We have had a killer summer so far in the bulls room, making consistent money every month. We have a handful of go to setups that we play each and every day and this is how we make our money day in and day out. If you are going to become a successful trader you have to figure out a method that works for you and do that repeatedly every day with no emotions behind it. You can learn our strategies from A to Z in Kunal’s bootcamp class that is designed to teach you how to be consistently profitable no matter what the market is doing. One of those signature plays that you learn in the bootcamp course and that you will see us playing over and over again is the “red to green” play. This setup is a very quick and very easy way to make huge percentage gains in just a few minutes. Be sure and email me mb.willoughby@gmail.com with questions or if you want to join the bootcamp July 9th!

You want to wait and let this setup confirm before you enter. The characteristics of a red to green move are:

1. Major momentum stock from the day before

2. Morning washout (meaning the stock opens red or goes red fairly quickly when the market opens)

3. buy when the stock moves green for the first time that day

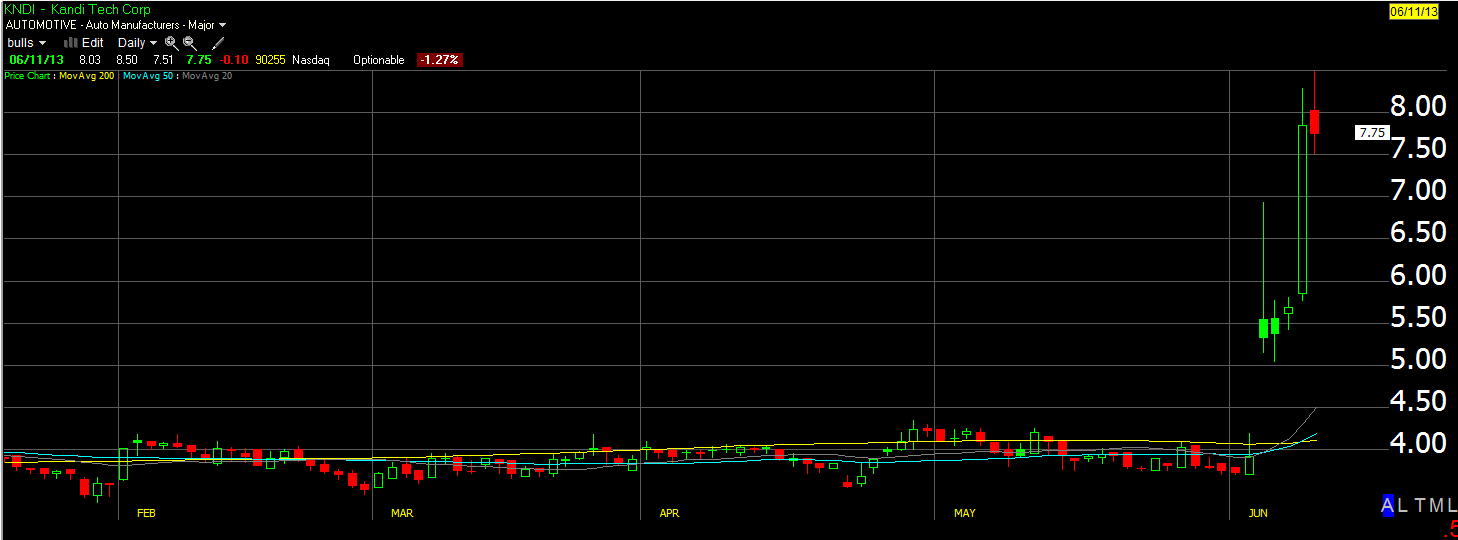

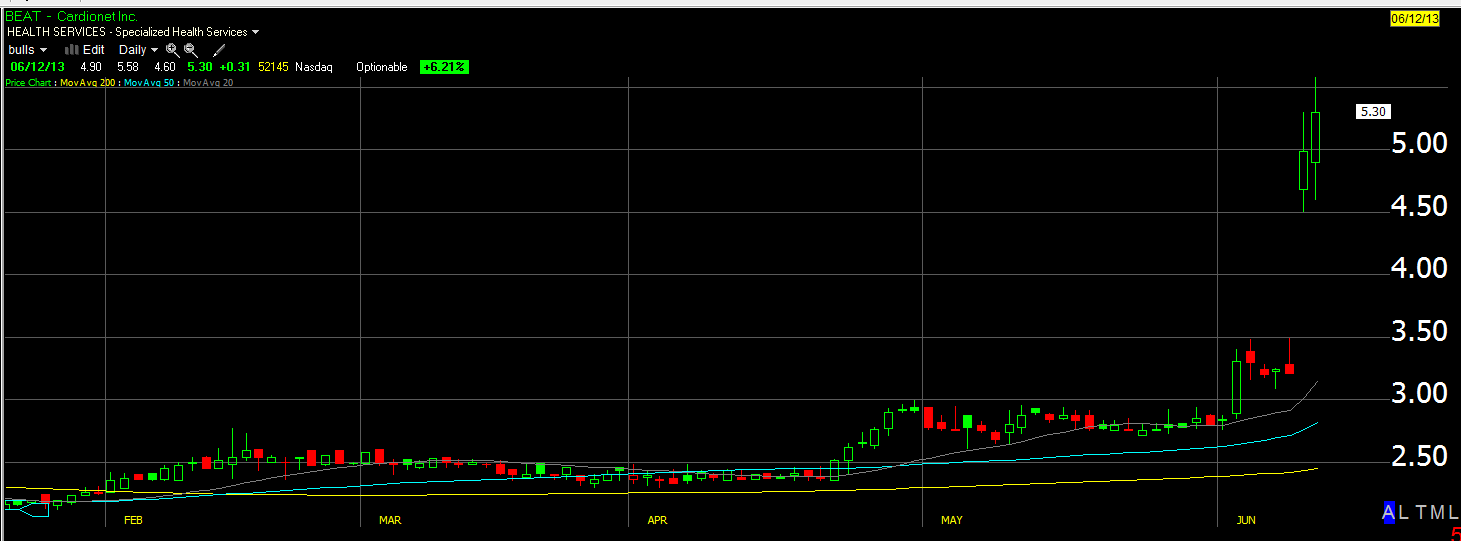

Earnings plays or news related stocks usually make for the best red to green moves. When you see a chart that looks like BEAT or KNDI, a huge pump stock that closed well the night before.. you automatically start thinking red to green move for the next day. Its impossible to hold shares of this stock overnight becuase