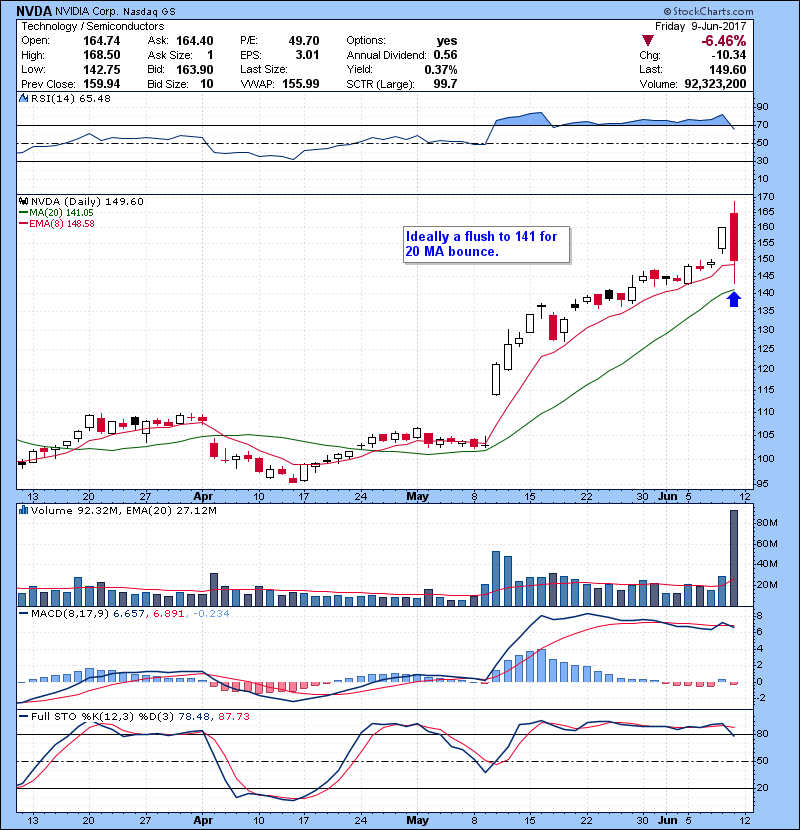

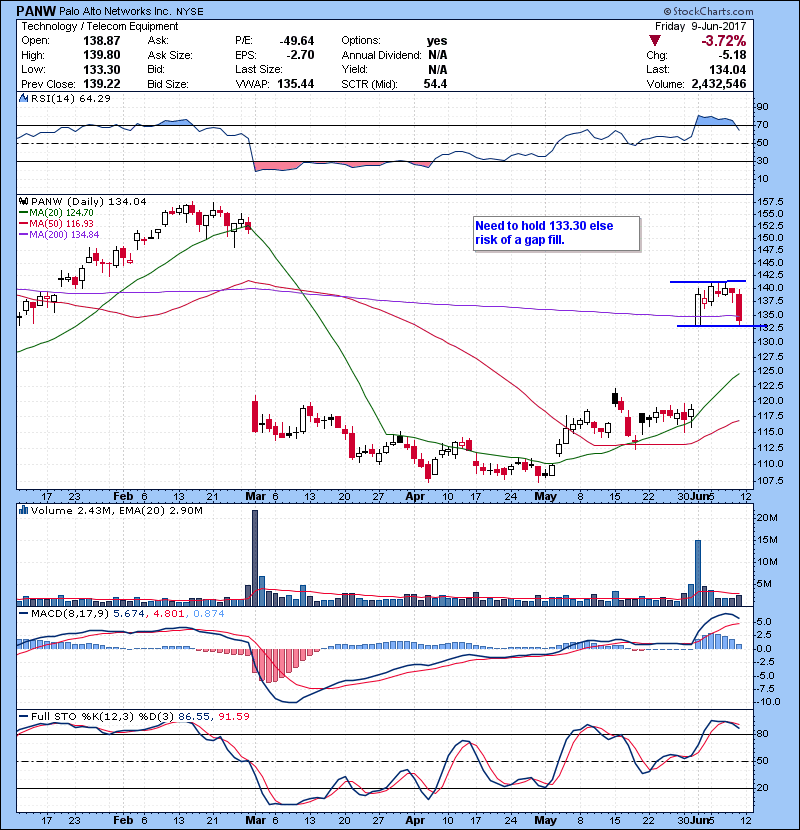

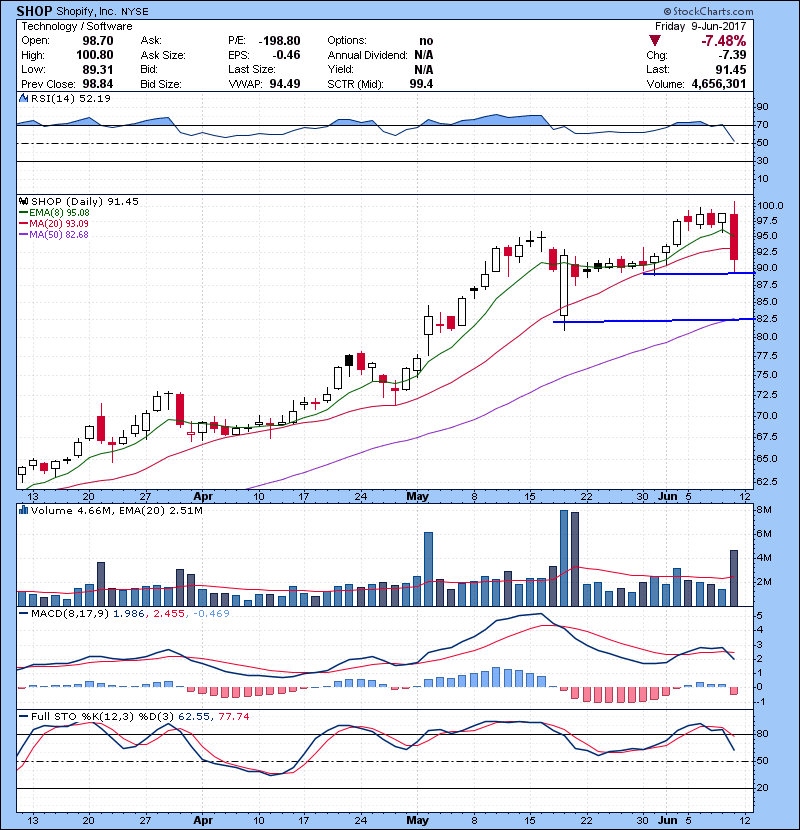

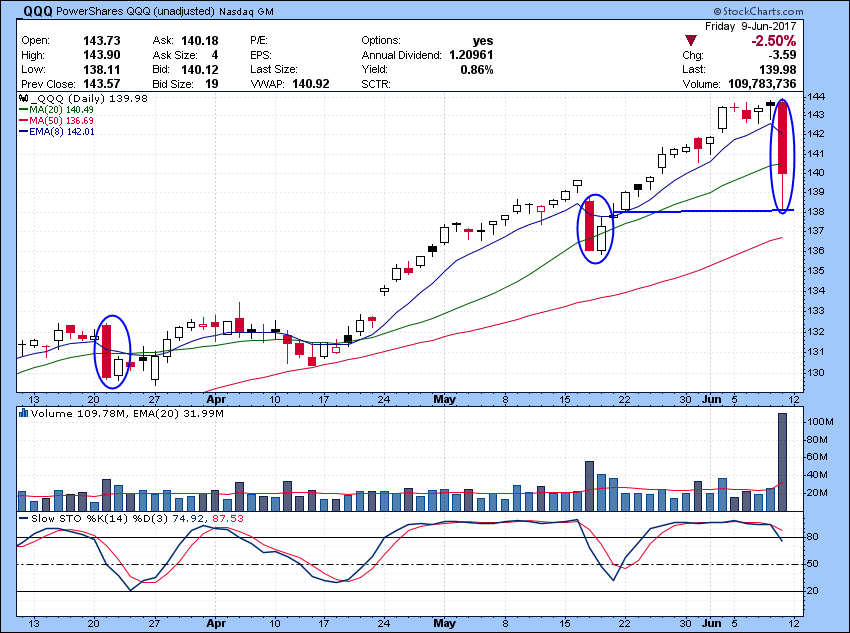

Flattish day for the SPY at close but the big story on Friday was the massive volume flush down on everyone’s favorite leader stocks, tech names! Nasdaq closed down 2.5 % with volume.

