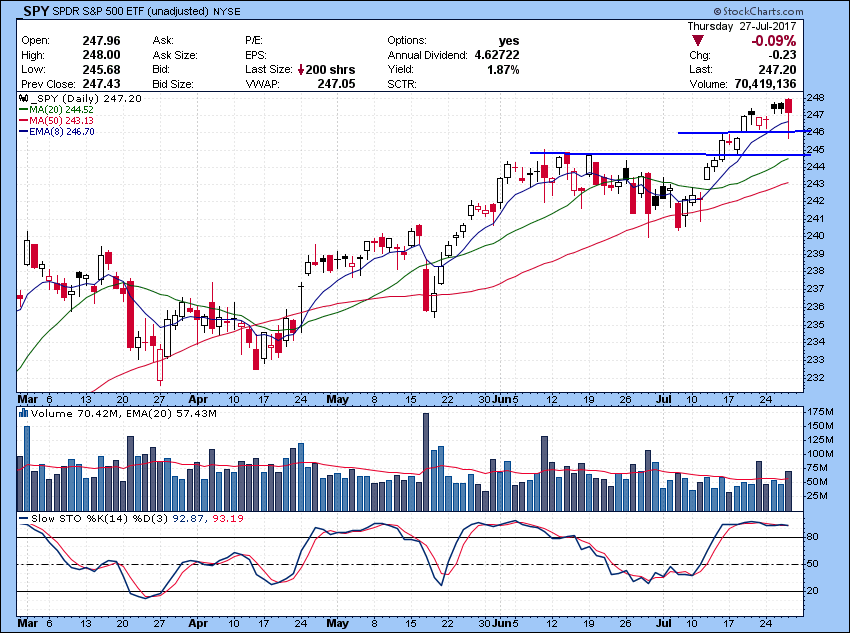

SPY closed flat off the support level but there were some drama during the day.