the stock ran has made a huge one day move! You could possibly wake up to a huge loss the next morning! So instead of doing that, you put the stock on your watchlist and have it ready for trading the next day. The buy on both of these stocks occurred the minute the stock went green.

In this example of KNDI, you can see the stock closed at 7.85, so thats the mark you are eyeing for the red to green move. You get that initial washout in the morning where the stock goes red. The dip then gets bought and you start watching for the stock to approach your mark. As soon as the stock goes green on the day, thats your entry. Remember red to green moves are very fast.. so you immediately begin to scale out as the stock pops.

Here’s the intraday look after the stock popped red to green. Our entry came at 7.86 as the stock was moving red to green.. we quickly sold off shares into the pop at 8.18 for a $640 dollar or 4.07% gain in just a few minutes. These plays can be really powerful.. as you can see the stock ran to $8.5 after the breakout.

The second example of the red to green move that we encountered this past week was BEAT. As you can see, the stock made a huge up move on news, putting it on our radar for a red to green move the next morning. As you can see the stock closed right at at 5.00, so thats the mark we are eyeing for the red to green move. If you take a look at the intraday chart on this stock.. you will notice that the stock opened red on the day the next morning, the dip quickly got bought, and as soon as it broke 5.00 it exploded. We took this trade for 6% or $900 in minutes!