Parabolic Short Trade Setup

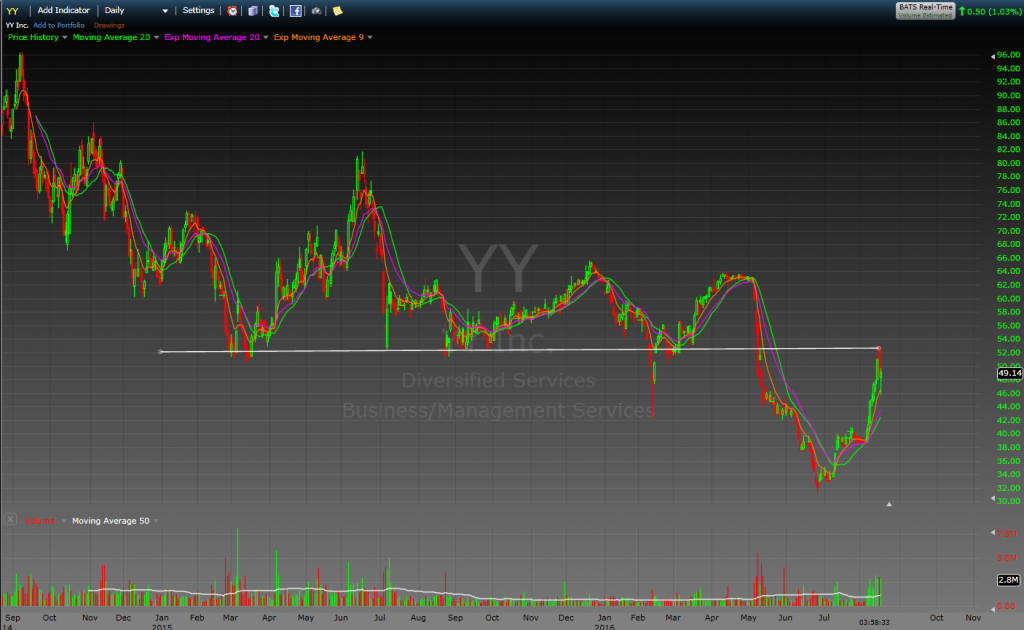

This week we made a great parabolic short trade in $YY. YY is a volatile stock, with a crazy history of ups and downs. Over the last couple of months, it has made a significant run from $30 to over $50, going “parabolic.” Whenever a stock runs so hard that quickly, we know it will only be a matter of time before it must reverse direction.

One of the best triggers for such a reversal is a big gap up. On the surface, that seems like a bullish sign. But for a parabolic stock, it’s usually the last gasp before a drop. On Tuesday, $YY gapped up and right into a long-term resistance level.

Once you see that gap up, then you start looking for weakness intraday. Frequently, you’ll get a move from green to red, meaning the stock will start the day higher than the previous day’s close (green), then drop through that level and go red. That’s our trigger to enter. In this case, the stock plummeted once it went red, which is a common occurrence with this type of play.

If you miss that initial entry, you’ll usually get several other opportunities throughout the day. $YY was no exception, providing a couple nice bear flags for secondary entry. To learn more, check out this video or email me at kunal@bullsonwallstreet.com