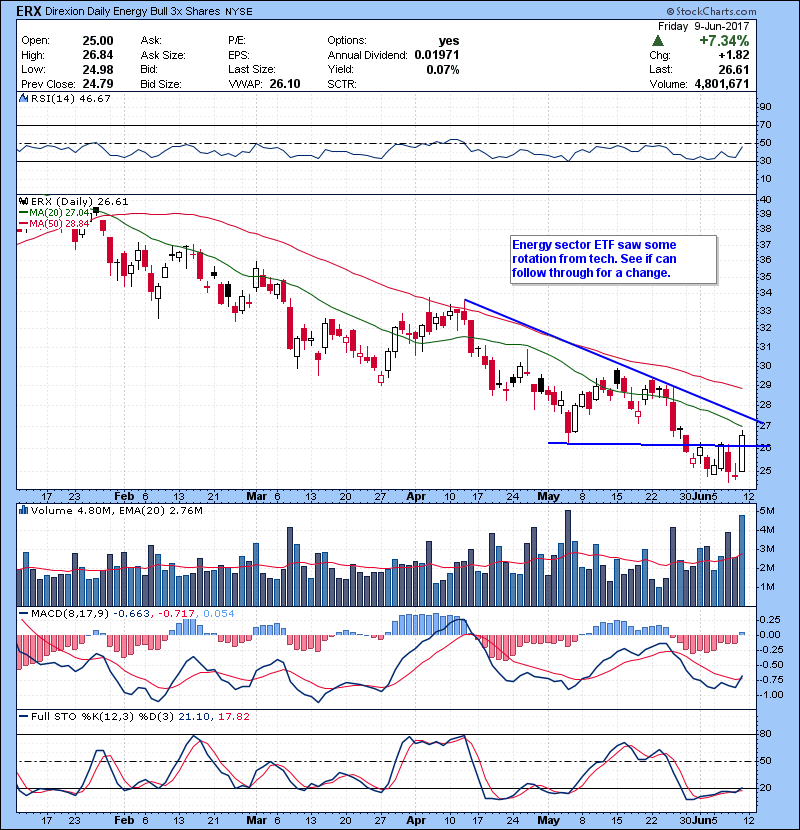

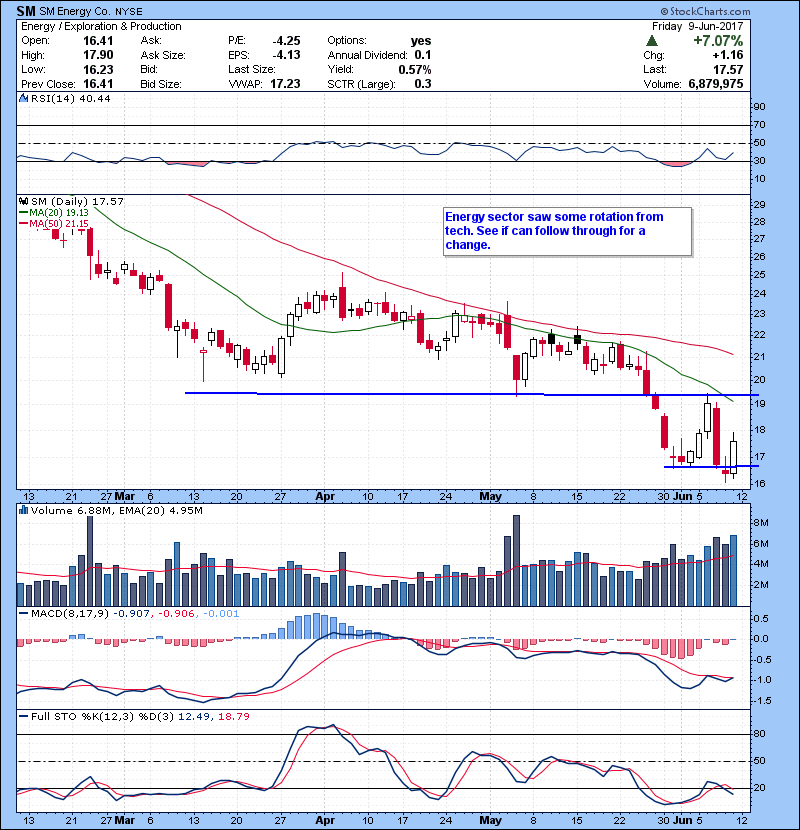

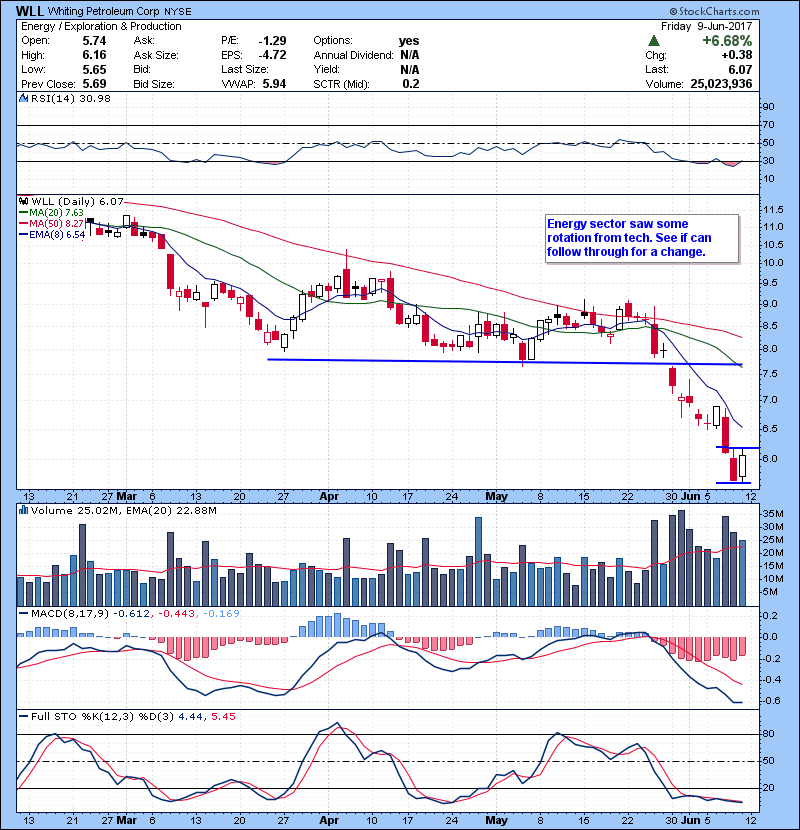

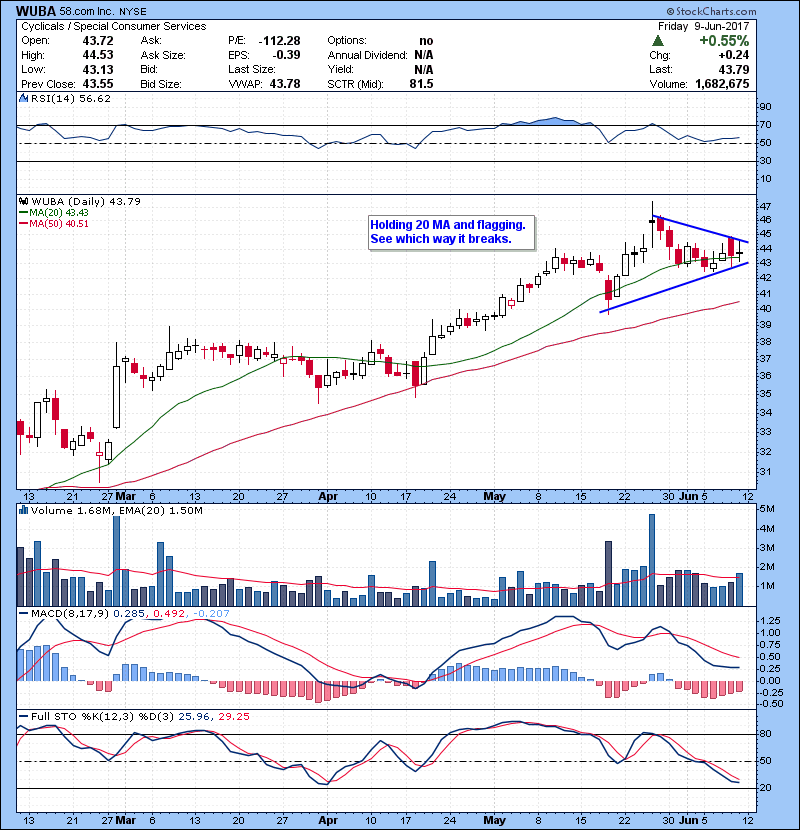

Market was climbing wall of worries even on negative news flows. The sell off in tech came without news while money rotate into small caps , some energy and financial names. So , simple explanation for this is sell off, sector rotation, alogo’s, profit taking, late buyers “get me out of this pain”. All feed into each other, causing violent movement. What’s next for tech ? Will this be just one day sell off like back in March and May or start of something significant/possible top in tech? We don’t know that, we have wait till next week to see if there is any follow through or bounce. One positive thing we saw was money stayed in the market and rotated into other sectors like laggard small caps.