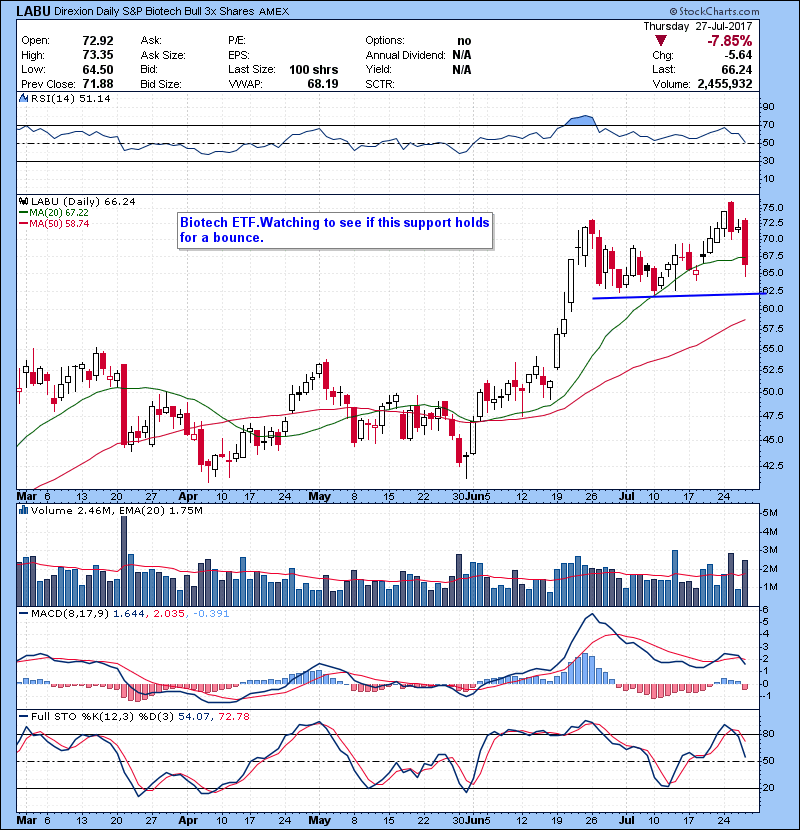

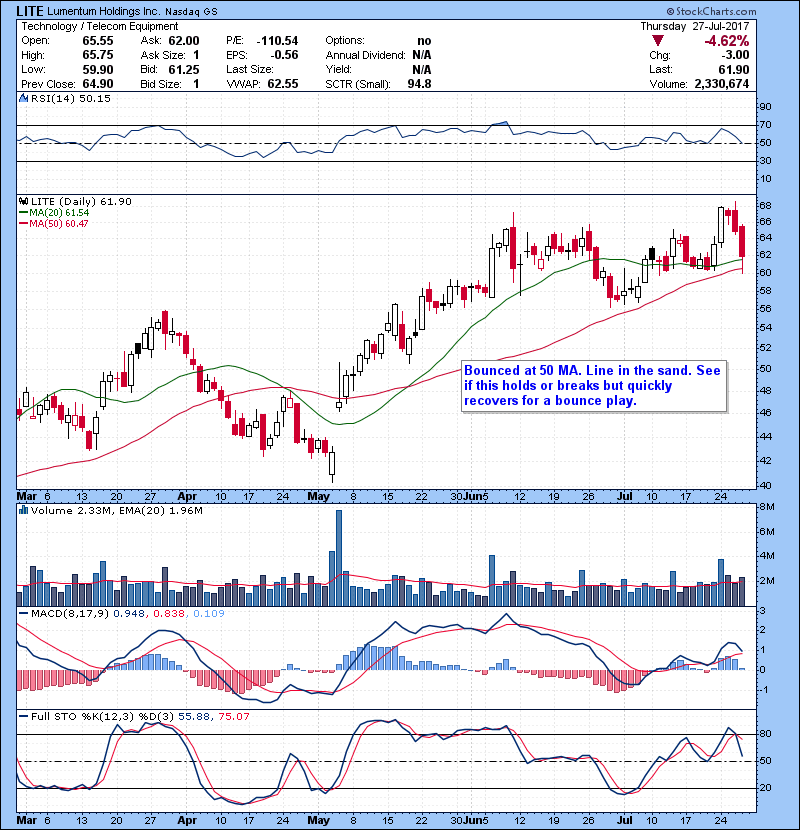

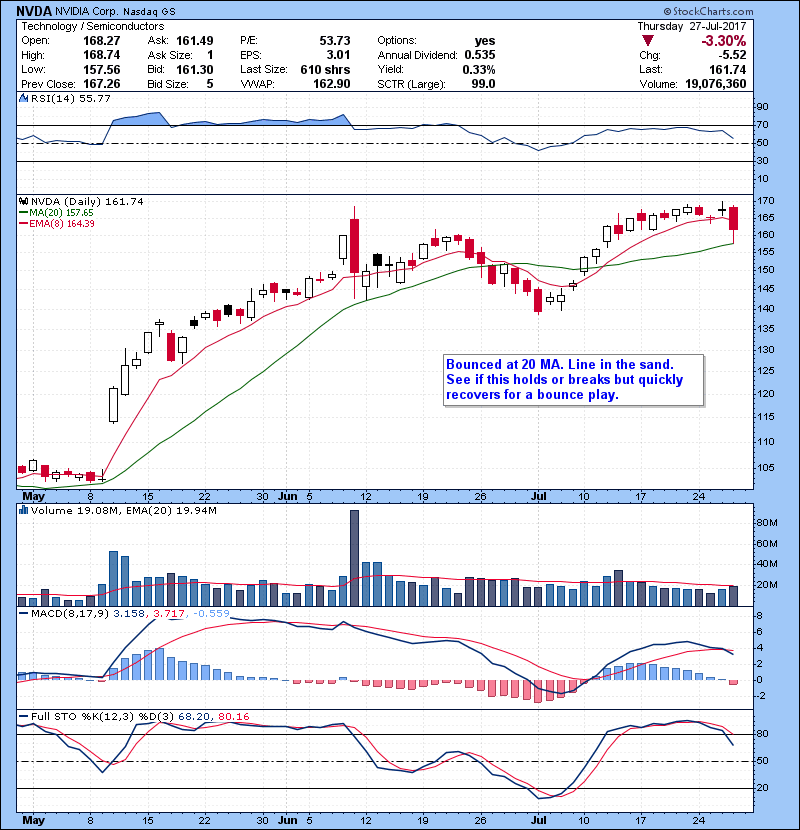

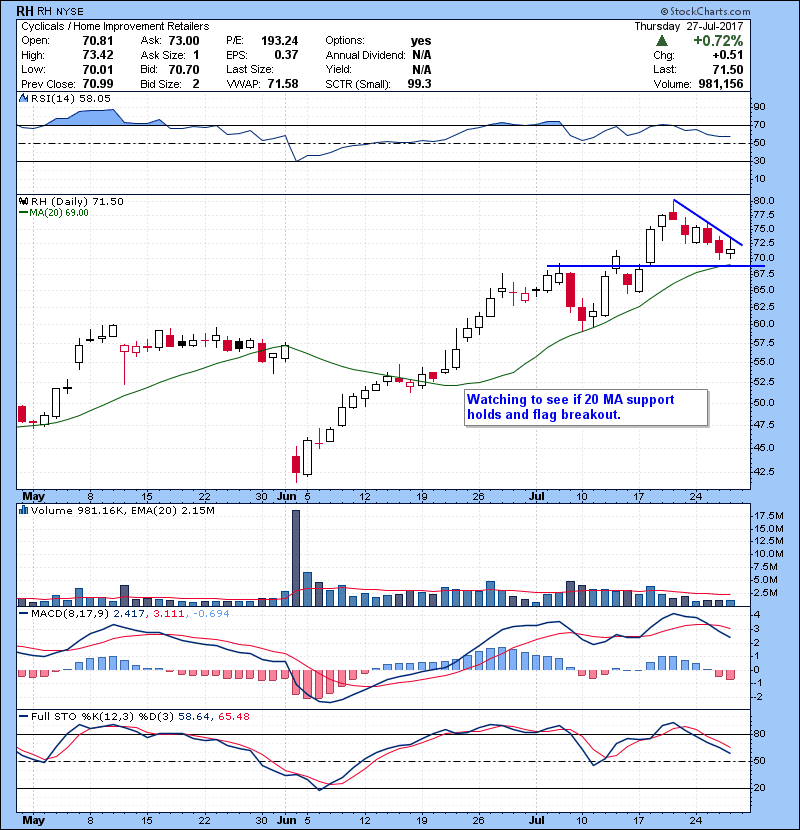

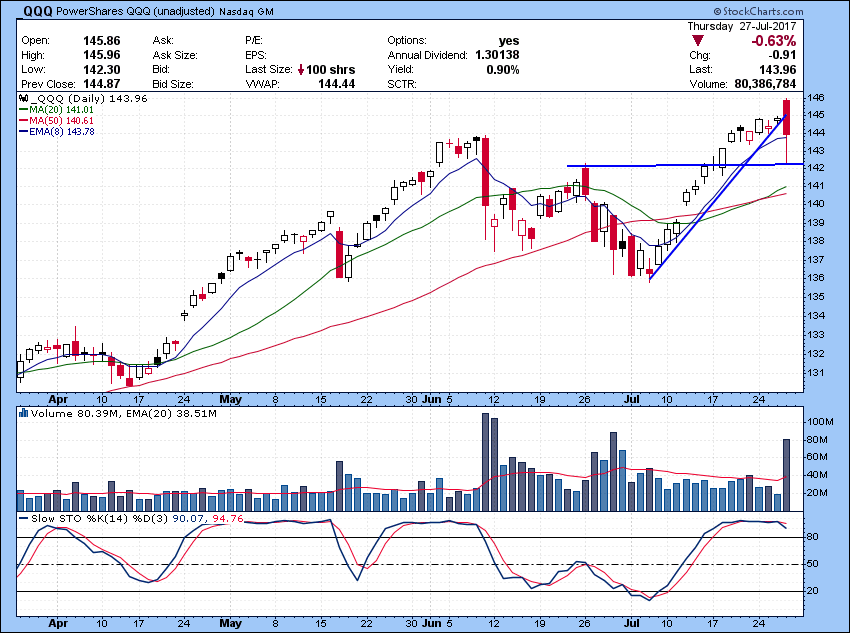

After days of grinding action we finally saw some volatility in Nasdaq. Quiet common in extended market as we have seen this type of move before. Buyers came back at support.

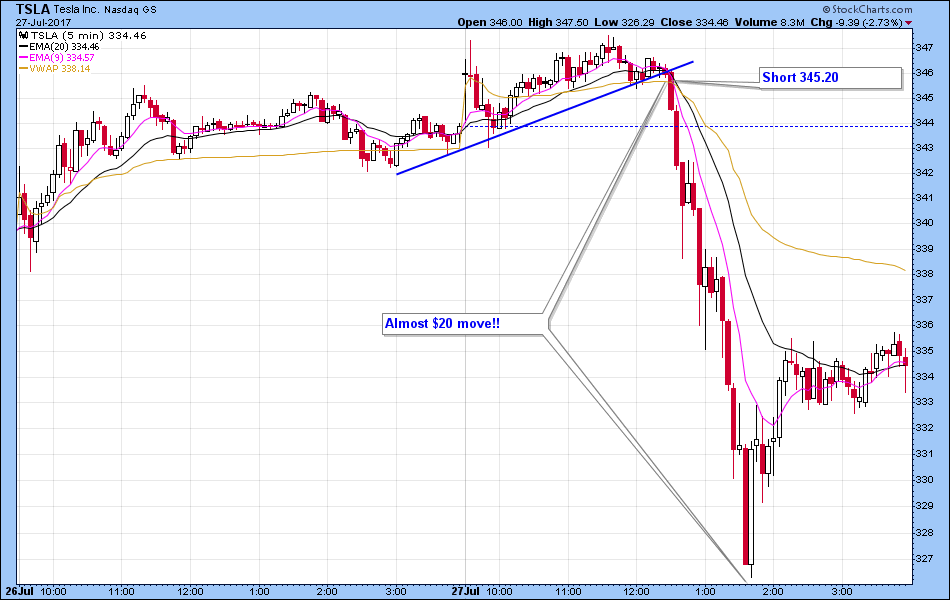

As active traders volatility is out friend for some short term trading action. Check out our TSLA short trade. We shorted this while market was fading hard and TSLA was still holding up. As soon it broke intraday trend line we shorted at 345.20. Idea was even though it was holding up, it won’t for long given how everything else flushed. It went down $20 fast, giving us a sweet short trade.

Price support still holding in indices. If breaks, 20 MA next. See where we go from here. Market/stocks could sure use some basing action to gain energy to push higher.

If you are struggling with your trading or learn how to trade you need to check out our trading courses. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room Check them out here.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of

@kunal00 while he trades live everyday.