I receive a lot of questions about how and where to scan for stocks, so I decided I’d review one of my favorite scanning websites – Finviz.com.

Cost

As a new trader, keeping your expenses down is important: commissions, subscription services, taxes and software will all cut into your net profits. Several of those items, like commissions and taxes, are unavoidable. One of the best things that Finviz has going for it is cost – it’s free! While they offer a paid subscription (Finviz Elite), you can find most of the functionality you need as a new trader with the free version. Once you’ve become consistently profitable for several months, you can consider a more robust scanning program like TC2000, but until then keep your overhead low!

Ease of Use

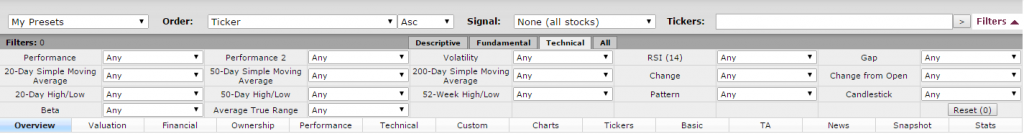

Finviz is incredibly easy to navigate. You don’t need to know any proprietary scanning language or even be particularly well versed in financial industry lingo to use it effectively. Most of the options you will want to use are simple dropdown menus. For example, if you want to only see stocks that are up at least 5% today, riding above their 20 SMA, and have average volume of at least 500,000, that’s three easy clicks.

Scanning Settings

While it doesn’t have the level of customization available in a tool like TC2000, Finviz provides most of what you will need: price, price change, average daily volume, relative volume, sector, float short, etc. You can even save your settings for later, so you don’t have to reenter them every time you visit the site. The only significant difference between the options with a tool like Finviz and a subscription-based tool like TC2000 is that you select from a handful of values for each setting. For example, if you want to scan for stocks that are up a certain percentage today, your choices are +5%, +10% and +15%. You are unable to enter a custom value like you can in some other stock scanning tools. That said, I don’t think this is particularly important for the type of scanning we do.

Data Presentation

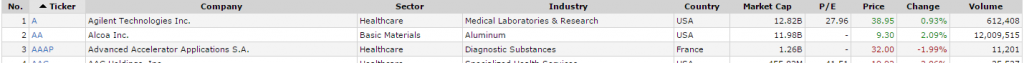

This is an area where Finviz really shines as a trading tool. They provide a host of options for presenting your scan results. I’ve found this incredibly helpful. Sometimes, I just want to breeze through a list quickly and look for names I recognize. Other times, I want to see charts, so I can look at the patterns.

Even within the returns, there are additional sorting options. For example, I can sort the results in ascending or descending order of their volume, price, change today, etc.

Data Feed

One area in which Finviz is limited is speed. While you can very quickly and easily enter a scan (or load a saved one) and get your results, the actual market data lags (in the free version). That makes Finviz suitable for weekly and nightly scanning, and even some intraday scanning once things have slowed down a bit, but it’s not the best tool for finding hot stocks in the first hour of trading.

Review Summary

Finviz is a powerful, easy-to-use scanning tool that should be in every new trader’s stock scanning toolbox. Once you begin consistently winning as a trader, then it might be time to look at other options which offer additional customization and real time data. Even then, if you are primarily swing trading, rather than day trading, you could probably continue to solely use Finviz for your scanning needs.