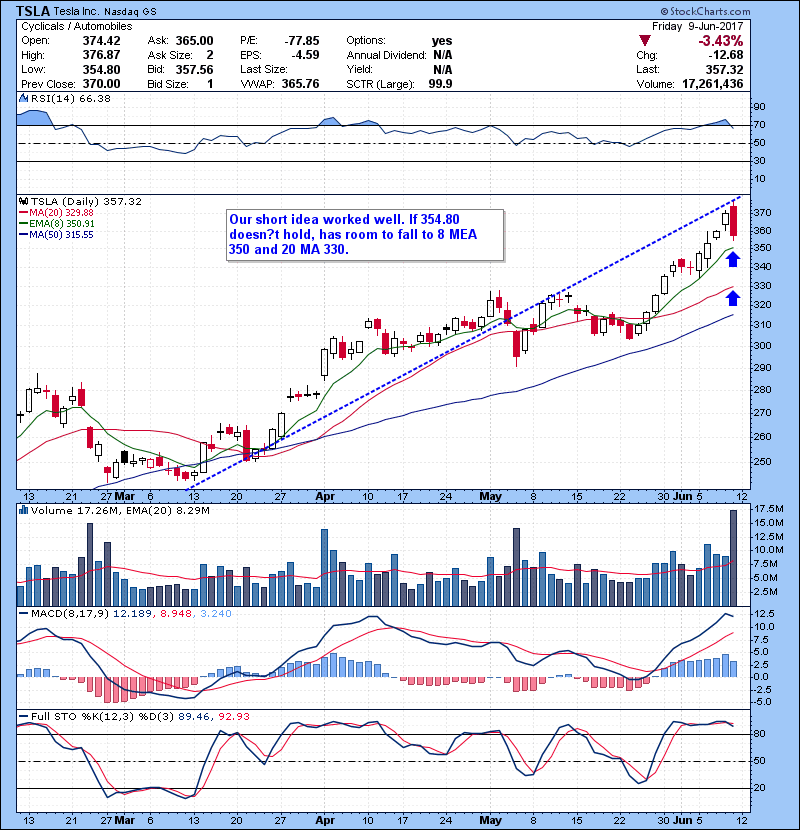

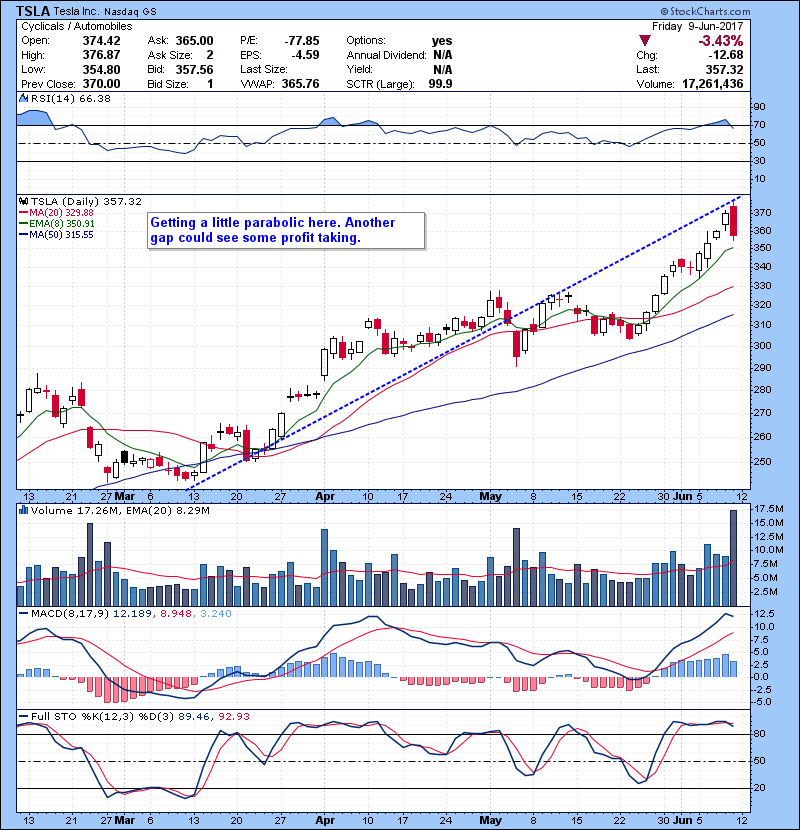

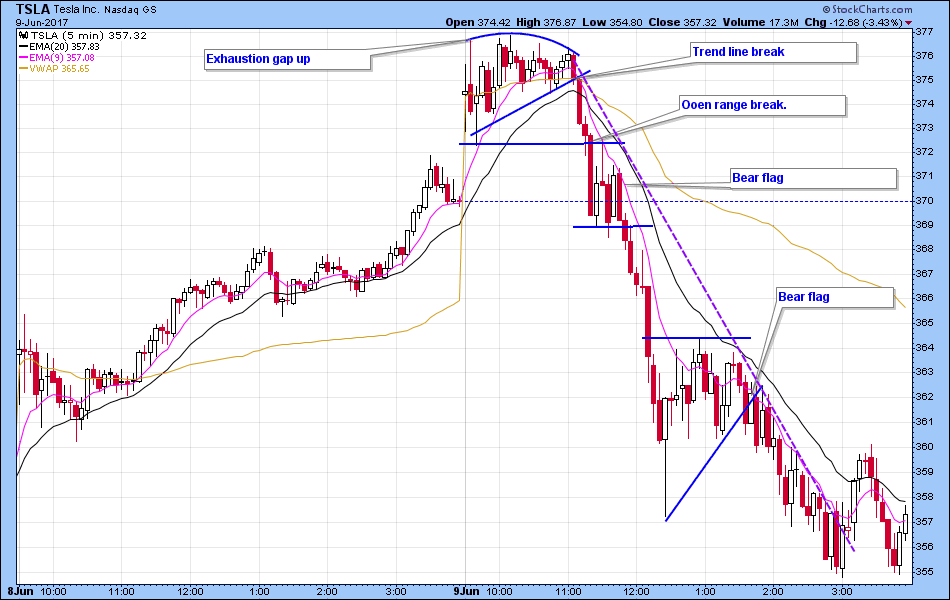

Biggest mover and trades from watch list was TSLA short idea. We were short this in chat room and covered last of our shares for $19 gains!

TSLA opened right at our price resistance level. We added short at 374.50 with $2 or so stop. Rest was pretty easy as it trended down all day along with other tech. names.

If you are struggling with your trading or learn how to trade you need to check out our trading courses. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room Check them out here.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of

@kunal00 while he trades live everyday.