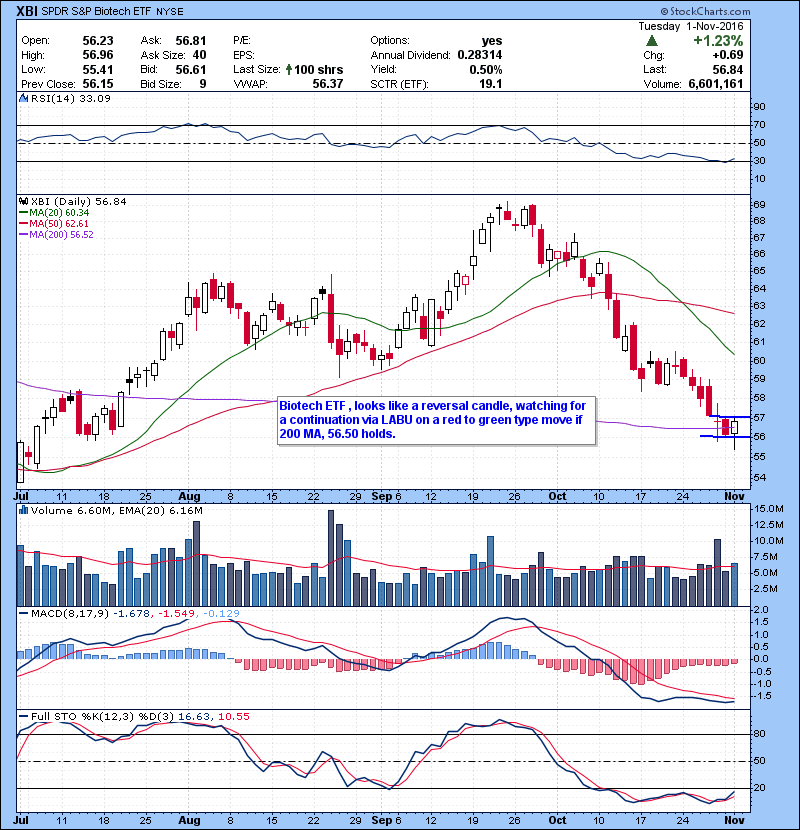

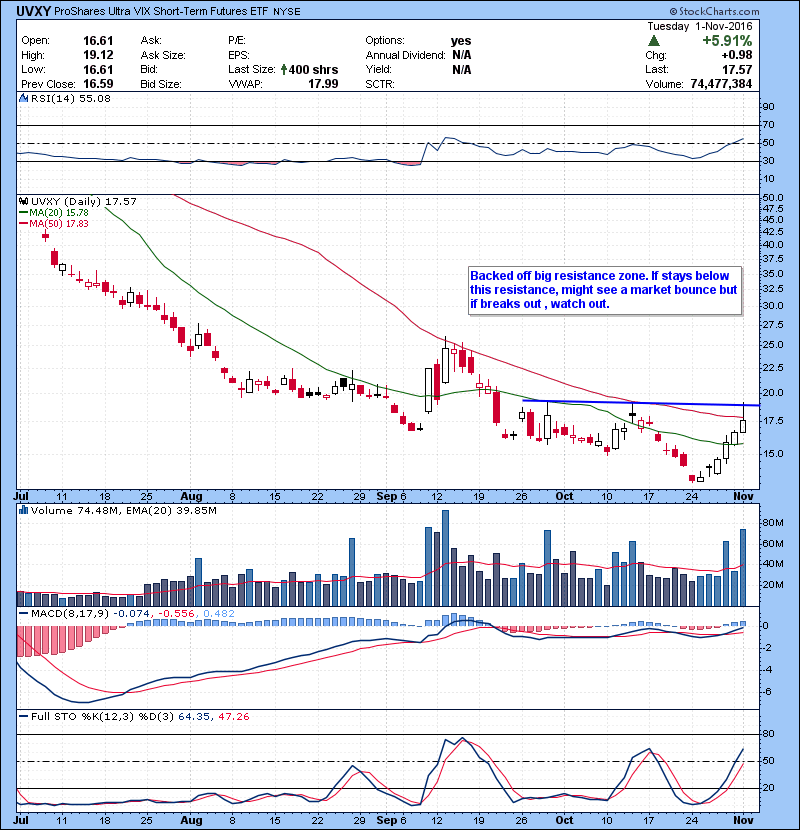

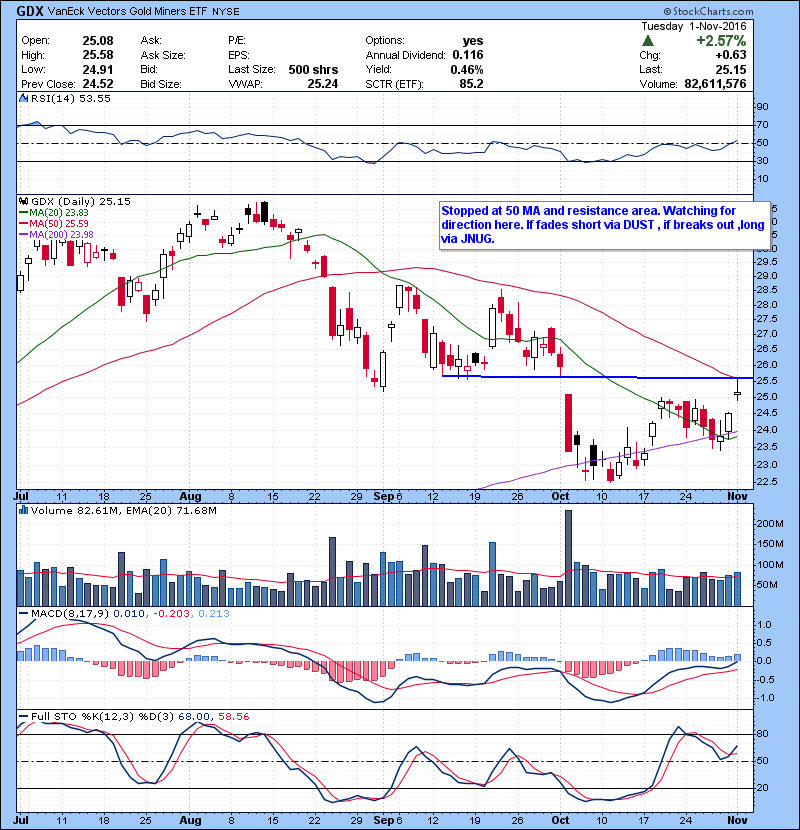

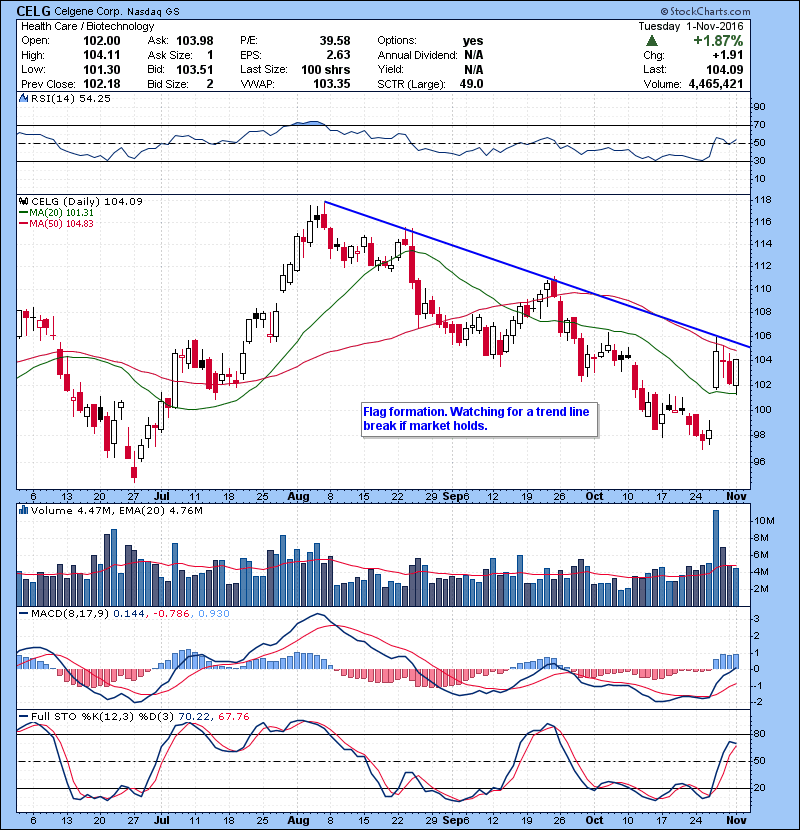

Even though a late bounce, made SPY closed off the low but it is still below the recent trading range. Market most likely pricing in a chance of Trump win, we also saw a nice bounce on biotech XBI and it actually closed green for a change. Clinton hasn’t been a fan biotech names. That also support chance of Trump win theory. SPY no clear support until 200 MA. However, market is quiet oversold so we could also see a bounce attempt back into the range. We are mostly sticking with trading ETF’s names. They trade much better on volatile market than individual stocks. So watch list contains bunch of ETF’s.Check out our trading courses. starting again thismonth. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of

@kunal00 while he trades live everyday.